How to calculate VAT in South Africa: a useful guide for 2022

Did you know the tax you pay to the government is used to develop infrastructure and finance investments in human capital? The government of South Africa collects various taxes, and Value Added Tax (VAT) is among them. This tax is levied on goods and services. We have you covered if you wish to learn how to calculate VAT.

PAY ATTENTION: Click “See First” under the “Following” tab to see Briefly News on your News Feed!

Source: UGC

Many people want to learn how to calculate VAT. This tax is normally charged at a given percentage. Every South African resident or citizen pays VAT whenever they purchase products or services in the country.

How to calculate VAT in South Africa in 2022

VAT is an indirect tax on the country's consumption of products and services. Other nations besides South Africa also pay this tax.

Value Added Tax was first introduced in South Africa on 29th September 1991 at a rate of 10%. The percentage has since increased to 15%. The final price of a product or service includes the VAT payable.

PAY ATTENTION: Never miss breaking news – join Briefly News' Telegram channel!

Learning how to calculate VAT is necessary for vendors and tax practitioners because the law requires them to complete the Value Added Tax form, commonly known as the VAT201 form.

Using the VAT inclusive and VAT exclusive formula

Below is a simple formula to help you determine the VAT inclusive and exclusive prices.

How to determine the VAT inclusive price

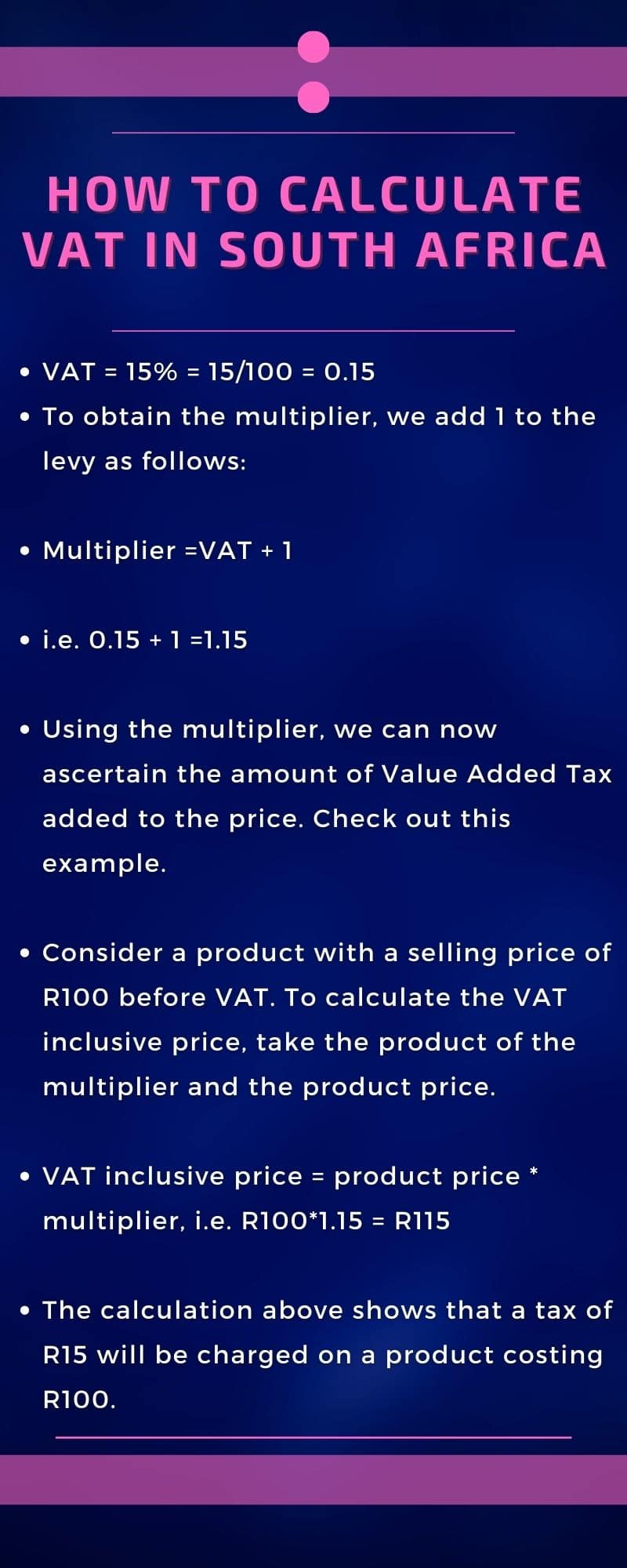

Knowing the multiplier is the first step. Currently, Value Added Tax in South Africa stands at 15%. Below is a simple yet comprehensive guide on completing the calculation.

