A Letter of Authority South Africa: format, sample, how to get one

Death is an unavoidable phenomenon. After the demise of our loved ones, we have to find closure to move on, however difficult it may be. Life keeps going. It does not stop to let you wallow in your sorrows. For this reason, a Letter of Authority South Africa is significant.

Source: Facebook

After death, especially of the parents, their children are left to divide among themselves. With this, a lot of disagreements may come up on how to divide the assets. This is where the Letter of Authority comes in. This document dictates the liquidation and distribution of the properties of the deceased. Furthermore, the letter speculates the steps to be followed to collect and divide property to the heirs according to the will. Here is all you need to know about the letter of authority in South Africa.

How do you get a Letter of Authority?

What is the purpose of Letter of Authority? The LOA is a document issued by the Master of the High Court regarding the executorship of property. The document dictates the terms of passing the estates of a deceased person to the right executor. With this, confusion and eventual conflict between those who are rightfully supposed to inherit the deceased's property are sorted.

This way, a letter of executorship is issued to the rightful executor, who thereby manages the deceased estates. It is always advisable to choose a professional executor who can handle the property.

How to apply for a letter of authority

After death, the deceased's family has to nominate a representative who handles the deceased's property. They are given the power to handle all the debts left by the dead and ensure that all the heirs get their equal share.

How long does it take to get a Letter of Authority? The document is obtained from the Office of the Master of the High Court of a Magistrates court and can take up to 120 days to be issued.

What documents are needed for Letter of Authority

The following documents are required when applying for the Letter of Authority.

- Complete death notice

- Original or certified copy of the certificate of death

- Original or certified copy of a marriage certificate (if applicable)

- All original wills or documents intended as such (if any)

- Next-of-kin affidavit if the deceased did not leave a valid will (form J192)

- Completed inventory form (form J243)

- List of creditors of the deceased (if applicable)

- Nominations by the heirs for the appointment of a Master’s representative in the case of an intestate estate or where no executor has been nominated in the will or the nominated executor declines the appointment.

- Undertaking and acceptance of Master’s directions (form J155)

- Declaration confirming that the estate has not already been reported to another Master’s Office or Magistrates Court.

What do you do when someone dies in South Africa?

Source: Facebook

There is a legal procedure that needs to be followed upon the death of an individual. These formalities are observed when the cruel pangs of death bite. Here is what to do when someone dies in South Africa.

Notice of death

When a person dies, it is upon their close friends and family to make a Notice of Death to the legal authorities. The health practitioner usually collect this data in case the deceased died in their care. The Notice of Death indicates the date and time as well as the cause of death.

Issuance of death report together with the burial order

The Home Affairs issues the death report along with the burial order. If the family opts for cremation instead of burial, the confirmation of a second doctor will be required.

Issuance of a death certificate

On receiving the Notice of Death and the Death Report, the Department of Home Affairs issues a death certificate, which is usually needed when an executor makes claims on the Letter of Authority for a deceased estate.

Death report to the Master of the High Court for executorship

According to South African law, one must report the death of the deceased to the Master of High court within 14 days after the death to get a Letter of Executorship and a Letter of Authority. Once the Death Certificate is presented, the court is permitted to permit executorship. Anyone who is in control of the property can make the report.

