VAT number search: Simple steps to find a business's VAT number

The law requires all South African business owners who meet the set taxation criteria to register for a Value Added Tax number. The obligation falls particularly on those with taxable goods and services exceeding R1 million in 12 months. The tax obligation also includes those expecting their yearly returns to exceed the figure. At some point, a VAT number search is necessary for validation or related reasons. Luckily, it is now possible to check VAT numbers online without making calls or visiting offices.

Source: Getty Images

Businesses can find their VAT registration numbers in the certificate issued by the South African Revenue Service. However, other individuals and businesses may need to check the VAT database for validation. The check is mainly essential when dealing with a new business partner. Learning how to get a VAT number right is crucial.

Can I check if a VAT number is valid?

Can I check if a company's VAT registered? It is now possible to verify a VAT number without reaching the call center with apparent queries. Checking the validity of a VAT number should not trouble you because it is more convenient. Even so, SARS insists on the correctness of tax invoices as a precaution against costly errors.

Can I check a company VAT number?

Yes, a simple VAT number lookup for a company can save you from becoming a victim of terrible business decisions. On this basis, most dealers opt for a search to verify their clients and suppliers before going on with their usual business exchanges.

VAT number check requirements and guide

How to check a company's registration number? The purpose of the VAT Vendor Search is to verify a VAT registration number if the exact correct trading name is entered. Before initiating a search, it is necessary to have at least one category of the following information.

- VAT registration number of your business, client, or supplier

- A trading name of the business you want to verify

What is my VAT number? A VAT number comprises ten digits, with number 4 being the initial character. On the other hand, a VAT name varies depending on whether it is an individual, group, or business.

- For individuals, provide the Surname, then space, and then the initials.

- For companies, trusts, corporations, and partnerships, provide the full name of a company, including all the necessary punctuation marks.

Users can complete VAT searches on the SARS eFiling system or the VAT Search System.

Using the SARS eFiling system

Source: Depositphotos

The South African Revenue Services has developed a free access platform for the VAT search. SARS eFiling reliably provides users with a detailed report on the company information. If you are concerned about who is this number registered to, go ahead and find out.

How do I check a VAT number?

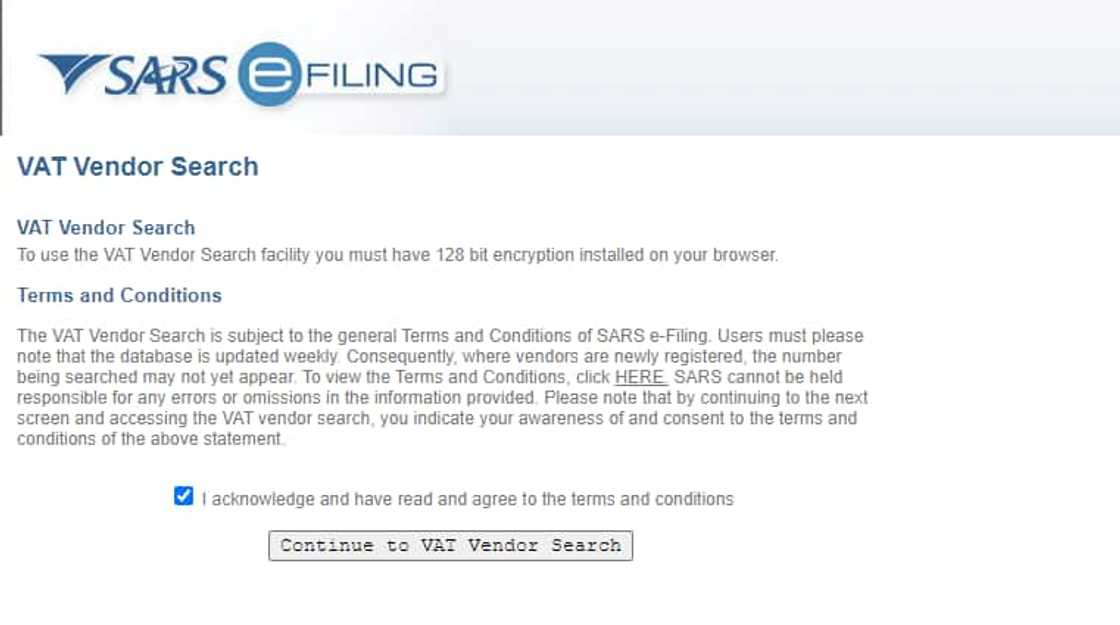

- Start by accessing the SARS VAT Vendor Search page.

- Read and agree to the terms and conditions and then proceed to search for the VAT vendor.

- Choose between these two options to continue with your VAT search

- Verify whether a person is registered for VAT (Trading name required)

- Verify VAT number registration (VAT registration number required)

4. Now, provide the exact VAT trading name or VAT number of a client and click search to receive all the details you need for the verification.

5. The page offers an option of printing the search result for reference.

VAT search functionality

Note that e-filing registered members can do a partial search on both the VAT number and Trading Names as opposed to non-members, who must do an exact search. How long does it take to get a VAT number in South Africa? It is also crucial to consider that the clients who registered most recently may not show any results because SARS updates their database every week.

Using the VAT Search System

The site is an alternative to the standard SARS eFiling page. The system makes it possible for users to verify or validate their VAT numbers in a few clicks.

- Access the search page.

- Provide a trading name or a 10-digit VAT number to perform a search

The system accepts a minimum of five characters when using the trading name as a search query. Users having trouble with the search can contact help@VATsearch.co.za for help.

SARS has made it possible for South Africans to complete VAT number checks from their smart devices. The system is not only convenient but also user friendly and accurate in its information delivery.

READ ALSO: How does VAT registration work?

Briefly.co.za explained how VAT registration works. This is an indirect duty imposed on all consumer goods and services, indirect because it comes inclusive of the buying price, so you may not know when you pay.

It is mandatory for any enterprise with a yearly income exceeding R1 million in any consecutive period of one year to register for VAT. This tax is normally charged at intervals during the production-distribution process and on imported commodities. However, some products and services are exempted.

Source: Briefly News