NSFAS balance check online: Easy steps to verify your balance (2024)

The National Student Financial Aid Scheme (NSFAS) has assisted tertiary students in receiving much-needed funding while obtaining their education. If you are a student receiving financing, how can you check your NSFAS balance? Here, we detail how to do an NSFAS balance check online and other essential information.

Source: Facebook

TABLE OF CONTENTS

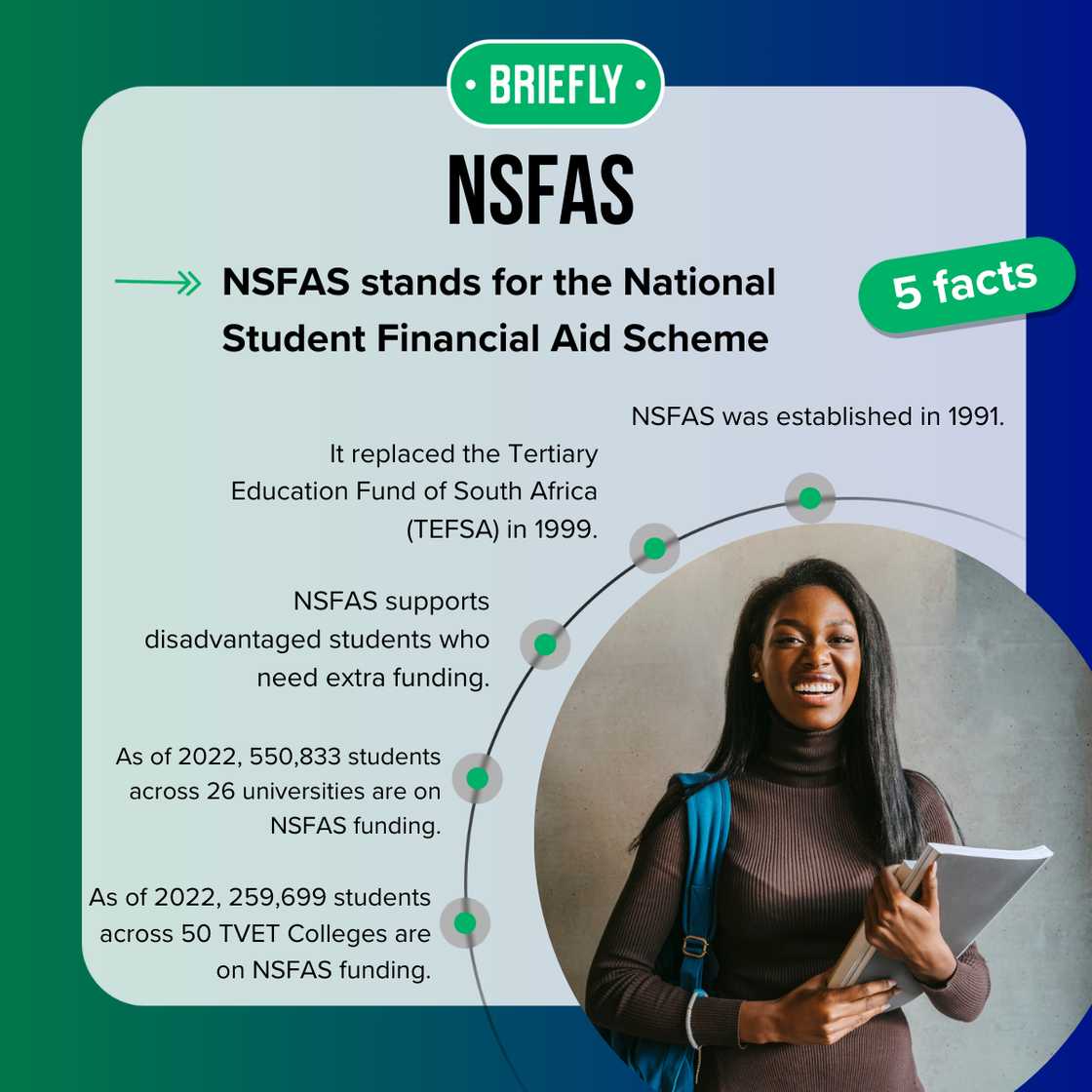

The National Student Financial Aid Scheme was established in 1991, replacing the Tertiary Education Fund of South Africa (TEFSA) in 1999 by gazetting the NSFAS Act of 1999. Funded by the South African government and local and international donations, the scheme aims to assist students needing funding throughout their tertiary education.

The funding was explicitly created to support financially disadvantaged students who wish to study further at national public universities or TVET colleges. If you are a student on NSFAS, knowing how to perform an NSFAS status check is essential. How can you check if NSFAS money is reflected?

