Coinvest NSFAS 2024 guide: How to sign up, fees, withdrawals

Coinvest NSFAS is one of the ways that the National Student Financial Aid Scheme has adopted to make managing your student aid hassle-free. Students usually receive monthly allowances from NSFAS to help them pay for food, transport, and other living expenses. Learn how to register and manage your finances effectively via Coinvest in this comprehensive guide.

Source: UGC

TABLE OF CONTENTS

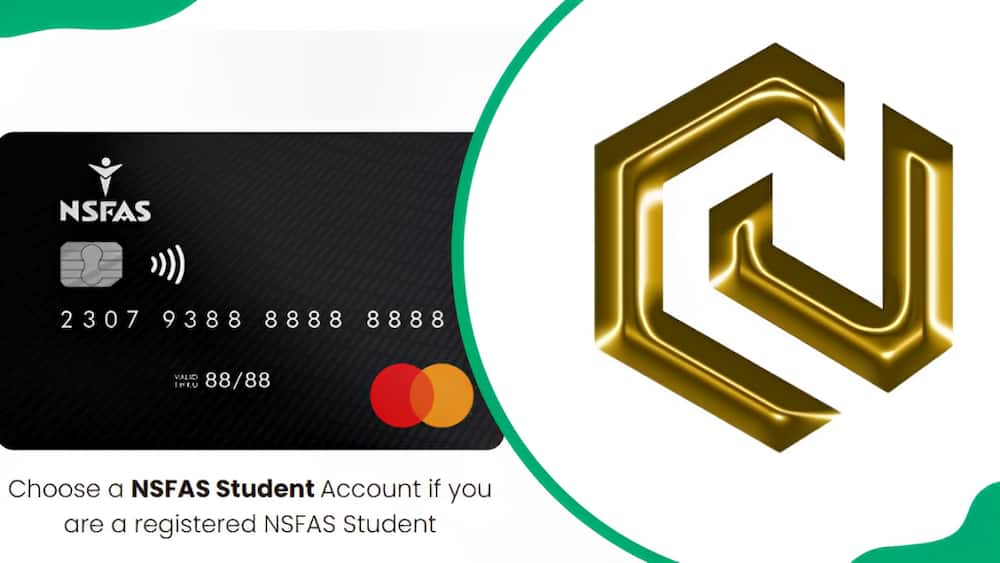

With a Coinvest NSFAS account, a student can withdraw cash from ATMs and selected retail stores, make electronic transfers, and make online transactions and purchases. The issued card is secure and gives beneficiaries complete visibility of all transactions and balances. Students can also download the Coinvest NSFAS app and perform EFT transactions.

What is Coinvest NSFAS?

Coinvest Money is one of South Africa's leading fintech companies that provides convenient and secure mobile money transactions. The company partnered with the National Student Aid Scheme to create a seamless online platform called Coinvest NSFAS.

The Coinvest NSFAS web-based platform allows students in South Africa to apply for, receive, withdraw, and manage their NSFAS funds. It ensures eligible students can access their financial aid securely and efficiently.

Coinvest NSFAS registration

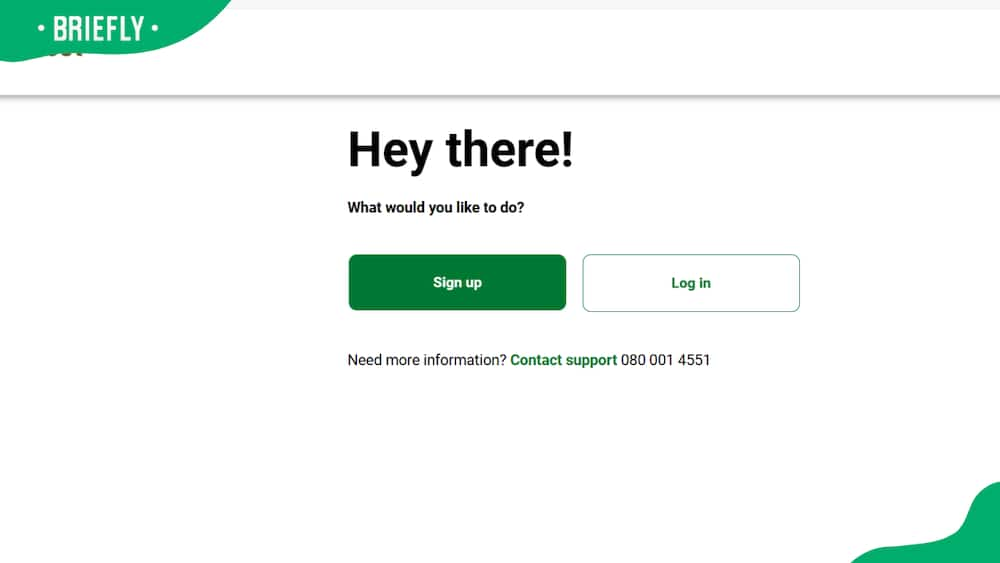

To access Coinvest NSFAS services, you must have an account. After confirming your eligibility to receive student aid, follow these easy steps to register;

- Visit the Coinvest NSFAS website or download the Coinvest NSFAS app from the Google Play Store or the Apple App Store.