VAT = 15% = 15/100 = 0.15

To obtain the multiplier, we add 1 to the levy as follows:

Multiplier =VAT + 1

i.e. 0.15 + 1 =1.15

Using the multiplier, we can now ascertain the amount of Value Added Tax added to the price. Check out this example.

- Consider a product with a selling price of R100 before VAT. To calculate the VAT inclusive price, take the product of the multiplier and the product price.

- VAT inclusive price = product price * multiplier, i.e. R100*1.15 = R115

- The calculation above shows that a tax of R15 will be charged on a product costing R100.

The formula above can help you learn how to calculate VAT payable or refundable. The South African Revenue Service pays refundable VAT to a vendor who paid their VAT fee in excess.

Source: UGC

How to determine the VAT exclusive price

Calculating the VAT exclusive price is possible if you have the VAT inclusive price. You need to know the divisor to complete the calculation. Below is a quick guide to help you compute the divisor using the fee rate.

VAT rate=15% = 15/100 = 0.15

To determine the divisor, we add 1 to the VAT rate expressed in decimal.

Divisor=1 + 0.15 = 1.15

- Consider a product with a VAT inclusive price of R115 before VAT. To calculate the VAT exclusive price, we use the divisor.

- VAT exclusive price = VAT inclusive price/ Divisor, i.e. R115/1.15 = R100

- The calculation above shows that a product with a VAT inclusive price of R115 has a VAT exclusive price of R100.

How to calculate VAT on Excel in South Africa

Follow the steps below to complete the calculations using Microsoft Excel using one of its formulas.

- Activate the formula in a cell by typing the equals symbol.

- If you want to know the final price of a product or service that would be R50 without VAT, for example, you need to calculate 15% of R50.

- In a cell, add the price of the product without VAT (A1), then in another cell (B1), divide the VAT sum by 100. In this case, in cell A1, type 50 and cell B1, 15/100.

- Next, multiply the price by the VAT/100. In other words, A1*B1. You can multiply the price without VAT by 0.15, i.e., 50*0.15.

- Press Enter to get the VAT result, which in this case would be 7.5.

- Finally, you need to add the initial price of the product or service to the result, i.e. (Initial Price *VAT) + Initial Price. Using Excel, this would be (A1*B1)+A1, giving you the VAT inclusive price. Following this example, type in =(50*0.15)+50. The final result will be R57.5.

Source: Facebook

VAT calculator in South Africa in 2022

If the above calculations are challenging for you, do not fret. You can use a tax calculator in SA to know the tax inclusive and exclusive prices.

There are different online calculators you can use. Ascertain the one you use should is free and reliable because many unscrupulous sites take advantage of people's information.

Online calculators are easy to use. Enter the amount to be adjusted, click on add or subtract VAT, and the calculator will automatically compute the figure needed.

How much is VAT in South Africa in 2022?

Starting 1st April 2018, the standard VAT rate has been 15%. Only a few select products and services are subject to 0% VAT.

What is the formula for calculating VAT in South Africa?

VAT is calculated by multiplying the VAT rate of 15% in South Africa by the total pre-tax cost. The cost of VAT is then added to the purchase.

What is the easiest way to calculate VAT?

The easiest way is to use an online calculator. Before using any site, confirm its reliability.

What is the VAT rate in South Africa in 2022?

The current rate is 15%. This rate was effected on 29th September 1991.

How does the VAT system work in South Africa?

The Value Added Tax system is designed to be paid mainly by the ultimate consumer or purchaser in South Africa. It is an indirect tax directed at the domestic consumption of goods and services and at goods imported into South Africa. It is levied at a standard rate of 15% or a 0% for select dates.

What is VAT output?

This is the VAT that is calculated and charged on the sale of goods and services from businesses that are VAT-registered.

What is input VAT?

Input VAT is the tax included in the price when you purchase taxable goods or services for your business. If you are registered for VAT, you will be able to deduct input VAT against output VAT in your manual VAT 201 form. All businesses should learn how to calculate input and output VAT in South Africa.

Learning how to calculate VAT is necessary, especially for vendors and tax practitioners. You can calculate your VAT manually, using Excel, or an online calculator.

READ ALSO: How to get your tax number in 2022: Essential information

Briefly.co.za recently published how to get your tax number in 2022. There are two categories of taxpayers: residents and non-residents.

The government levies taxes on residents based on their worldwide income and non-residents based on their South African income. SARS uses your tax number to track your Income Duty payment progress and other related information.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Briefly News