SA Reserve Bank Announces Repo Rate Hike by 75 Basis Points, Bad News for Car and Home Loans

- The South African Reserve Bank announced that the country's repo rate has gone up by 75 basis points

- The repo rate had been hiked to 5.5% and the prime rate to 9%, inflation is expected to increase by 6.5% this year

- According to the SARB, if the Russian war in Ukraine continues, it may significantly affect global prices

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

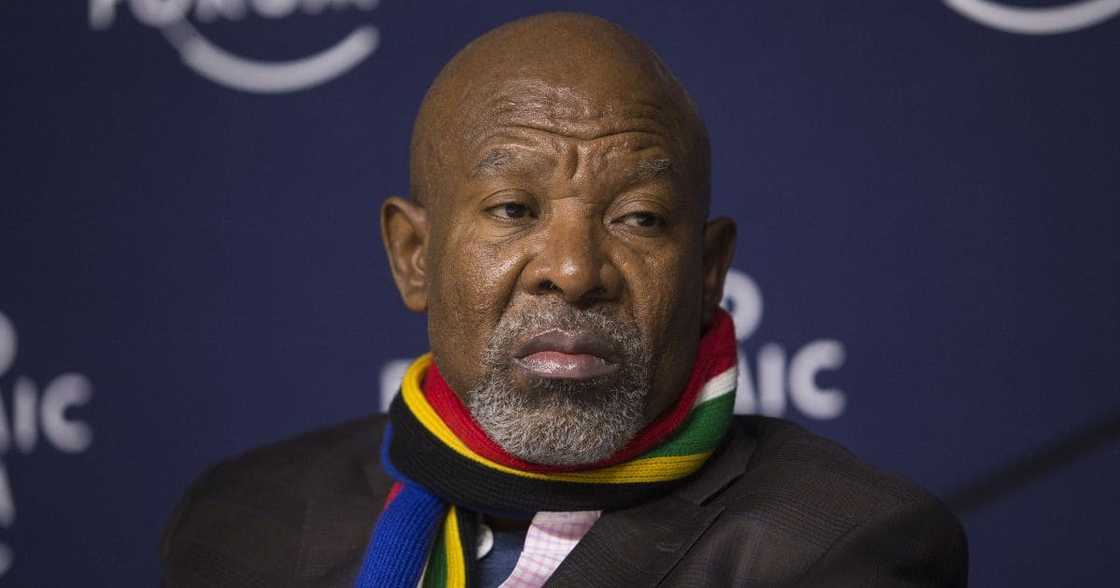

PRETORIA - The country’s repo rate has gone up by 75 basis points, according to the Governor of the SA Reserve Bank, Lesetja Kganyago. He made the announcement on Thursday, 21 July and said inflation continues to “surprise to the upside.”

Source: Getty Images

The cost of living has been spiraling out of control in recent months, and the large hike adds pressure to already struggling citizens. News24 reported that the repo rate had been hiked to 5.5% and the prime rate to 9%. The bank now expects inflation of 6.5% this year.

Read also

One of the world's largest solar power facilities set to be built in SA: "Significant milestone"

Kganyago said that inflation is increasing and that if the Russian war in Ukraine continues, it may significantly affect global prices. He said global producer prices and food prices inflation were higher than usual in recent months. Kganyago warned that the price inflation might do so again.

Investec Economist Annabel Bishop told IOL that Central Banks worldwide are grappling with high inflation, pushing through from the supply side on the price pressure commodity prices experienced. Bishop said with a global recession expected for next year and global economic growth and demand expected to slow down this year, the SARB may wish to get larger rate hikes in more rapidly.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

South Africans are in despair over the country’s high repo rates:

@LW4477 said:

“Well this is expected with the inflation data of yesterday and the state that the global economy is in now.”

@GracyMosetlha commented:

“While salaries don’t move.”

@Mupper77 wrote:

“I asked the Governor what theory informs this madness? How do you increase interest rates to want curb inflation... it is exactly doing what you are trying to prevent?”

Read also

Europe heatwave: Over 1k people die in Portugal, authorities blame climate change for drought and wildfires

@TheLegendOfSAC1 posted:

“Honestly, it’s crazy. How will we survive? Every month it is going up.”

@FedixM stated:

“They are deliberately destroying the heavily indebted middle class.”

@MYKAPTENI added:

“A global recession is coming!”

Rand plummets to new lows, the Euro takes a blow as US Dollar strengthens, global recession fears grow

In a related matter, Briefly News also reported adding to the list of growing problems that South Africans face, the rand continues to weaken and is trading at R17,04 to the dollar.

The dollar strengthens to be at par with the euro for the first time in 20 years. The rand and other emerging currencies’ value have decreased as international investors look to the safety of the US dollar due to fears of a global recession.

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: Briefly News