SA Divided Over Woman’s Reveal of High Tax on 2-Pot Fund: “Ministers Need to Eat”

- A young woman on TikTok shared with app users the tax amount for her two-pot system withdrawal

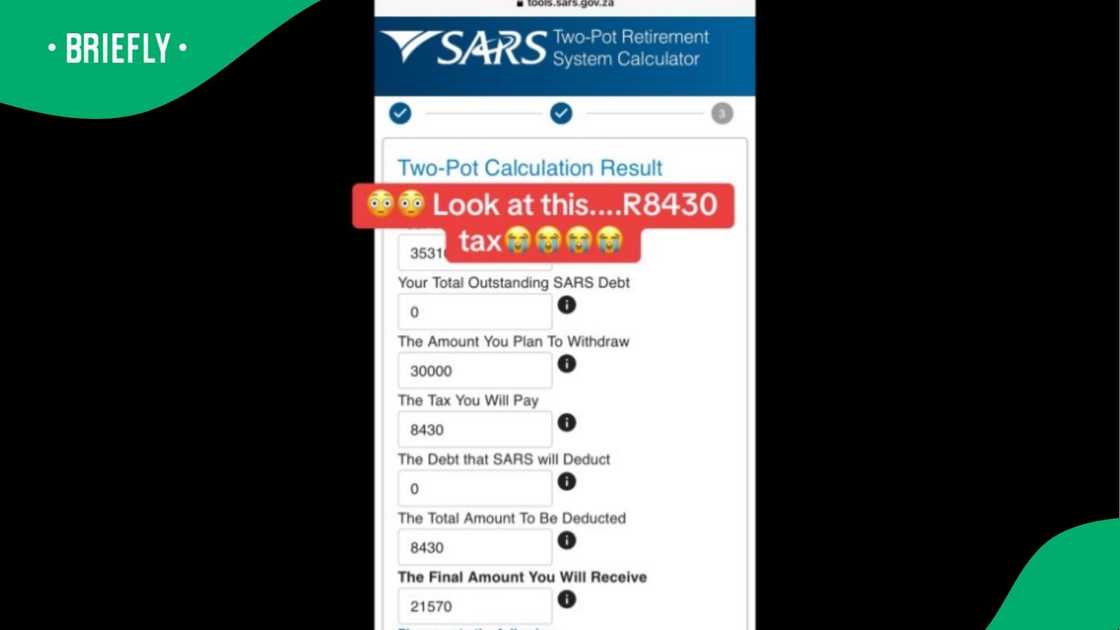

- She showed people that she would be taxed just under R8 500 if she had to take the maximum amount from the retirement fund

- While some social media users thought it best to take the money sooner rather than later, while others thought she should leave it

- A financial advisor spoke to Briefly News about whether the woman should withdraw the funds or keep it until retirement

Source: TikTok

The two-pot retirement system has left many people curious about the tax implications when withdrawing their savings. Recently, a woman unveiled the surprisingly high tax amount she would incur from her fund, leaving online users on the fence about whether she should withdraw her money.

2-pot tax breaks woman's heart

Dorah Tulikey took to her TikTok account (@dorahtulikie) to share a screenshot of her search results when she checked her two-pot fund on the SARS website.

After she had entered the maximum amount (R30 000) she had planned to withdraw, the online calculator showed her how much she would be taxed.

"Look at this. R8 430 tax," said a disheartened Dorah.

Take a look at the picture below:

Source: TikTok

Withdraw 2-pot funds or keep it for retirement?

Cape Town-based financial advisor Walter De Wet from Mzingisi Brokers said to Briefly News:

"The best option in this instance is to be decided by the individual. Many people find themselves in dire financial situations and are looking for some sort of relief."

Walter also weighed out the pros and cons concerning the two-pot funds:

"Taking from your retirement savings could relieve the financial pressure immediately or to a degree. However, there are implications, such as costs and taxation.

"There will be administration fees payable as determined by the service provider. Tax will also be deducted as per the individual’s marginal tax rate. The aforementioned would reduce the net amount paid to the individual."

He also mentioned that one-third of the individual's retirement contributions will go into a savings pit for future access, thus reducing their retirement savings at retirement age.

"In my opinion, it would be wise not to access retirement savings before retirement so that the individuals would be better prepared for retirement."

Mzansi reacts to tax on 2-pot retirement fund

Local taxpayers rushed to the woman's comment section to express their thoughts on whether to withdraw their money or leave it for retirement.

A saddened @wendydevilliers2 wrote:

"Taxing us on our own blood, sweat and tears. So unfair."

@joinclemy said to people online:

"Guys, take your money. Life is not guaranteed. What if you leave it and next year you die? Just chow your money."

@susanmjsberry added in the comments:

"Very sad. Why are they doing this to us? We are just salary workers. We are also trying to get somewhere. Let the sun also shine over us."

Read also

Two-Pot Retirement System: Alexander Forbes processes withdrawal requests totalling over R1 billion

@nadiafct advised the woman of their opinion:

"Take the money. It's better than taking a personal loan at the bank and then you must pay interest. Rather, pay tax than bank interests. Book a holiday package for yourself, enjoy it and make memories."

@tanianwhitney said to the online community:

"Imagine retiring, and then both pots are empty."

@efl2021 wrote in the comment section:

"Ministers need to eat. We work, and they chip away. They should have lowered the tax for this 2-pot specifically."

What you need to know about 2-pot system

The Two-Pot Retirement System allows you to withdraw a small portion of your retirement savings before retirement for emergencies. However, most of your savings will remain “preserved,” meaning you'll need to keep most of your funds invested until you retire.

Starting 1 September 2024, one-third of your contributions will be allocated to a savings component, while the remaining two-thirds will go into a retirement component.

On 31 August 2024, there will be a one-time mandatory transfer of 10% of your retirement savings (up to R30,000) to the savings component. The remaining funds will stay in your vested component.

Moving forward, both the vested and retirement components will continue to be subject to existing restrictions, whereas the savings component will be available for use at any time before retirement, serving as a “rainy day” fund.

Man complains about high tax on 2-pot withdrawal

In a similar article, Briefly News reported about a local man who shared a screenshot of the amount he wanted to withdraw from his two-pot system pension fund.

The picture also showed the total tax deductions, which the man was not too pleased with.

PAY ATTENTION: Сheck out news that is picked exactly for YOU - click on “Recommended for you” and enjoy!

Source: Briefly News