How to check if your name is under debt review in 2024 (guide)

Are you struggling with debt? There is a system in South Africa that helps people struggling to meet their debt obligations. If you are enrolled in the system, you should learn how to check if your name is under debt review. This will help you manage your repayment arrangements and reduce the monthly payments to a manageable amount.

Source: UGC

TABLE OF CONTENTS

- How to check if your name is under debt review

- How long does your name stay under debt review?

- How do you clear your name under debt review?

- How do you find out if you have debt in your name?

- How long does debt review last?

- Can you get a loan if you are under debt review?

- How do you check your debt review status online in South Africa?

The National Credit Act (NCA) came up with a credit review process to assist indebted South Africans in being free from liabilities. The system can only be used by consumers registered with a National Credit Regulator (NCR). If you meet these requirements, you should learn how to check if your name is under debt review.

How to check if your name is under debt review

Did you know you must generate a credit bureau report whenever you want to access a loan from all South African financial institutions? To do this, you should learn about the debt review process, which is quite simple.

What is debt review?

Debt review is the process of helping over-indebted South Africans to manage and clear their debts. The process was introduced by the National Credit Act (NCA) to assist people in becoming debt-free.

The National Credit Regulator (NCR) and other approved organisations have qualified and registered debt counsellors to assist the NCA in achieving its mandate.

How does debt review work?

The debt review process works by offering debt solutions to South Africans owing other people, businesses, or firms and struggling to manage their finances. A registered debt counsellor assesses an individual's outstanding debt.

After conducting a debt review, the counsellor comes up with a structured plan for repayment. The counsellor may renegotiate interest rates with loan providers or request an extension of the repayment period.

If someone owes multiple parties, the counsellor organises things in a manner that the individual makes one monthly repayment to a payment distribution agency.

The agency then pays all the parties owed. This reduces the mental anguish and stress of trying to keep up with multiple repayments. Simply put, registered debt counsellors are debt rescue professionals.

Source: UGC

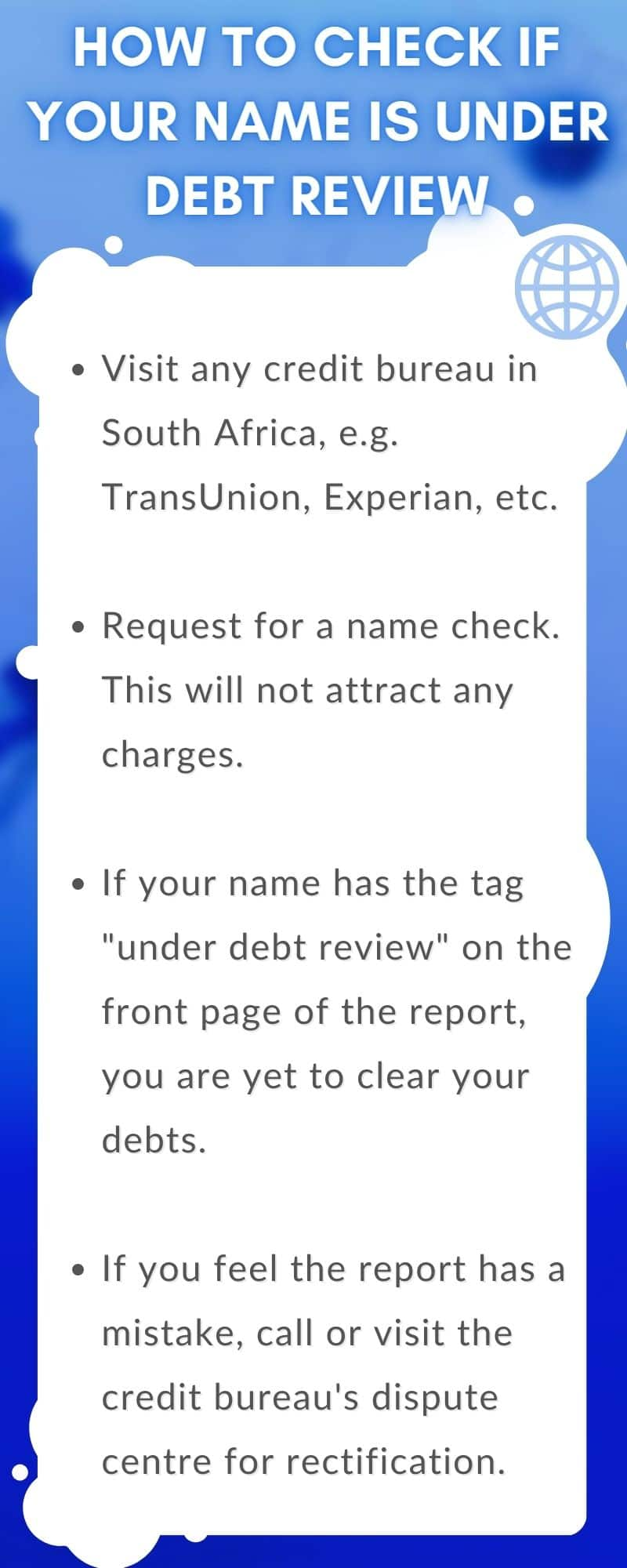

How to check if you are under debt review

Follow the steps below to check if your name is under debt review.

- Visit any credit bureau in South Africa, e.g. TransUnion, Experian, My Credit Expert, etc.

- Request for a name check. A credit bureau status check does not cost anything.

- If your name has the tag "Under Debt Review" on the front page of the report, you have yet to clear your debts.

- If you feel the report has a mistake, call or visit the credit bureau's dispute centre for rectification.

Debt review removal process

You can only remove the debt review status after you repay everyone you owe. Follow the steps below to complete this process.

- Your counsellor will notify you immediately after you repay all your debts in full.

- The bureau will remove the Debt Review Status tag under your name as required by the law. This change is normally effected within a maximum of 21 days business days from the day of the notification.

- The bureau will issue you with a debt clearance certificate.

Source: UGC

How long does your name stay under debt review?

The length of time depends on the amount of money owed and how much you can afford to repay monthly. For most people, it takes between 36 and 60 months to be declared debt-free.

How do you clear your name under debt review?

You can take your name off by repaying everyone you owe. Thereafter, you can get a clearance certificate.

How do you find out if you have debt in your name?

You can check your debt status by visiting a credit bureau and requesting a report. This will not cost you anything.

How long does debt review last?

Debt review lasts until you repay everyone owed. Some people clear their debts faster than others, so they get clearance certificates sooner.

Can you get a loan if you are under debt review?

No, if you are under debt review, your loan application will be rejected. You can access loans once you repay everything owed and get a clearance certificate.

How do you check your debt review status online in South Africa?

Usually, people check their status free of charge by visiting any credit bureau in South Africa. People who wish to do it online can use approved checkers with online platforms, e.g., Experian and My Credit Expert.

Learning how to check if your name is under debt review is important for every South African citizen. This knowledge will help you keep your financial status in check.

Briefly.co.za recently published a guide on how to start a construction company in South Africa. Starting your own business may seem daunting, but it can open new doors and provide newfound financial stability.

A construction company offers a service that is always required, with ongoing employment opportunities. Starting a construction company with no experience is easier than you may think.

Source: Briefly News