How to reverse an eWallet payment in 2025? All you need to know

The FNB eWallet service allows you to send and receive money instantly. The service allows people to transfer money from their bank accounts to registered mobile numbers across the country. What happens if you make an erroneous transaction? Well, you should learn how to reverse an eWallet payment in case you make an error.

Source: UGC

TABLE OF CONTENTS

- How to reverse an eWallet payment

- Cost of reversing eWallet transactions

- How do you retrieve money from eWallet?

- How do you get a refund from eWallet?

- What should you do if you experience FNB eWallet problems?

- How long does money stay in an FNB eWallet?

- Can eWallet automatically be reversed?

- How do you reverse payment on FNB?

- Can you transfer money from eWallet to your account?

- Can you reverse an online payment via the FNB app?

The FNB eWallet service allows recipients to receive money instantly. They can withdraw at any FNB ATM countrywide. You should know how to reverse an eWallet payment to avoid losing money if you mistakenly send it to the wrong person.

How to reverse an eWallet payment

Have you ever wondered how to reverse an FNB eWallet transaction? Well, reversing a transaction is pretty easy. There are multiple ways of doing it, as explored below.

The FNB eWallet helpline (call centre)

Most people feel high levels of stress the second they discover they have made an erroneous transaction. If you are in similar shoes, breathe in and out.

Next, call the FNB customer care desk and request a reversal. The contact details to use are listed below.

- Complaints resolution telephone number (eWallet reversal number): 087 575 9408 (Note there may be a charge when requesting a reversal)

- Complaints resolution email address: care@fnb.co.za

- International: +27 11 371 3711

NB: Kindly note that you will receive a faster response when you make a call instead of sending an email.

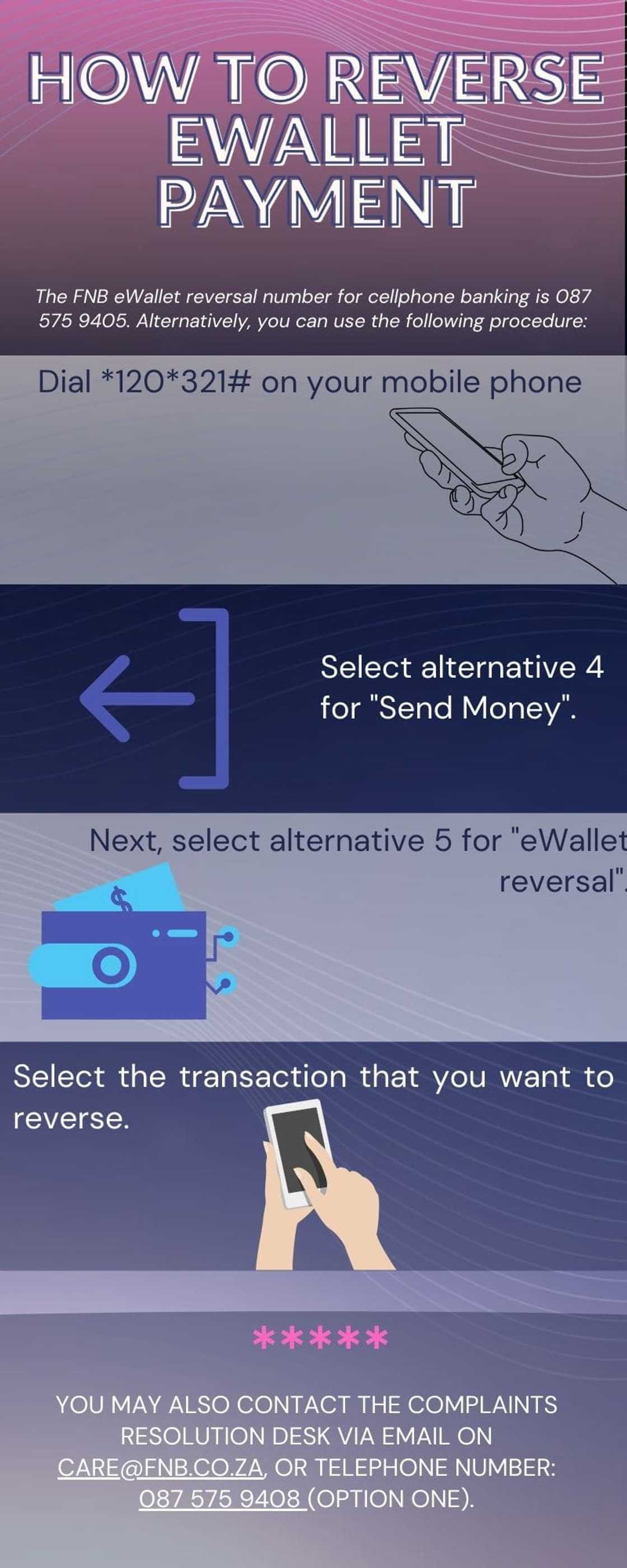

FNB's eWallet reversal USSD code

You can request a reversal using a USSD code. The steps to follow to accomplish this are listed below.

- Dial *120*321# on your mobile phone.

- Select option 4, i.e., Send Money.

- Next, choose alternative 5, i.e., eWallet Reversal.

- Select the transaction that you want to reverse, and follow the prompts to complete the process.

Source: UGC

How to reverse an eWallet payment on the FNB app

If you wish to learn how to reverse an eWallet payment on the FNB app, follow the steps below. The process is straightforward.

