The best free and proprietary payroll software in South Africa

Running and managing organisations and businesses can be hectic, especially if you have a massive number of employees. With the recent technological advancements, however, one can run most of the operations using computers which are more efficient and save on time. One of the services that an employer or manager in an organisation should embrace is the use of payroll software.

Source: UGC

Computers have made not only most aspects of life simpler but also increased productivity. The use of payroll software by organisations has resulted in more accurate and organised records. It has also made it possible for an organisation to file tax returns easily. If you are in the human resource department, you might want to try out the payroll software to ease your operations.

Is there any free payroll software?

Which is the best free payroll software? Most of the applications that could be beneficial in workplaces require one to pay for them. However, there are some of the payroll software that one could use and not be required to pay for their services. This list provides some of the free software and their features.

1. TalyPayroll

Source: UGC

TalyPayroll is a reliable and free payslip software that is compliant with SARS. South Africans developed it; hence, its scope is the South African market. These are some of the critical factors that can draw you to the software:

- It supports employee loans.

- It allows one to create, print, and save payslips to PDF.

- It has features that allow employees to view their payslips online.

- It has features that take care of the generation of weekly and monthly payslips.

- For cash employees, it has a coinage feature.

- It has a feature that generates EMP501, EMP201, and IRP5 reports.

- It has a feature that exports tax certificates to e@syFile/eFiling.

- It has a feature that supports the Employment Tax Incentive (ETI)

- It has 2021 tax tables.

You can enjoy the features that TalyPayroll offers if you have a maximum of five employees. If you want to access the services of the application program and have more than five employees, you will be required to upgrade to the premium package. The premium package is only accessible at a fee.

2. Remunerator Payroll Software

Source: UGC

Remunerator Payroll Software is a user-friendly application program that aids in running payrolls. It boasts of the following features:

- It allows for pay runs to be printed in columns making it easier for one to crosscheck.

- It generates slips that are easy to understand since it breaks down every deduction from the gross income.

- It has additional features that allow for calculation of MEIBC leave pay as well as bonuses.

- It has a custom report generator feature that allows for the generation of monthly reports like a PAYE and Bargaining Council levies.

- It has a powerful feature that is essential for calculating the different income sources and deductions.

- It automatically generates a file which is imported to SARS' EasyFile (E@syfile).

- It has a feature that creates a back up every time one creates a Payrun Batch.

- It generates a journal report making it easy for a user to update their accounting program with transactions.

3. Freeroll

Source: UGC

Freeroll, also known as Free Payroll software South Africa, is a cloud-based application for payroll operations. The application does not limit its users to the number of employees and users. It also complies with SARS. These are the other features that a user enjoys on the application:

- It offers local support; hence, a user can call the developers of the application for assistance.

- It has a feature that automatically updates all the SARS tax tables.

- It has an online portal that offers a platform for interaction between the employer and the employee.

READ ALSO: SARS not willing to hand over Zuma's tax record to Mkhwebane

4. Mirror payroll

Source: UGC

Mirror payroll is another straight forward wage calculator South Africa that suits small and medium businesses. It is also compliant with SARS, and it comes with tutorials on how to run it.

Proprietary payroll software

What is the best software for payroll? Unlike free payroll software, proprietary payroll software are more advanced and offer a broader scope of services. These are some of the best applications that you could settle for.

1. Sage Business Cloud Payroll

Source: UGC

Sage Business Cloud Payroll is an application that guarantees to generate accurate and compliant payslips. It also takes care of bonuses, travel allowances, medical aid, pension, to mention a few. These are the other features that you will enjoy on the software:

- It has a feature that allows a user to enter fixed payments and deductions, making it easier for calculation of PAYE, SDL, and UIF.

- It has the Automatic Clearing Bureau, which allows a user to export a bank payroll to the company’s banking software, making it easier to pay employee wages.

- It has a feature that allows a user to add several companies and create payrolls weekly, bi-weekly, and monthly.

- It has a feature that generates legislative payroll reports.

- It has a leave management feature that manages leave cycles and captures leave transactions.

- It has an online chat platform that offers expert advice when needed.

Sage Business Cloud Payroll annual charges depend on the number of employees, and they range between R615 for two employees and R5,185 for twenty employees.

