How to check if you are blacklisted in SA: A comprehensive guide

Being blacklisted in South Africa means that you have a poor credit score which could hinder you from getting credit when you have urgent financial needs. You may have defaulted on your loan and credit cards or failed to pay for goods and services on time. This article gives a comprehensive guide on how to check if you are blacklisted in South Africa and what you can do if you are on the blacklist.

Source: Getty Images

TABLE OF CONTENTS

Blacklisting has several consequences for your financial future. When you have flags on your credit report, no lender will want to extend financial help because you are a risk they do not want to deal with. The good thing is that you can get out of the blacklist if you make conscious financial and borrowing decisions, although it might take some time and effort.

How to check if you are blacklisted by the credit bureau

You can check the status of your credit rating by contacting credit bureaus in South Africa. The country has 11 credit bureaus, but the four major ones include Experian, TransUnion, Compuscan, and XDS.

South African citizens usually receive one free credit report annually, but you can request one by confirming your identity to the bureau. The report is given free of charge, although some bureaus may charge a fee. Here are the simplified steps to take to check your rating;

- Contact a credit bureau online, via telephone, or by visiting their physical offices.

- Confirm your identity by providing the bureau with verifiable data.

- The bureau will send you the full credit report via email or SMS. The report shows how lenders view you and contains details like your personal information, payment profile, and credit lists, as well as judgements and defaults.

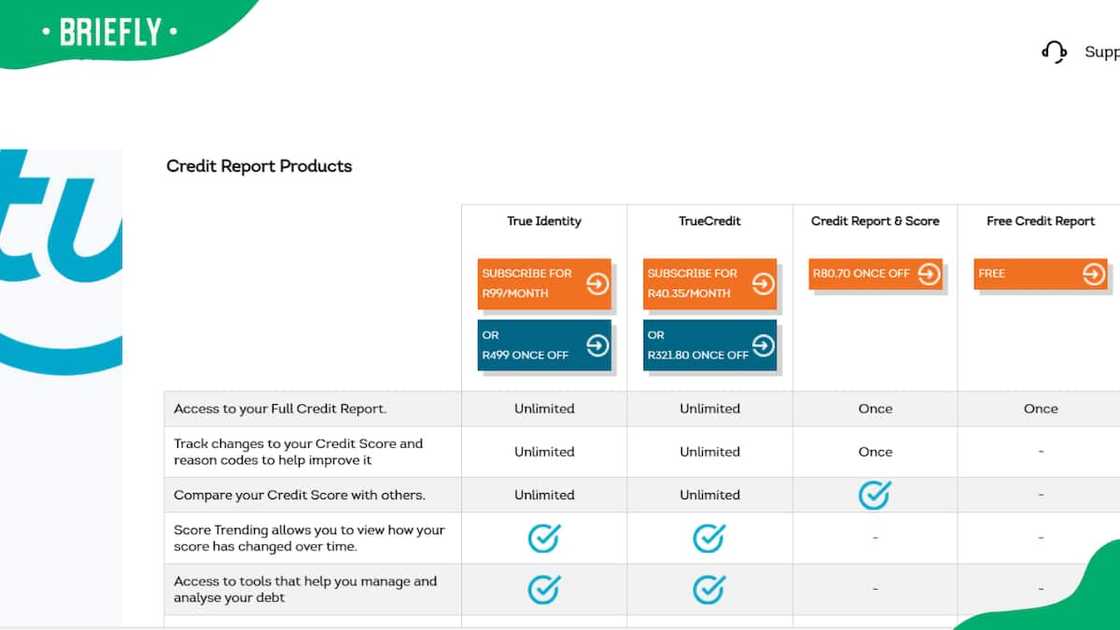

Major credit bureaus offer consumers credit alerts via SMS or email. You may have to subscribe at a fee so that you are alerted in real-time whenever there is an application inquiry, the addition of a judgment or default, and any other changes related to your credit profile.

How to check if you are blacklisted for free online

Credit bureaus like Experian have free online services to help you view your profile. You will need to have a valid South African ID to access your credit information. Experian has the My Credit Check portal, which users have to sign up for to receive free reports.

XDS credit bureau has the Splendi portal where users can get free reports online. You have to sign up and log in to access your details. TransUnion members have to pay a subscription fee.

Source: UGC

How do you get blacklisted?

Individuals are usually placed on the blacklist by credit bureaus in South Africa. They look at a person’s borrowing and repayment history and then use the information to measure credit risk. Here is an outline of how you get flagged;

- A person defaults or makes late payments on their loan

- The lender, including banks and credit card companies, pass the information to the credit bureaus

- The bureau updates the individual’s credit information, such as the amount of debt, credit provider, and date of default, among others.

