Powell says US Fed could 'raise rates further,' but urges caution

Source: AFP

PAY ATTENTION: Fuel your passion for sports with SportBrief.com. Click here to discover the latest sports updates!

The US Federal Reserve is prepared to raise interest rates higher -- and hold them there -- to bring down above-target inflation, but will proceed "carefully" going forward, chairman Jerome Powell said Friday.

"We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective," he told the Jackson Hole Economic Symposium in Wyoming.

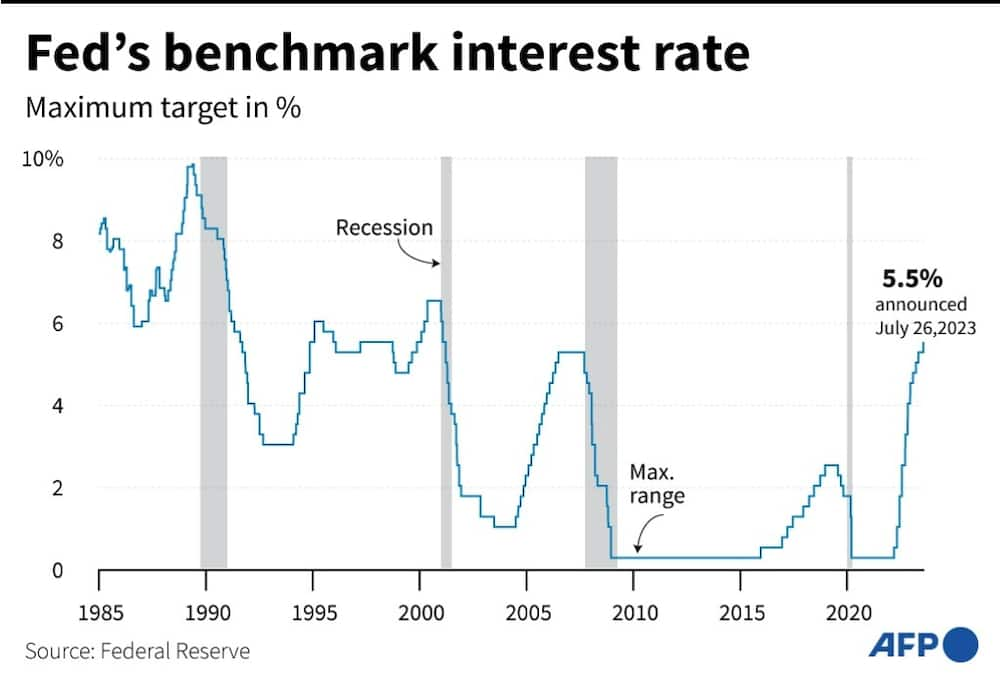

After 11 rate hikes in less than 18 months, the US benchmark lending rate now sits at a range between 5.25 and 5.5 percent -- its highest level for 22 years.

However, the rapid cycle of interest rate increases has failed to definitively quash inflation, which remains stuck above the Fed's long-term target of two percent, despite slowing sharply from recent multi-decade highs.

Navigating 'under cloudy skies'

Source: AFP

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Despite insisting the Fed could yet raise rates, Powell urged caution moving forward during his speech Friday.

"As is often the case, we are navigating by the stars under cloudy skies," he said.

"Given how far we have come, at upcoming meetings we are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks," he added.

US stocks entered a bumpy period following Powell's remarks, with major indices mixed at noon in New York.

"The overall tone of Chair Powell’s Jackson Hole speech is one of cautious optimism coupled with clear determination to take no chances with the inflation outlook," Pantheon Macroeconomics' Chief Economist Ian Shepherdson wrote in a note to clients.

"If that requires further tightening, in the Fed’s view, then so be it. But nothing is guaranteed," he added.

"Relative to market expectations, Powell perhaps delivered a bit more on the side of potential further rate cuts, and a bit less on the idea that average policy rates will be higher," Citigroup economists wrote in an investor note after the speech.

"But overall, the message is that policy rates may stay at higher levels for some time," they added.

Reaffirming two percent target

Source: AFP

Powell told the Jackson Hole retreat that the two Fed's percent goal "is, and will remain, our inflation target."

"We will need price stability to achieve a sustained period of strong labor market conditions that benefit all," he said.

"We will keep at it until the job is done," he added.

Analysts and policymakers remained split ahead of Powell's speech on the likelihood of a 12th hike to tackle inflation at the Fed's next rate-setting meeting in September.

Surprisingly strong jobs and growth data in recent months indicate that the US economy is in better health than many economists feared earlier this year when they forecast the United States was headed for recession.

In his speech, Powell announced the Fed estimated a slight annual increase in its favored inflation measure in July, known as the personal consumption expenditures price index (PCE).

The Fed estimates that PCE in July rose to an annual rate of 3.3 percent from 3.0 percent a month earlier. Inflation excluding volatile food and energy prices also increased.

Official figures will be published by the Commerce Department on Thursday.

Futures traders currently assign a probability of around 80 percent that the Fed will vote to pause rates at its next rate-setting meeting on September 19-20, according to data from CME Group.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP