Tips on how to avoid customs charges in South Africa

When importing stuff in South Africa, SARS customs are likely to charge you a customs duty. SARS has its guidelines on what should be declared when importing goods and the customs charges for different items. Customs charges will vary based on the type of any imported item, as well as the quantity. All goods imported, whether, through the sea, air, rail, or road, have to be cleared by customs authorities; thus, there is no clear guide on how to avoid customs charges in South Africa. Nevertheless, here are some tips that will be useful in minimizing custom charges.

Source: UGC

Do I have to pay customs charges? Tax evasion is a crime which can land you in jail, or you can end up paying a huge fine. However, there are some things you can do to lower or cancel custom charges. These things will help when buying personal goods and some business goods. If you have a large business, then it will be hard to lower your custom charges legally.

READ ALSO: How to recover your forgotten SARS eFiling login password with ease

Tips on how to avoid customs charges in South Africa

Before importing anything, it is important to know that SARS, when it comes to importation of second hand or used items, will require you to have an import permit. Some items are prohibited from being imported to South Africa. These tips will mostly work for personal items, that is, people who import items in little quantities.

Source: Facebook

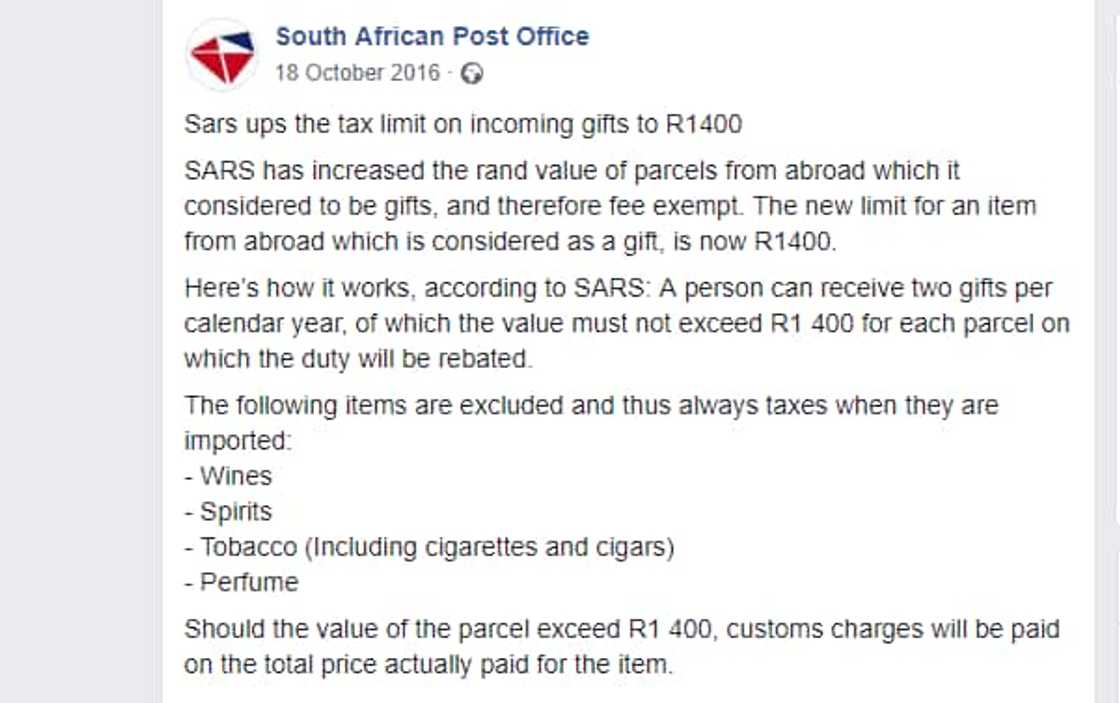

- Wondering, why do I have to pay customs charges on a gift? Here is the good news. If you have a friend or relative in the country you want to buy an item for, you can send them the money and tell them to buy the item for you and send it to SA while declaring it as a gift. The gift policy is, however, limited to two gifts per the calendar year, and the item should not exceed R1400. Items that do not fall as gifts include wine, spirits, tobacco, and perfumes. The friend or relative can also bring any item when they come to visit you.

- When buying an item from neighboring countries, if possible, go pick it up and break the seal before coming back to South Africa. This method will only work if the product is very expensive and the customs duty is more than the cost you will incur if you picked up the goods.

- Use local online sites that help cover import duties South Africa. Local businesses get incentives, and thus, the items may still have a reasonable price even after going through South African customs. Avoid international sites where online shopping customs South Africa may double the price of the item.

- Buy items while on holiday or trips in different countries. To avoid South African import duties, break the seal of the items before coming back. If you arrive at the airport, for example, with a new phone still sealed in a box, you will be charged a customs duty even if it is yours. Break the seal and place the item in a different bag out of the box.

- How is customs duty calculated in South Africa? Go through the import tax South Africa break down. Some tariffs will vary depending on quality. The higher the quality of an item, the higher the custom charge. Understanding the breakdown will help in knowing how to lower your import duty South Africa. For example, it will be cheaper to import some types of weaves compared to others.

- Buy items from local vendors instead of importing to South Africa. If the item is sold locally, most times, it will be cheaper to buy it from local shops than importing to South Africa, especially when you add the import duty. Compare the prices with local stores while factoring in South Africa import duties before making your decision.

- Buy cheap goods. When buying goods under $10, you are likely to receive the South African customs duty free allowance. Buying in large quantities will still attract customs duty.

READ ALSO: SARS requirements for 2019: here is everything you need to know

Knowing how to avoid customs charges in South Africa is important in saving money. However, you should not engage in illegal activities when trying to avoid customs charges. Paying tax is every citizen's role, and you should be proud of it. Keep in mind that tax evasion is a crime, thus if you are running a business instead of avoiding customs duty as a whole, work with authorities to find ways to lower the charges within the law.

READ ALSO

- Useful information on MTN and Vodacom contract cancellation processes

- SARS eFiling 2019: Steps on how to file your tax returns using eFiling and Sar's new MobiApp

- What is provisional tax?

- Major expectations and significant details of SONA 2019

- eFiling register: How to register for eFiling

Source: Briefly News