FNB Private Clients minimum salary: Perks and eligibility explained simply

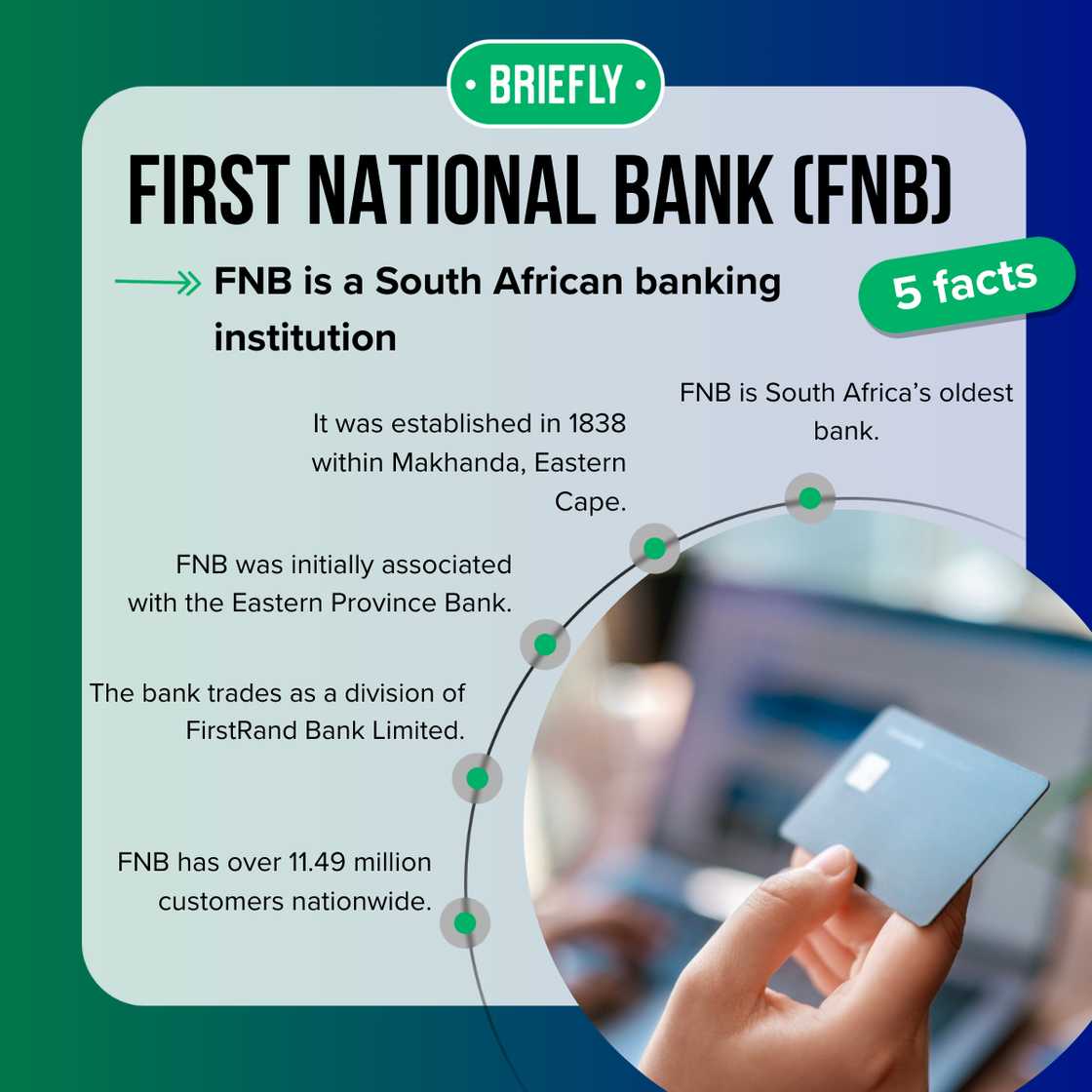

First National Bank (FNB) is one of South Africa's most popular banks, offering exclusive banking to wealthy individuals. Among these exclusive offerings is the FNB Private Clients option. How much do you need to earn for FNB Private Clients?

Source: UGC

TABLE OF CONTENTS

FNB is the oldest bank in the country and offers varying kinds of accounts for those within all income brackets. However, the FNB Private Clients account is for wealthy individuals who wish to have extra perks, including a personal banker available 24/7.