2. SimplePay Payroll

Source: UGC

SimplePay Payroll is another payslip software that allows the user to interact with the application on their terms. The software keeps track of employee loans, pension, and all other deductions. It is also easy to set up. These are some of the features a user enjoys on the software:

- It guarantees more accurate management of employee leave days as it comes with a self-service function that employees can use to communicate with the system. It also prevents mishaps like the accidental counting of public holiday days.

- It comes with an inbuilt feature that allows the submission of legislative reports.

- It is an online payroll software; hence, you do not need to have it installed on your computer.

- The software supports the Private Security Industry.

- It has a feature that keeps the activity log that states any changes that have been made and by whom.

SimplePay pricing depends on the number of employees and not on the number of payslips generated.

3. BluuBin Payroll

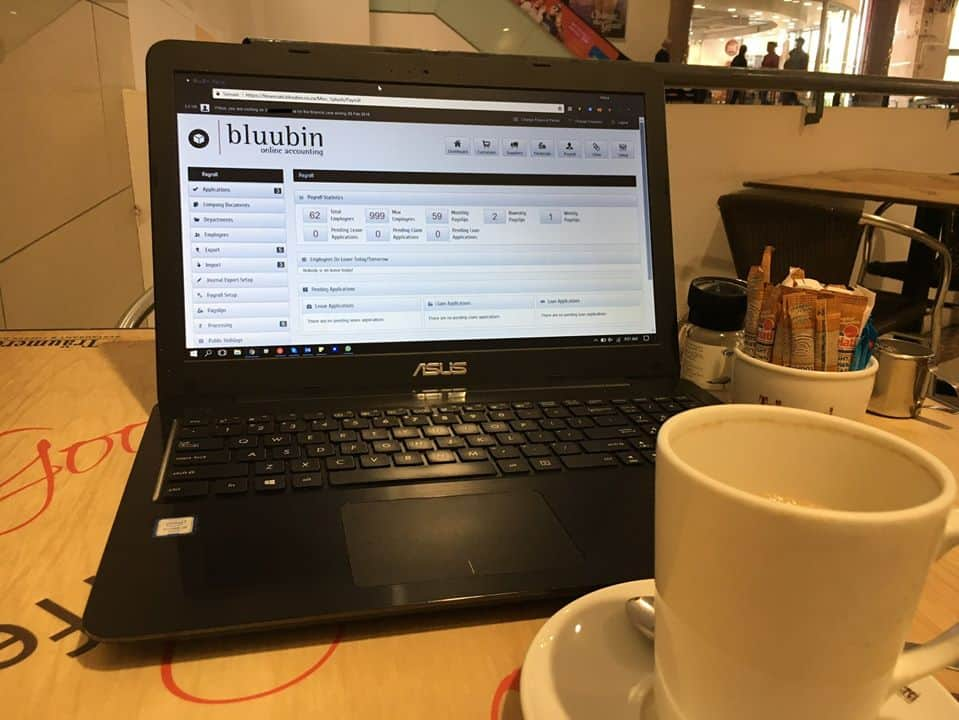

Source: UGC

BluuBin Payroll is another online payroll software that is user friendly and gives the best results. These are some of the features that the package comes with:

- The software can be changed to suit your organisation, making it easier for a user. It also comes with an interactive interface that is user-friendly, regardless of whether or not you have experience in using it.

- It comes with a self-service portal that allows employees to access their payslips and IRP5 certificates.

- Access to the system is permission driven; hence, it is safe and secure. The software also provides free updates.

- It has features that incorporate leave management, several staff members, staff loans, approvals, and claims.

- The software seamlessly integrates with other accounting software.

BluuBin payroll software pricing depends on the nature of the enterprise.

From this list, it is clear that payroll software can get a lot of tasks done with minimal effort. Before settling on one, you need to understand the structure of your organisation and how much work you need to be done. That way, you will know whether or not to settle for free or proprietary payroll software.

DISCLAIMER: This article is also intended for general informational purposes only and does not address individual circumstances. Therefore, it is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility.

READ ALSO:

- Zwai Bala owed SARS R2 million in taxes at one point due to ignorance

- Free South African payslip template doc and download links 2020

- McAfee antivirus free: 15 best free and paid antivirus for mac and Windows

Source: Briefly News