Most Asian markets up on rate hopes but China fear casts shadow

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Briefly News on your News Feed!

Most Asian markets rose Monday after a surge on Wall Street fuelled by hopes the Federal Reserve could begin to slow its pace of interest rate hikes.

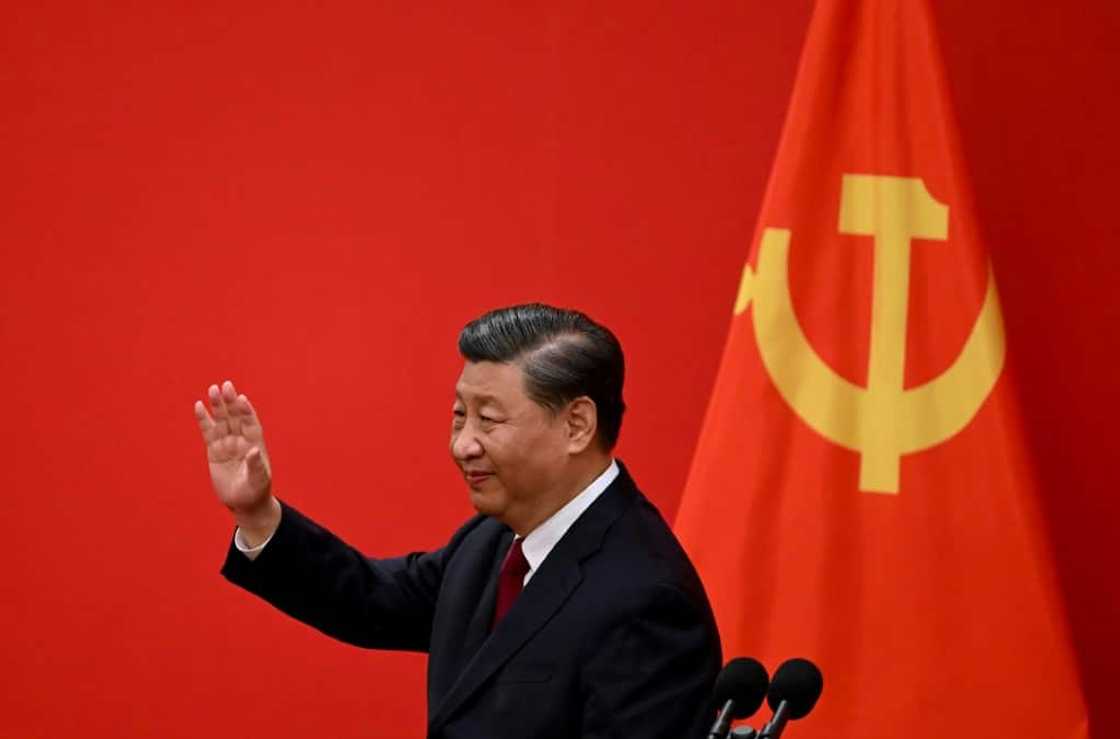

However, the bright start to the week was overshadowed by a plunge in Hong Kong and Shanghai after Xi Jinping was handed a third term as leader and put in place a team who back his economically damaging zero-Covid strategy.

The yen fluctuated against the dollar as speculation swirled that Japanese authorities had stepped into forex markets again to support their currency for a second time in as many sessions.

Tokyo, Sydney, Seoul and Taipei led gains after a strong performance in New York that was sparked by a report the Fed could begin to take its foot off the pedal in its rate hike campaign.

The Wall Street Journal article said some officials were keen to discuss a slowdown when they meet next month.

Markets have been hammered this year by fears that moves by the Fed and other central banks to fight decades-high inflation will spark a recession.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Officials had been expected to lift rates 75 basis points for a fourth successive time next month, while bets were increasing on another such move in December.

"The mere suggestion of the Fed stepping down from 75 basis points to a 50 basis point incremental rate hike in December produced a fierce rally in US equities, partial reversal of the recent surge in US Treasury yields and smart about-turn in the US dollar," said National Australia Bank's Ray Attrill.

However, while most equity markets across the region were well up, Chinese markets were being hammered by the reshuffle at the top of government. Hong Kong shed more than four percent and Shanghai almost one percent.

Zero-Covid worries

Xi, who was at the weekend given a third five-year term as leader, handed key positions to loyalists who back his strategy of fighting Covid outbreaks with lockdowns and other strict measures.

The policy has been blamed for the sharp drop in growth in the world's number two economy, and while data showed Monday that it expanded more than forecast in the third quarter, traders remain on edge.

On currency markets, the yen was hovering around 149 to the dollar, having strengthened to 145.65 earlier amid talk that authorities had intervened to support the unit for a second time in as many sessions.

Observers said officials likely stepped in on Friday after the dollar soared to a fresh 32-year high of 151.93 yen. That came after warnings from the finance ministry that it was keeping tabs on movements, and follows a similar move last month.

"Whilst the (finance ministry) has since declined to comment on whether they intervened, such action has not come without multiple warnings from officials," said Matt Simpson at City Index.

"The MoF last week said they will deal with speculators 'severely' and the strong price reaction on Friday suggests they did just that.

"Price action has also been erratic in Monday's Asian session, which points to another probable intervention."

The pound rose after former UK prime minister Boris Johnson said he would not stand for the Conservative leadership again, after the resignation of Liz Truss last week.

His decision leaves his former finance minister Rishi Sunak the favourite to take the reins and become the country's third premier this year.

The choice of the less-controversial Sunak could provide a little stability in Westminster after weeks of turmoil sparked by Truss's debt-fuelled mini-budget that hammered the pound and sent shivers through markets.

Key figures around 0230 GMT

Tokyo - Nikkei 225: UP 1.0 percent at 27,156.95 (break)

Hong Kong - Hang Seng Index: DOWN 4.4 percent at 15,497.13

Shanghai - Composite: DOWN 0.9 percent at 3,010.37

Pound/dollar: UP at $1.1318 from $1.1258 on Friday

Dollar/yen: UP at 148.92 yen from 147.65 yen

Euro/dollar: DOWN at $0.9840 from $0.9863

Euro/pound: DOWN at 86.93 pence from 87.26 pence

West Texas Intermediate: FLAT at $85.05 per barrel

Brent North Sea crude: FLAT at $93.47 per barrel

New York - Dow: UP 2.5 percent at 31,082.56 (close)

London - FTSE 100: UP 0.4 percent at 6,969.73 (close)

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP