Diaspora Story: The Conundrum of Living in Two Societies

When Martin Kapami left his home in Lusaka, Zambia, for the United Kingdom, he set his sights on the opportunities ahead.

All was going well until he lost a family friend in the UK, whose body needed to be repatriated back to Zambia for burial. The family did not have the £6,000 (R125 000) needed by the company that does body repatriation.

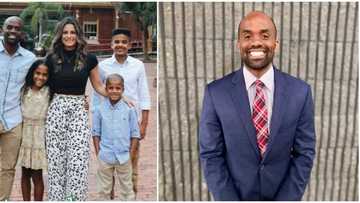

Source: UGC

His friend had not taken insurance to cover expenses like these. They had to create a GoFundMe account to raise the money needed. It was a nightmare for him and the family. The wife ended up borrowing money from the bank to meet the costs.

Diaspora Insurance

Years later, during a church service at one of the local churches, Kapami came across Diaspora Insurance company’s stand, and he took an interest in what they had to offer.

“I wasn’t serious. I just wanted to find out what they could do. So I talked to a gentleman there and asked him what he was doing there, which countries they service," Kapami said in an interview.

The gentleman advised Kapami that Diaspora Insurance provided a funeral policy that paid cash upon the death of a loved one. They targeted Africans in the diasporas and paid up to £20 (R417).

One of the things that Kapami was impressed by were the low premiums that the company offered.

“The premiums were quite low, something like 20 pounds per individual,” he recalled.

Kapami shared with his wife, Bessie Kapami, about the insurance cover. After reviewing it together, they agreed it was more affordable than the 200 pounds (R4 172.60) they’d been paying for insurance with a different firm.

“I thought it was reasonable at that particular time, and it’s more affordable looking at the actual costs involved,” Kapami noted. Not only was it cheap, but it offered many appealing features like the fact that you could add people back in Zambia on the same policy, something which the UK insurers could not do. Moreover, Kapami and his family would remain covered even if they relocated to Zambia later on.

Right from the beginning, Kapami and his wife had started preparing to go back to Zambia.

Read also

Man buys house with R2.3m mistakenly credited to his account, after 9 months, bank orders him to pay it back

“We thought we should start preparing for our retirement so we came here and started doing all our projects with the intention that one day or the other, we’ll be old so we should come back to Zambia,” he added.

Little did Kapami know that he would soon need the same insurance cover.

In March 2021, Kapami lost his beloved late wife, Bessie, who took the Diaspora Insurance cover.

“We were both covered even when we traveled for the burial of our friend during the COVID-19 era from about March 2020 till now,” he recalled.

Source: UGC

When the time came for Kapami to organise his wife’s funeral, he wasn’t sure where all the funds would come from, but he knew he had to get things going.

He needed to bring his late wife’s body to Zambia to honour her wishes to return home to Zambia.

Repatriation costs

So, he and three other people began the process of repatriating Bessie’s body back to Zambia. They had to foot several costs, including travel and hotel accommodation.

“Looking at that cost alone, it’s very high. Plus, the airline we always use had canceled all flights to the UK, so we weren’t sure how we were going to travel back with the high costs,” he quipped.

The costs of repatriation plus travelling with the three family members proved a huge cost for Kapami.

He was desperate for a miracle.

Two days after his wife died, Kapami got in touch with Diaspora Insurance and shared with them what had happened and what he was going through.

The insurance company swung into action and deposited money into Kapami’s account to cater to funeral expenses.

“I got in touch I think after two days, and the fourth day, they had transferred the money to my account. They looked at my premium payments and saw that everything was up to date, and that was all they needed from me,” Kapami said delightfully.

Diaspora Insurance had helped relieve Kapami’s heavy load at the time when he needed them the most.

“They did everything and then called me to check my account and confirm if the money had been deposited was there,” he added.

The insurance company had come through for Kapami. They paid for repatriation and everything else he had needed to give his late wife a befitting sendoff.

Read also

Kindhearted investors buy old hotel worth R130 million, convert it into 139 mini-apartments for the homeless

The cost of death in the diaspora

When a loved one dies in another country, it’s not only expensive but also requires immediate and significant financial resources to cover a host of costs.

Among those costs include:

- Prolonged funeral vigils abroad and back home.

- Body repatriation.

- Family travel to or from the diaspora.

- Burial costs (coffin/casket, food, church service, photography/videography, flowers and décor, memorial services, household bills, shipment of the deceased’s personal effects).

- Local transfers or transportation.

- Cost of burial, whether abroad or back home.

- Household bills like electricity.

- Memorial service and/or Tombstone ceremony

All these and other related costs have untold suffering on the deceased’s next of kin and relatives. There’s the trauma of mourning their loved one with empty pockets to emotional scars, no closure, loss of personal/family dignity, undignified send-off, post-funeral bills, no peace of mind or protection of loved ones, and more.

