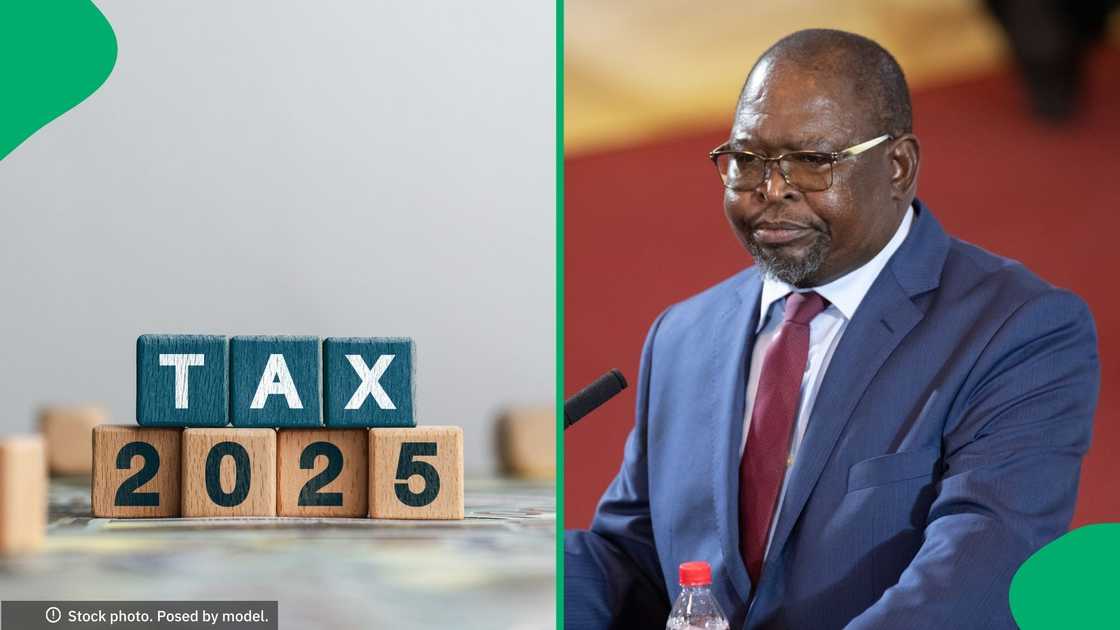

Enoch Godongwana Scraps Proposed VAT Hike, SA Suggests How Government Can Negate Expected Shortfall

- Enoch Godongwana has officially scrapped the proposed Value-Added Tax increase included in the budget

- The decision was made late at night on 23 April 2025 after meeting with the various political parties

- South Africans made suggestions as to how the government could make up for the shortfall from the VAT

Source: Getty Images

Briefly News journalist Byron Pillay has dedicated a decade to reporting on the South African political landscape, crime, and social issues. He spent 10 years working for the Northern Natal Courier before transitioning to online journalism.

GAUTENG – The proposed Value-Added Tax increase has officially been scrapped.

VAT will remain at 15% on 1 May 2025 after Finance Minister Enoch Godongwana reversed an original decision adopted in the National Assembly on 12 March.

The National Assembly agreed to a 1% VAT increase over the next two years, with ActionSA saying that it agreed to the budget on condition that the ANC find an alternative to the increase.

Read also

State wraps up its case in Joslin Smith trial, accused opt not to testify or call any witnesses

PAY ATTENTION: stay informed and follow us on Google News!

Finance Minister scraps VAT hike

In a move reminiscent of late-night cabinet reshuffles, Godongwana opted to scrap the increase at midnight on 23 April.

The move came after a lengthy meeting with the top leadership of the African National Congress in which Godongwana announced his intentions to do away with the increase.

“The decision not to increase VAT means that the measures to cushion lower-income households against the potential negative impact of the rate increase now need to be withdrawn and other expenditure decisions revisited,” the minister said.

He added that the decision came after extensive consultations with the various political parties and careful consideration of parliamentary committee recommendations.

Godongwana will now have the task of covering the estimated revenue shortfall of about R75 billion that the VAT would have brought in.

A revised version of the Appropriation Bill and Division of Revenue Bill will now be presented within the next few weeks. The minister will go back to the drawing board, considering the different suggestions and proposals, before making the required changes.

Read also

ActionSA accuses DA of using budget speech for political gain, says party MP helped plan 2% VAT hike

Economic Freedom Fighters labelled Godongwana a liar

The reversal of the VAT hike comes after a long-drawn-out battle going back to 19 February. The Democratic Alliance (DA) and Economic Freedom Fighters (EFF) object to any VAT increase from the beginning, even taking the adopted budget to court.

In his reply to the application brought forward by the parties, Godongwana said it was too late to reverse the decision. The EFF took offence to this statement, accusing him of lying to cabinet when he suggested that he could reverse the decision if ActionSA and other parties voted for its adoption.

Source: Getty Images

What you need to know about the budget speech saga

- Julius Malema stated that the government collapsed after failing to present a budget on 19 February.

- The uMkhonto weSizwe (MK) Party threatened a national shutdown if a VAT hike was included in the budget.

- The 2025 Budget was adopted in the National Assembly on 2 April 2025 after 194 members voted in favour of it.

- The EFF filed papers in court to challenge the legality of the budget adopted by Parliament.

- The ANC Youth League wants DA ministers to be removed from their posts for voting against the budget.

- The ANC and DA sat down to discuss the future of the Government of National Unity (GNU) following divisions caused by the budget.

Read also

Donald Trump's administration considering draft order, aims to reduce diplomatic footprint in Africa

South Africans suggest cost-cutting ideas

Social media users welcomed the news, but many felt as if there was more that could be done. South Africans suggested how the government could free up funds to negate the expected shortfall.

Lazarus Luvalo said:

“It’s so simple. Stop corruption, and all the crooks must bring back the money, and it will be enough.”

Thabane Dladla suggested:

“Clamp down on corruption. Cut the bloated cabinet. Reduce ministers’ spending spree. Taxi associations should also pay tax.”

Sibabalwe Nono Mayeki also had ideas:

“Cut the Covid 19 grant. Reduce ministers’ allowances. Scrap certain development agencies because there is just a duplication with what departments are doing, and build capacity, if that is the challenge. Also, regulate churches.”

Moloko Moloko added:

“Cut a bloated cabinet. You can't have 32 ministries and 43 deputies. In fact, SA can run on 16 ministries without deputies. Stop corruption, theft, money laundering and racketeering, then we will all be fine. Don’t forget to reduce VAT to 12% to attract investors, period.”

Read also

Institute of Race Relations DA, EFF, and MKP benefited from VAT saga, ANC lost support from people

Martin Badenhorst stated:

“And minimising the bloated cabinet will save us billions.”

Charmaine Webber said:

“Cut government perks. Government officials should live on the same salaries and income as the people of the country. The ANC government is spending what is not theirs to spend.”

ANC considering scrapping VAT increase

Briefly News previously reported that the ANC met with the DA to discuss a way forward regarding the budget.

The DA voted against the proposed VAT increase in the budget, and even took the matter to court to stop it.

A senior ANC member admitted that the party may have to abandon the proposed hike as the party failed to earn the support for it.

Source: Briefly News