NSFAS balance check online

How can you check your NSFAS balance online? You do not need to log on to any website to check for available funds. Here is how you can see your funds if you are a first-time user:

- Step 1: After setting up your account, visit the NSFAS wallet webpage.

- Step 2: You will receive an SMS welcoming you to your NSFAS wallet.

- Step 3: Verify your account using the NSFAS USSD code *120*176# and reply with your ID number.

- Step 4: You will receive a five-digit password that is required when transacting.

- Step 5: Once you are given a password, you can withdraw at various retailers, including ShopRite, Usave, SPAR, Checkers, Boxer, or Pick n Pay.

You must keep your password secure at all times, as anyone with access to it could access and spend your money. The organisation also advises you to log on to Celbux.appspot.com to update your password to something more secure and unique.

Source: Original

How to check your NSFAS balance using your ID number

You do not need to use your ID number when checking your fund balance. The fund works as a regular bank account, requiring only your five-digit or updated password to see your available funds.

How to check your NSFAS balance without airtime

You can perform an NSFAS status check in a few seconds by using the following two steps:

- Step 1: Dial the NSFAS USSD code *120*176# mentioned earlier.

- Step 2: Enter your five-digit password to confirm your available funds.

Does NSFAS check your bank account?

The financial scheme will liaise with your bank to confirm your banking details. They do not have the authority to look directly at your bank account. However, in your supporting documents, you must provide a certified or original copy of a recent payslip and letter of employment for each parent or person who supports you.

They also require the relevant supporting documents from yourself if you are employed. This is done to ensure you qualify for NSFAS funding.

Will NSFAS fund you if you have an outstanding balance?

There are instances where NSFAS will not cover fees, which include the following:

- Outstanding fees.

- Doctor's fees.

- Breakage costs.

- Fines.

- Rental of appliances.

Source: Getty Images

How to submit your banking details

The funding scheme requires your banking details to deposit the funds. Here is how to submit your banking details:

- Step 1: Visit the funding organisation's website.

- Step 2: Select the 'myNSFAS portal' tab.

- Step 3: Log on to your myNSFAS account using your username and password.

- Step 4: Navigate to the 'profile information' section.

- Step 5: Select 'bank account details'.

- Step 6: Fill in your relevant banking details.

- Step 7: Click the save button.

Once you have submitted the details, the organisation will verify your banking details through your submitted bank.

NSFAS online application for 2025

The myNSFAS online application process is done in a few simple steps. As of 25 September 2024 there are 81 days remaining to apply. Applications are set to close on 15 December 2024. Here is how you can apply for funding for 2025.

- Step 1: Go to the financial institution's website.

- Step 2: Select 'register'.

- Step 3: Fill out all of the necessary information.

- Step 4: Upload all of the required supporting documents.

- Step 5: Confirm all of the information has been provided and is correct.

- Step 6: Select 'submit'.

Source: Getty Images

Supporting documents

To ensure your application is successful, you need to include the following documentation:

- A certified copy of your ID document.

- A certified copy of each household member's ID document (including parents or guardians).

- A certified copy of your most recent academic transcript or exam/test results (not relevant if you are in grade 12).

- A letter informing NSFAS that you are exempt from paying school fees (where applicable).

- Original or certified copy of your most recent payslip (if employed).

- Original or certified copy of the most recent payslip of both parents, guardian, or any individual that supports you.

- A copy of an official pension payslip (where applicable).

- Documentation proving your parent(s) or whoever financially supports you is an informal trader (where applicable).

- A certified copy of a death certificate (where applicable).

- A divorce decree (where applicable).

- If your parents do not live at home, you must provide an affidavit explaining why.

- If you are supposed by an individual who is not your parents, you must provide an affidavit explaining why.

- A certified copy of the SASSA letter if your family members receive social grants and contribute to the household's income.

- Proof of registration or acceptance if any household members attend a TVET college or university.

- Supporting documents proving a disability (where applicable).

Despite some confusion, you do not need to do an NSFAS balance check online. Instead, dial the relevant USSD number on your mobile device to see your NSFAS status, check your balance, and obtain details on your available funding within a few minutes. Withdrawing is also quick and can be done at participating retailers within moments.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take based on the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: SASSA branches, contact details and office hours (detailed guide)

SASSA is another government-funding scheme to assist the financially disadvantaged, providing much-needed funding for eligible South Africans. Briefly.co.za wrote about where to find your local SASSA branch if necessary.

What is the closest SASSA branch to you? Read on for the relevant contact details and office hours.

Source: Briefly News