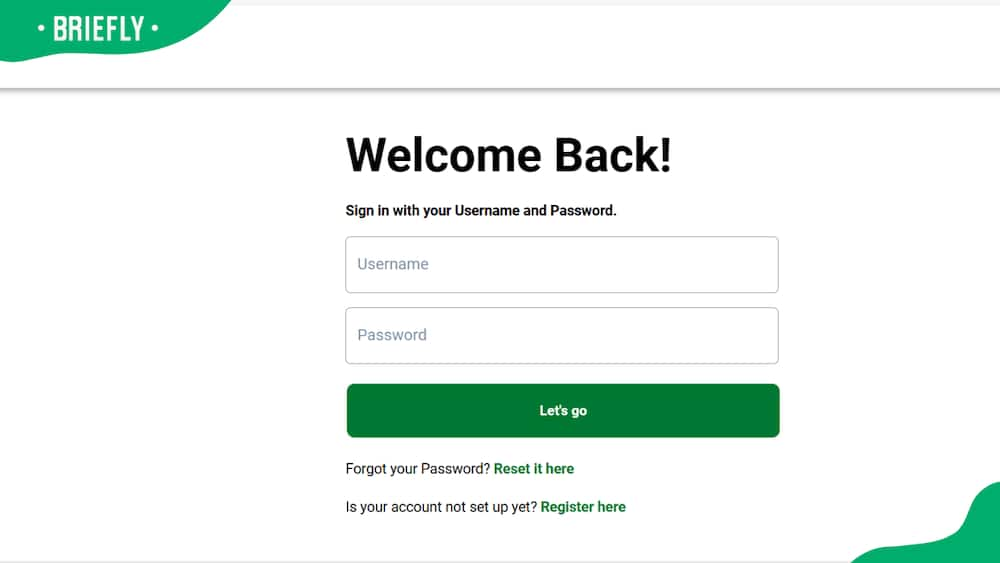

- Click on 'Sign up'

Source: UGC

- Enter your ID number to confirm your identity, then click 'Next' to proceed. If you are not an NSFAS beneficiary, you will not be able to go beyond this step.

- Enter your mobile number

- Accept the terms and conditions, then click 'Next'.

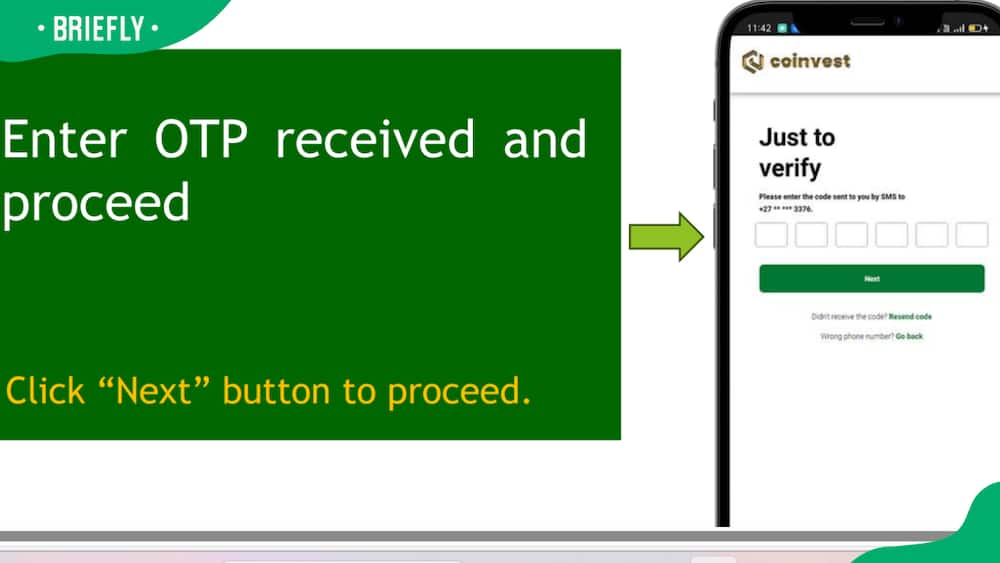

- Enter the One-Time Pin (OTP) received, then proceed

Source: UGC

- Create your username

- Create a strong password you can remember, then click 'Next'.

- Choose the identification type, i.e. the document you would like to use to verify your identity, then click 'Next'.

- Upload the type of identification document selected in the above step by clicking on 'Upload document'.