- The individual’s credit report is flagged with a negative listing, affecting their creditworthiness. If you try to find another lender, they will turn down your loan/credit request after assessing your credit report. Lenders also use the report to determine the terms of the loan in case your application is accepted.

Bureaus have different ways of assessing creditworthiness because they deal with varying types of credit information. It is, therefore, essential to do credit score checks from several bureaus and compare.

The bureaus in South Africa usually update credit reports every 45 days, but the lender could also influence the length of the period. For more details on how credit reporting works, you can contact the credit bureaus directly.

Source: Getty Images

Consequences of getting blacklisted in South Africa

Once your name is blacklisted, it is likely to have long-lasting negative consequences on your creditworthiness. This will, in turn, lead to the following;

- Restricted access to credit since most lenders will not be willing to extend credit.

- Higher interest rates on approved credit applications because you are seen as a risk

- You may have difficulty finding housing since property managers and landlords are unlikely to accept you as a client if your credit rating is bad.

- A bad credit report can affect your employment prospects since some employers check your credit history for certain positions.

How do you clear your blacklisted name?

Once your name has been flagged, it is possible to seek blacklist removal. Here are some of the ways you can clear your name in South Africa;

1. Pay your outstanding debt

Clearing your debt is one step closer to having your name removed from the blacklist. After paying, you should request a paid-up letter and then inform your creditor to have your information updated by the credit bureaus.

2. Lodge a formal complaint with The National Credit Regulator (NCR)

If, after repaying your debt, the creditor fails to update your details, you can contact NCR, which is responsible for regulating the credit industry in South Africa. You can also lodge a complaint to NCR if the rescission of a judgment previously affecting your credit score is taking too long to be resolved by the credit bureau without reasonable cause.

Source: UGC

3. Get an attorney

It is crucial to get professional legal help if the information listed about your credit rating is inaccurate or if repayment and rescission of a judgment have not been updated in your report. The law protects every South African, but if you are unaware of your consumer rights, creditors may take advantage.

Attorneys will help you navigate the legal aspects. They can also seek a reduction of your overall debt obligation, making it easier to repay outstanding balances.

4. Get a debt counsellor

If you cannot manage your financial needs and you are unable to service your current debts, it is crucial to get professional counselling on how to handle your finances. Various debt counselling professionals are found in South Africa, but assess their trustworthiness before working with them.

Debt counsellors can help make your debt affordable by seeking reduced repayments on your behalf. They also help to protect your assets from being seized by debt collectors and prevent creditors from taking legal action against you.

5. Debt review

Over-indebted South Africans are usually placed under a debt rehabilitation program overseen by the National Credit Regulator. The rehabilitation is generally conducted by a debt counsellor to protect the consumer as they repay their debts based on the stipulated debt repayment plan.

The program ensures the consumer does not access more credit before their current debt is repaid in full. They also receive legal protection and other repayment benefits.

Source: Getty Images

How long does blacklisting last?

The blacklisting period is usually five years, but the duration depends on what got you blacklisted. Here are some things that could get you on the blacklist in South Africa and how long it can stay on your report;

- Late credit payments: If you fail to remit your debt payments on time, the creditor usually reports the issue to credit bureaus. Late payments can stay on your report for up to two years, but this can be reduced to three months if you start making payments.

- Debt collection listings: Your lender can contract the services of a debt collection agency to recover debt from you. This kind of listing is likely to stay in your report for up to five years.

- Court orders: A court may order you to honour your financial obligation to a particular creditor. Such rulings will be reflected in your report for up to five years. However, according to the Credit Act in South Africa, the judgements should be removed from the report immediately after being settled.

- Writs of execution: A lender can take legal action to seize your assets and recover money owed. Such actions are likely to be reflected in your report for up to five years.

- Insolvency can reflect on your credit report for up to 10 years

- Individuals can be blacklisted indefinitely if they do nothing to improve their credit score.

Source: Getty Images

Though blacklisting is not permanent, it is crucial to manage your financial responsibilities to maintain a favourable credit profile. The above guide on how to check if you are blacklisted should help you control your credit habits as you strive to achieve financial freedom.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: How to open a Totalsports account in a few steps

Briefly.co.za highlighted all you need to know about opening a Totalsports account in South Africa. Totalsports is one of the leading sportswear retailers in the country.

Having a Totalsports account allows you to take advantage of interest-free credit and access to exclusive offers. Check the article for a comprehensive guide on how to become an account holder.

Source: Briefly News