FNB Private Clients' minimum salary

To participate in the FNB private banking option, you must meet the income tax bracket requirements. Clients must receive a minimum annual salary between R750,000.00 and R1,799,999.00.

There are other account options for those in the higher income bracket, including the following other options:

- FNB's Premier Credit Card: Clients must have an annual income between R300,000.00 and R749,999.00.

- A Solopreneur Bundle: Clients must have an annual income between R0 and R5 million.

- Fusion Private Wealth Account: Clients must have an annual income of R1.8 million or a net asset value of R15 million.

Source: Original

How can you be a Private Client at FNB?

Apart from meeting the minimum income requirement, qualifying for private banking at the bank includes meeting the following FNB Private Clients' requirements:

- A valid South African ID or South African passport.

- A passport with a valid work or retirement permit for non-South African residents.

- Proof of residence in the applicant's name, not over three months.

- The last three months' bank statements or latest payslips.

Additional financial requirements

Clients may also need to adhere to the following balance or deposit requirements:

- Minimum transactional requirement of once a month (using electronic channels).

- A minimum balance of R75,000.00.

- A minimum monthly deposit of R32,500.00.

- A deposit of at least R150,000.00 over the previous three months.

According to FNB's PDF Private Clients pricing guide, the FNB Private Clients account fee is R420.00. You may also receive financial rewards, with terms and conditions.

Who qualifies for FNB Private Wealth?

Obtaining a FNB Private Wealth card requires more than meeting the income bracket. Here are the other requirements to become an FNB Private Wealth customer:

- A valid South African ID or South African passport.

- A passport with a valid work or retirement permit for non-South African residents.

- Proof of residence in the applicant's name, not over three months.

- The last three months' bank statements or latest payslip (for applicants applying for an overdraft).

Source: Getty Images

What are the benefits of FNB Private Clients?

FNB Private Clients' benefits include the following:

- Personal banking: As an FNB client's Private Client, you have a dedicated private banker available 24/7.

- Personalised credit options: Clients are given credit options tailored to their needs.

- Added perks: FNB clients can earn and spend eBucks rewards at selected stores, including Checkers, SPAR, Engen, iStore, and Clicks.

- Global travel insurance: Clients who buy their return ticket with their FNB debit card, FNB Fusion card, credit card, or eBucks are eligible for R5 million in travel insurance for the first 90 days of their holiday.

- Financial perks: Private Clients get zero increase in monthly account fees regarding personal banking current accounts and reduced costs on prepaid airtime.

How can you contact your private banker?

You can contact the Private Clients Service Suite via 087 575 9411. Alternatively, you can email servicesuite@fnbprivateclients.co.za if you require further assistance.

Where can you report a bank complaint?

Some customers may find their complaints more severe or significant than speaking to their bank's customer care centre. If you would like to file a complaint about your bank as an entity, you can contact the National Financial Ombud Scheme (NFO) for free assistance.

Source: Getty Images

What types of problems does the Ombudsman handle?

The National Financial Ombud Scheme (NFO) deals with the following complaints:

- Poor service

- Inappropriate advice

- Incorrect information on account payments

- Unfair treatment

- Discrimination

- Disputes of fact or law

Contact details

Contact the specialised FNB Private Clients' contact number at 086 013 6739 or a customer care agent via the bank's general customer care centre at 087 575 9404.

FNB's head office details

To escalate a query, contact the bank's head office via the following details:

- Address: 288 Pretoria Avenue, Ferndale, Randburg, Gauteng

- Cell phone number: 087 575 9404 (standard customer care line)

- Email address: info@fnb.co.za

The FNB Private Clients' minimum salary directly reflects how the bank has banking solutions for those of all income brackets, with exclusive benefits for each banking option. Those with standard bank accounts can also look forward to exclusive perks and speak to an agent at their local FNB branch.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take based on the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: Can you reverse an unredeemed Capitec Cash Send in SA?

While discussing banking options, Briefly.co.za wrote an article about Capitec's cash send option. Capitec provides its clients with a cash-send option, allowing customers to send money without requiring banking details.

Can you reverse an unredeemed Capitec cash send in South Africa? Read on for everything you need to know about the bank's function and other features.

Source: Briefly News