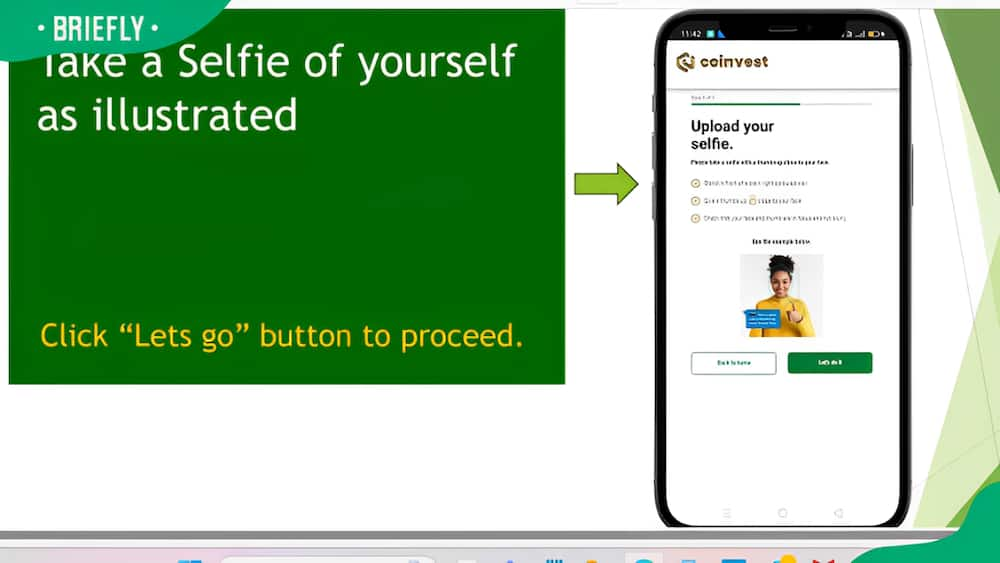

- Upload a selfie and click on 'Let's go'. To take the selfie, ensure you stand in front of a plain, light-coloured wall, and then give a thumbs up close to your face. Ensure your face and the thumb are in focus and not blurry.

Source: UGC

- Enter your details, such as first name(s), surname, ID number, student number, and your institution. Click 'Done' once you have filled all the fields.

- The message 'Your account is ready!' will be displayed. Click 'Done', then add your account and cards.

Once onboarded, students receive an NSFAS Mastercard from Coinvest, which allows them to withdraw money from ATMs, make electronic transfers, use selected retail stores for transactions, and access their monthly allowances via the Coinvest money card. The card can be collected on campus from a Coinvest Agent.

How to withdraw on Coinvest NSFAS

To withdraw money from your online account to your linked bank account or another Coinvest account, follow these simple steps;

- Log in to your Coinvest NSFAS account on their website or via the app.

- Navigate to the 'Move Money' section.

Source: UGC

- Choose 'Withdraw'.

- Enter the amount you want to withdraw.

- Select your preferred bank account for the withdrawal.

- Review the details and confirm the transaction.

- Funds can be withdrawn from an ATM using the Coinvest NSFAS Mastercard. You can also make direct purchases using the card at a POS terminal.

How to check the balance on Coinvest NSFAS

To view your balance, log in to your NSFAS account on the official website or via the app. The dashboard will display your available balance. You can also view transaction histories and statements to see funds movements such as funds received, payments and withdrawals made and more.

Institutions to be onboarded by Coinvest

As an official NSFAS bank account distributing partner, Coinvest currently works with the following educational institutions in South Africa;

- Rhodes University

- Sefako Makgatho Health Science University

- Stellenbosch University

- University of Cape Town

- University of Mpumalanga

- University of South Africa

Coinvest NSFAS contact details

If you have queries regarding the service, you can contact Coinvest NSFAS on their toll-free line at 080 001 4551 or send an email to nsfas@coinvest.africa. You can also dial 011 507 5555.

Source: UGC

FAQs

Coinvest NSFAS has simplified student financial management, but the concept is yet to be understood properly. Here are some frequently asked questions about the service;

Is Coinvest working with NSFAS?

Yes, Coinvest Money is working with the National Student Financial Aid Scheme (NSFAS). The collaboration led to the formation of Coinvest NSFAS, an online platform that facilitates a more streamlined process for students receiving financial assistance.

What is Coinvest NSFAS withdrawal limit?

The maximum amount a student can withdraw in a day is R5,000. The minimum amount that one can withdraw is R10.

What are the NSFAS card charges?

The NSFAS bank card has a monthly charge of R12. NSFAS launched the bank account service to ensure beneficiaries receive their allowances and transact directly using the NSFAS bank card.

With an NSFAS bank card, students can withdraw cash at ATMs, transfer money electronically, and conduct online transactions and purchases. NSFAS bank account distributing partners include Coinvest, eZaga, Norraco, and TeneTech Technologies.

Is Coinvest NSFAS available to international students?

Coinvest NSFAS is not available to international students. The service is primarily designed for South African students. Foreign learners can explore other available financial aid options.

Can you change your Coinvest NSFAS withdrawal method?

A student can change their withdrawal method by logging into their Coinvest account. Navigate to the 'Withdraw Funds' section, and then choose your preferred withdrawal method.

Source: UGC

Navigating Coinvest NSFAS is straightforward, as highlighted above. If you are an NSFAS beneficiary, ensure you sign up to enjoy a streamlined financial management process!

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take based on the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: How to write a diary entry: A simple guide for beginners

Briefly.co.za highlighted all you need to know about writing a meaningful diary. A diary is a useful tool for expressing oneself freely by documenting thoughts, feelings, and experiences.

There is no standard procedure for writing a diary, which is essential for giving it a personal touch. Go through the article for useful tips on how to make a great diary entry.

Source: Briefly News