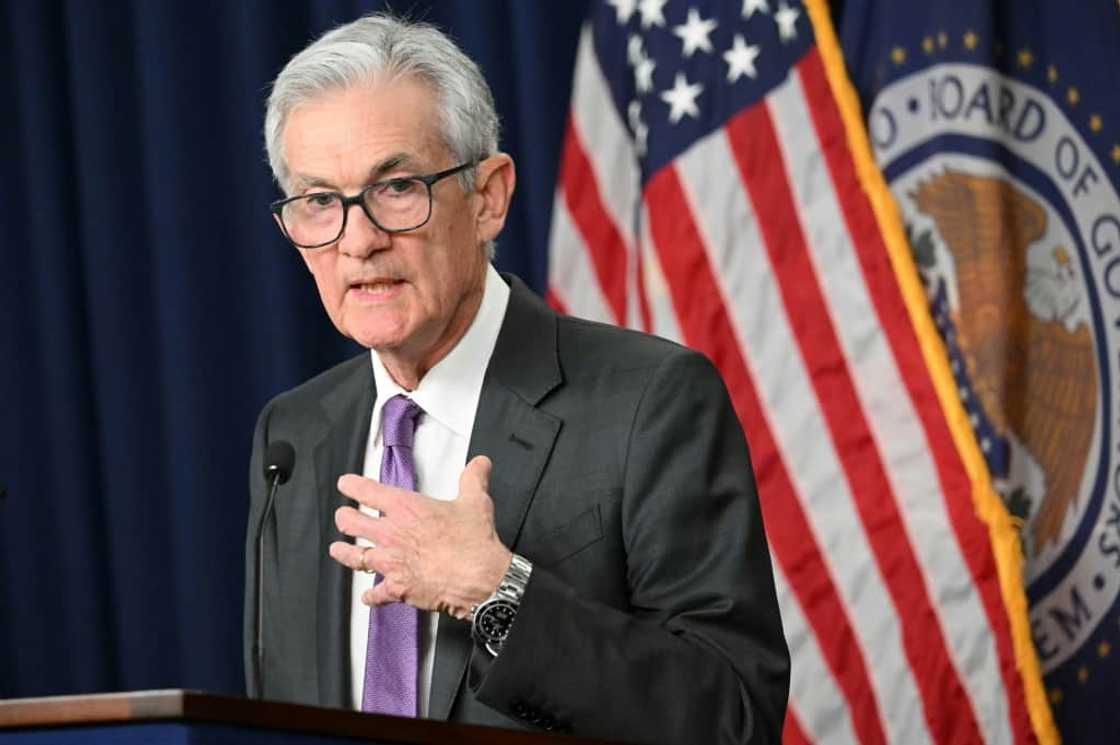

US Fed's Powell says inflation fight may take 'longer than expected'

Source: AFP

The US Federal Reserve's ongoing fight against inflation could take "longer than expected," the head of the US central bank said Tuesday, further paring back the chances of early rate cuts.

The Fed has been battling rising prices with interest rate hikes since 2022, lifting its key lending rate to a 23-year high as it looks to hit its long-term inflation target of two percent.

But three months of higher inflation data since the start of 2024 have threatened to undermine the expectation of interest rate cuts this year, with one senior Fed policymaker recently suggesting that rates could remain at their current levels until 2025.

"The recent data have clearly not given us greater confidence, and instead indicate that it's likely to take longer than expected to achieve that confidence," Fed Chair Jerome Powell said during an event in Washington on Tuesday that was streamed online.

"That said, we think policy is well positioned to handle the risks that we face," he added.

In March, Fed policymakers penciled in three rate cuts for this year, leading markets to price in the first of them as early as June.

But hot March consumer inflation data caused many traders to reevaluate and push back their expectations.

Futures traders now assign a probability of around 70 percent that the Fed will have cut rates by mid-September, according to CME Group data.

"If higher inflation does persist, we can maintain the current level of restriction for as long as needed," Powell said Tuesday. "At the same time, we have significant space to ease should the labor market unexpectedly weaken."

"Right now, given the strength of the labor market and progress on inflation so far, it's appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us," he added.

Source: AFP