Of all these costs, body repatriation takes a huge chunk. That’s because there are several costs attached to it, including administration, flights, body preparation, and even getting a casket to ship the body from the foreign country and back home.

Read also

Man who has been in debt since age 18 celebrates as he finally settles his R2.8m school debt

Source: UGC

Such costs could easily top a whopping USD 15,000 or £5,000 if you’re repatriating from the US or UK, respectively, which translates to about KSh 765,000 to 1.5 million, or more.

For most African families, it’s hard to raise such staggering amounts, so they end up borrowing from a bank or enduring the embarrassment and double trauma of begging from strangers on GoFundMe and other platforms. The repatriation process is also complex, and it differs depending on each country. Read more on the Diaspora Insurance website.

Diaspora Insurance provides Africans living in the diaspora with their flagship product – The Diaspora Funeral Cash Plan (DFCP), a product born out of personal tragedies and experiences.

With the DFCP plan, bereaved families are assured of giving their deceased kin a befitting send-off bereft of the embarrassment of begging from strangers to foot the bill.

Specifically, the DFCP offers benefits such as:

- Immediate cash pay-out.

- Worldwide protection without borders: Once you are on the policy, you remain covered wherever you are, even if you relocate back home.

- Cover for you and your loved ones wherever they are: most insurers don’t cover out of territory risk.

- Uniquely flexible: you get burial abroad, body repatriation or cremation, and much more. Your family can choose what they want to do, for instance, repatriate their loved one to the country of birth or to lay them to rest in the host country.

- To learn more about the key features and benefits of the DFCP, please go to Diaspora Funeral Cash Plan.

The versatility of a cash-based funeral cash plan was amply demonstrated when the late Pamela Tawengwa sadly passed away whilst on visit in her native country, Zimbabwe, and the family opted to honour her wishes to be buried in the UK, her newly adopted country.

Her Diaspora Funeral Cash Plan was used to honour her wishes by paying for reverse repatriation. She was repatriated and laid to rest in Leicester, UK and a very dignified send-off. A suitable cover should always speak to and address the policyholder's needs, even transnational citizens.

Want to know more about the Diaspora Funeral Cash Plan?

Watch Diaspora Insurance’s CEO, Jeff Madzingo, explain how the cover works to help Diasporans across the world. The Diaspora Funeral Cash Plan is available to at least 13 African nationalities in the diaspora, including Kenyans. Each life on the policy can be covered for up to $/£/€20 000.

Diaspora Insurance doesn’t stop at doing business with its clients. They also have a direct impact on the communities they serve and change realities through their core business.

Few people consider funeral costs until they need to.

With Diaspora Insurance, you can protect your loved ones from the distress of arranging an “at need funeral” and unexpected costs.

For Kapami, Diaspora Insurance provided a lumpsum within 24 hours of providing proof of the death of his late beloved wife, Bessie.

“We had enough money to repatriate her, which was the most important thing for us, and with the money from Diaspora Insurance, we knew that it was going to be easier compared to when we didn’t have that cash,” said Kapami.

“As people in diaspora, we send money out to help our relatives back home but sometimes we forget we will one day need that money to solve our own problems. We need such kind of a (insurance) plan that will assist us,” he added.

Kapami urged everyone to take up a cover with Diaspora Insurance because they expedite processes quickly and release the cash when you need it, unlike other companies that take a long time to process payments. Plus, it goes a long way when contributions from family members aren’t enough to cover what you need.

Ultimately, Diaspora Insurance gives you guaranteed peace of mind, and it protects your dignity by giving your loved ones a dignified send-off when they depart.

Want to learn more about Diaspora Insurance and how they can help you in your time of need? Visit Diaspora Insurance for more information.

(Sponsored).

Source: Briefly News

Rianette Cluley (Director and Media Project Manager) Rianette Cluley is the Media Project Manager of Briefly News (joined in 2016). Previously, she was a journalist and photographer for award-winning publications within the Caxton group (joined in 2008). She also attended the Journalism AI Academy powered by the Google News Initiative and passed a set of trainings for journalists from Google News initiative. In February 2024, she hosted a workshop titled AI for Journalists: Power Up Your Reporting Ethically and was a guest speaker at the Forum of Community Journalists No Guts, No Glory, No Story conference. E-mail: rianette.cluley@briefly.co.za

Kelly Lippke (Senior Editor) Kelly Lippke is a copy editor/proofreader who started her career at the Northern-Natal Courier with a BA in Communication Science/Psychology (Unisa, 2007). Kelly has worked for several Caxton publications, including the Highway Mail and Northglen News. Kelly’s unique editing perspective stems from an additional major in Linguistics. Kelly joined Briefly News in 2018 and she has 16 years of experience. Kelly has also passed a set of trainings by Google News Initiative. You can reach her at kelly.lippke@briefly.co.za.