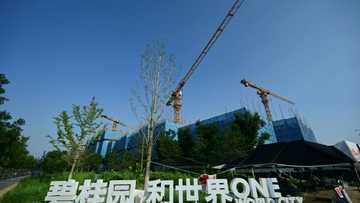

Pressure mounts on Country Garden despite temporary reprieve

Source: AFP

PAY ATTENTION: Have you recorded a funny video or filmed the moment of fame, cool dance, or something bizarre? Inbox your personal video on our Facebook page!

Country Garden creditors have approved postponing the repayment of a key loan, narrowly avoiding a potential default, Bloomberg reported Saturday.

Here is what the result means for Country Garden, which until recently enjoyed a solid financial reputation and was China's largest real estate company in terms of sales last year.

What was voted on?

A bond worth 3.9 billion yuan ($535 million) was set to mature Saturday.

But bondholders voted to postpone that deadline to 2026 to allow the group to recover financially, according to Bloomberg.

Country Garden has racked up enormous debts -- estimated at 1.43 trillion yuan ($196 billion) as of the end of 2022.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

The group, which reported record losses for the first half of the year on Wednesday, said that it had "done its best" to repay its debts -- but that it could not rule out a default.

Is the company off the hook?

Country Garden is not yet in the clear, as it faces another looming deadline.

In early August, the firm was unable to repay two interest payments on loans totalling $22.5 million.

It was given a 30-day grace period which is due to expire next week.

The firm still risks defaulting on this payment.

State of play

Country Garden says 96 percent of its cash flow comes from real estate sales.

But the Chinese property market is slumping: prices are on the decline and buyers are reluctant to invest as the broader economy stalls.

Many property giants have had no choice but to sell at a discount.

Country Garden's situation is all the more precarious because around 60 percent of its projects are located in smaller Chinese cities, where property prices have fallen the most and local customers have relatively low purchasing power.

The firm reported having 147.9 billion yuan ($20.3 billion) in cash at the end of June.

Broader risks

Country Garden has four times as many projects as its rival Evergrande, which defaulted in 2021 and prompted protests and monthly payment strikes last year with its shutdown of construction sites.

Any halt to construction work presents the risk of social instability in China, where homeowners often pay for a property before ground is broken.

Like Evergrande, which holds debt adding up to more than $300 billion, any collapse of Country Garden would have catastrophic repercussions on China's financial system and wider economy.

Headquartered in the southern city of Foshan, Country Garden employed nearly 58,140 "full-time" staff one year ago, according to a comparison of statements on its workforce.

Light at the end of the tunnel?

Chinese authorities have moved in recent days to boost support for real estate, a sector accounting for a quarter of the country's GDP.

On Thursday, the central bank announced the lowering of mortgage rates for first-time buyers from September 25.

And several major cities, including Beijing and Shanghai, are easing their criteria for obtaining mortgages in a push to stimulate demand.

But this is not likely to be enough to revive real estate, economist Michelle Lam, of Societe Generale, said.

Ongoing woes for developers will continue to "undermine the confidence" of potential buyers, she said.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP