CF filing: How to submit return of earnings in 2022 guide

The Compensation for Occupational Injuries and Diseases Act, No. 130 of 1993 (COIDA) was created to ensure that employees receive a compensation in case they sustain injuries, contract diseases, or die from injuries or diseases during the employment period. The compensation fund’s main aim is employee protection. If you find yourself in any of the above situations, here is a guide on CF filing.

Source: UGC

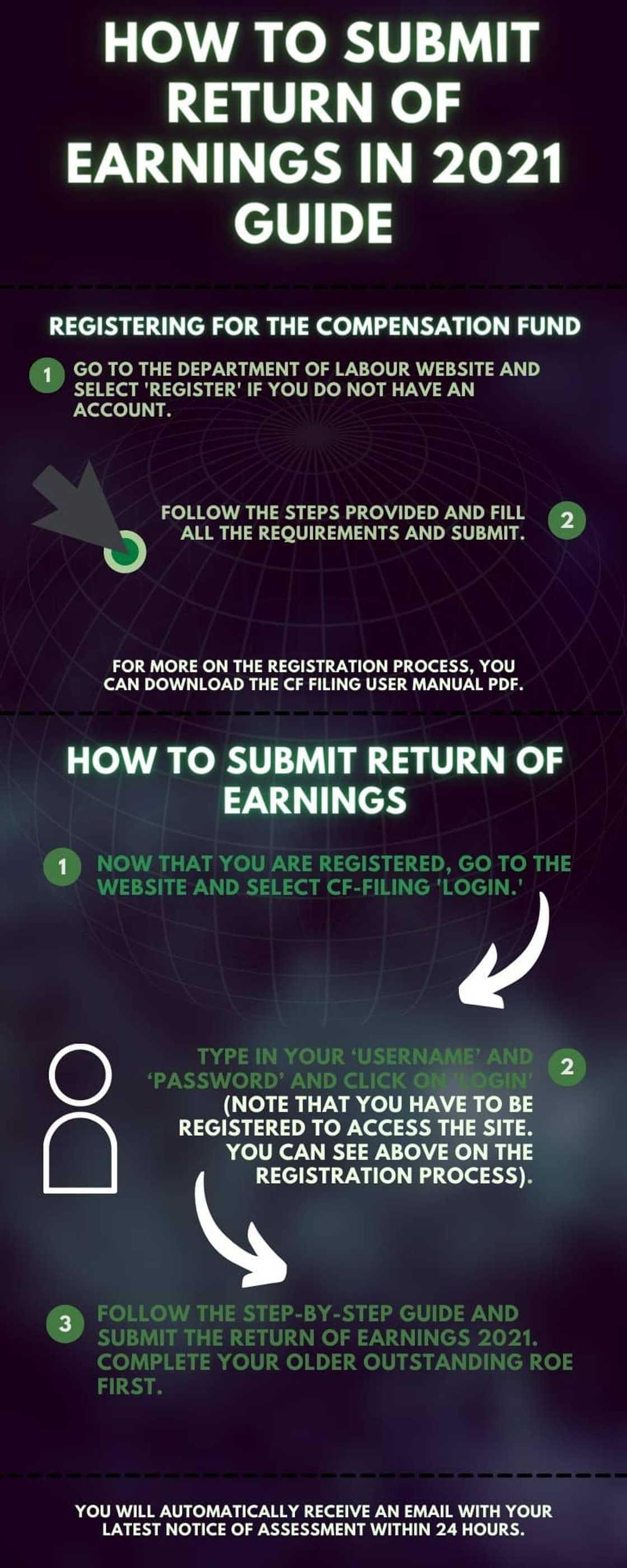

There are two ways to submit return of earnings South Africa, and you can do it online or manually. For convenience and to save time, we recommend CF online filing. As with many online portals, the first step is registration.

Registering for the compensation fund

Firstly, employers are required to register for the workmen's compensation fund, submit, and pay annually. To register, you are required to have a valid South African ID number and a valid email account.

- Go to the Department of Labour website and select 'Register' if you do not have an account.

- Follow the steps provided and fill all the requirements and submit.

For more on the registration process, you can download the CF filing user manual pdf.

How to submit return of earnings in 2022

- Now that you are registered, go to the website and select CF-filing 'Login.'

- Type in your ‘Username’ and ‘Password’ and click on 'Login' (Note that you have to be registered to access the site. You can see above on the registration process).

- Follow the step-by-step guide and submit the return of earnings 2022. Complete your older outstanding ROE first.

You will automatically receive an email with your latest Notice of Assessment within 24 hours. If you do not receive the email contact the CF Customer Care via their email: cfcallcentre@labour.gov.za. After filing your return online, you will receive an invoice showing the amount that the employer has to pay and the necessary bank details.

COIDA guidelines

- Employers registered for the compensation fund are required to submit Returns of Earnings in terms of Section 82 of the COID Act.

- The returns must be filed annually not later than March 31st as determined by the Commissioner.

- The information submitted should show the number of earnings up to the maximum established in section 83(8) that is paid to employees during the assessment period (Effective from the 1st March of the previous year up to and including the final day of February of the next year).

- In case of an error during the return of the submission, the employer should notify the Commissioner within 30 days, failure to do this will mean no revision to the previously submitted returns.

- There will be a penalty implication on an employer who fails to file the return by the due date as per Section 83 of the COID Act.

From this, you can see how simple CF filing is in 2022. It is good to have alternatives. Therefore, if you prefer the convenience of online filing, you have an option, and if you are a papers person, you still have the manual option. Choose what works for you and make sure that you beat the deadline and avoid the penalties.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Source: Briefly News