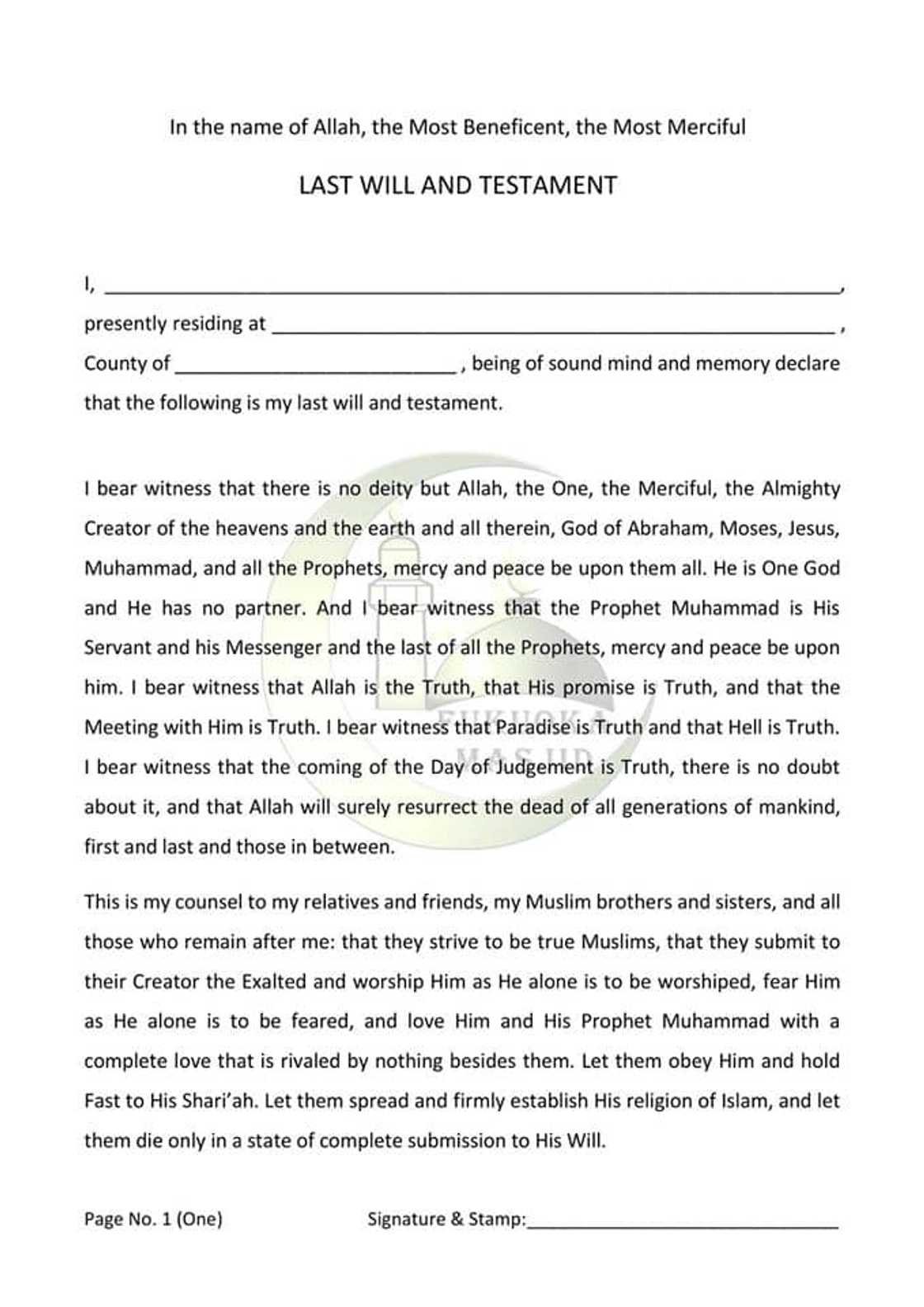

Inheritance law in South Africa

Source: Facebook

Several rules govern inheritance in South Africa. The sole control of heritage is a will that was written by the deceased when they were alive. The will dictates the ownership of the property after the death of the original owner. Below are the requirements of a legal will, according to the South African legal matters.

- The creator of the will must be over 16 years.

- The will provided must be in writing, either typed or handwritten.

- Every page must be signed by the testator or a person appointed by the testator in the presence of witnesses.

- The witnesses must also sign the will to prove its validity.

- A commissioner of oaths must certify the will and also sign the pages of the will.

The executor, with the Letter of Authority, manages the will according to the instructions it provides. In case the amount of money is not sufficient for the recipients, the executor puts the deceased property for sale.

Notice to creditors in the deceased estates

A notice to creditors is a public notice by an executor or a trust as part of the probate of a deceased person’s estate. This notice notifies all the possible creditors and debtors of the probate, and it usually runs for a period dictated by the state laws.

Frequently asked questions on inheritance matters

With long processes like these, people are often confused about where to start and go about the whole journey. They are left with many yet specific questions about the Letter of Authority. Here are the answers to the most common questions.

How long does it take to settle an estate in South Africa?

This process takes time to complete which, means it requires constant check-in to see if it was successful. With that, it averagely takes from 6 months to 13 months to finalize the estate administration process.

Is a handwritten will legal in South Africa?

Source: Instagram

A handwritten will is legal in South Africa. However, the will must be signed by the testator or a person appointed by the testator in the presence of witnesses.

How long does a letter of authority last?

The validity of a Letter of Authority is usually twelve months. The LOA usually indicates the validity dates. In the case that the validity is longer or shorter than 12 months, it should be mentioned.

Is inheritance taxable in South Africa?

Inherited assets are not taxable. These assets are considered capital receipts and are therefore not included in the gross income. The Capital Gains Tax (CGT) is not payable by the person inheriting the property. The CGT is usually payable by the estate itself.

What are the implications of dying without a will in South Africa?

Claiming a deceased estate in South Africa when there is no will requires the intervention of the Intestate Succession Act. Here, the Master nominates an executor who will foresee the management of the property.

Letter of Authority template

Below is an example of a Letter of Authority template in South Africa.

Source: Facebook

A letter of authority in South Africa typically gives the executor authority to act on behalf of the deceased person. The Letter of Executorship South Africa is issued by the Master of the High Court to permit the executor to perform their duties legally. It is always essential to write wills for a smooth liquidation and distribution of the deceased estates.

READ ALSO: How to apply for bursaries in South Africa in 2021

Are you looking to join a university or college, but you lack the necessary funding? Do you have a consistently strong academic history? Whether you are a continuing student or joining the university and your household income cannot allow you to do so, there are tons of bursaries in South Africa you qualify for. Briefly.co.za recently published details on how to apply for bursaries in South Africa in 2021.

Source: Briefly News