- Log into your FNB app.

- Select your debit order account.

- Click My Debit Orders and check the list of your debit orders the system will display.

- Select the reason for disputing the debit order.

- Click Reverse or Stop.

- You may be prompted to provide a reason for reversing the transaction. Be honest and clear in your explanation.

- Select Confirm to accept the terms and conditions.

How long does it take to reverse eWallet?

The duration FNB takes to reverse the money depends on the circumstance under which the transaction has been made.

- If you send money to the wrong recipient and call FNB's customer care centre, the reversal will take up to four business days to reflect on your end. Usually, the money is returned to the sender within 15 business days if the recipient's number is inactive.

- If you receive money you were not anticipating from an unknown sender, do not withdraw it. The FNB reverse payment system will automatically revert to the sender after the PIN expires.

- FNB and Standard Banks allow free money withdrawals at specified retailers. The receiver of the money must use a valid PIN within seven days for Nedbank and 30 days for ABSA and Standard Bank. If the recipient fails to withdraw the cash in the given period, the money is reversed to the sender's account.

NB: The FNB eWallet PIN you receive is valid for four hours only. Upon expiration, the recipient can make another FNB eWallet PIN request by dialling *130*277#.

Cost of reversing eWallet transactions

You will be charged a fee of R50 to get back the money you sent to the wrong number. All clients should note that FNB does not give assurance it will reverse your money because situations differ.

Therefore, every client should double-check the bank account or mobile number and the amount before hitting the send button to avoid wrong transactions.

Source: UGC

How to send money properly to avoid reversals

FNB's eWallet service is convenient because it works on multiple platforms, i.e., mobile banking, ATM, mobile app, and online banking. Follow the steps below to make successful transactions regardless of the platform you are using.

- Select Send Money on your chosen platform, then choose eWallet.

- Insert the mobile phone or bank account number of the person you wish to transfer.

- Double-check the recipient's mobile phone or bank account number to ascertain the digits are correct. This will prevent wrong transactions that require reversals.

- Next, enter the amount you wish to send. You will be asked for a PIN.

- Lastly, confirm and submit the transaction.

- You will receive an instant message after the money has been deposited into the recipient's account or mobile number.

NB: If your FNB eWallet is blocked, call the customer care desk for assistance. If you still send money to the wrong number, use the FNB eWallet reversal contact number given above for assistance.

How do you retrieve money from eWallet?

If you have money in your eWallet, you can withdraw it at an ATM. You can also use it to purchase airtime, data bundles, electricity tokens, or pay for goods and services.

How do you get a refund from eWallet?

You can make a reversal using the USSD code, app, or call the FNB complaints resolution desk. Note that reversals are not guaranteed and are dependent on specific circumstances. Read through the article for more information.

What should you do if you experience FNB eWallet problems?

If you experience any challenges with your eWallet, you should contact the bank using the customer care numbers given earlier.

How long does money stay in an FNB eWallet?

Money received from another person stays 15 business days in an inactive eWallet before being automatically reversed to the sender.

Can eWallet automatically be reversed?

Yes, the bank automatically returns money sent to an inactive eWallet after 15 business days.

How do you reverse payment on FNB?

You can reverse FNB eWallet payments by calling the customer care desk, using the FNB app, or using the reversal USSD code.

Can you transfer money from eWallet to your account?

Yes, funds can be withdrawn from an eWallet account to your verified bank account. To add a bank account to your eWallet, log i to your eWallet and click My Account. Next, go to Bank Accounts. Follow the prompts to complete the process.

Can you reverse an online payment via the FNB app?

Yes, you can reverse an eWallet payment on the FNB app. Check out the previous sections of this article for the step-by-step procedure.

It is normal to panic when you send money to the wrong number or account. Fortunately, the reverse eWallet service by FNB can help you to recover your cash, depending on the circumstances. We hope you understand how to reverse an eWallet payment, as explained in this article.

Read also

Mzansi left reeling after Reserve Bank hikes repo rate by 50 basis points to 7.75%: “I can barely survive”

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Briefly.co.za recently published how to check your NSFAS balance online. The National Student Financial Aid Scheme (NSFAS) has helped tertiary students in receiving much-needed funding while obtaining their education.

Funded by the South African government and local and international donations, the scheme aims to assist students needing funding throughout their tertiary education. If you are a student receiving financing, you should know how to check your balance.

Source: Briefly News

Jedidah Tabalia Jedi is a journalist with over 5 years working experience in the media industry. She has a BSc. in Human Resource Management from Moi University (graduated in 2014) and a working in progress MBA in Strategic Management. Having joined Genesis in 2017, Jedi is a passionate Facts and Life Hacks, Fitness, and Health content creator who sees beauty in everything. She loves traveling and checking out new restaurants. Her email address is jedidahtabalia@gmail.com

Cyprine Apindi (Lifestyle writer) Cyprine Apindi is a content creator and educator with over six years of experience. She holds a Diploma in Mass Communication and a Bachelor’s degree in Nutrition and Dietetics from Kenyatta University. Cyprine joined Briefly.co.za in mid-2021, covering multiple topics, including finance, entertainment, sports, and lifestyle. In 2023, she finished the AFP course on Digital Investigation Techniques. She received the Writer of the Year awards in 2023 and 2024. In 2024, she completed the Google News Initiative course. Email: cyprineapindi@gmail.com