Women battle on for equality in top business jobs

Source: AFP

More women are taking top management jobs but inequality persists, with men still dominating business leadership roles, research showed ahead of International Women's Day on March 8.

Despite some high-profile exceptions and laws helping to boost quotas for women board members and executives, it remains a slow march to the top.

A survey published last week by Equileap, which researches data on diversity, found only seven percent of CEOs and 17 percent of finance directors in big companies in developed countries were women.

"The battle for gender equality remains ongoing," said Equileap's CEO Diana van Maasdijk.

A 2023 report by the World Economic Forum noted that "women's share of senior and leadership roles has seen a steady global increase over the past five years," with the proportion of women hired into leadership roles rising from just over 33 percent in 2016 to nearly 37 percent in 2022.

Source: AFP

PAY ATTENTION: Let yourself be inspired by real people who go beyond the ordinary! Subscribe and watch our new shows on Briefly TV Life now!

But the overall figures for women's representation at companies show they are still in a minority at the top level.

"Work structures have been built up over the last 200 years to accommodate men's needs," said Tara Cemlyn-Jones, the CEO of 25x25, a non-profit organisation that aims to improve the gender balance in executive leadership roles.

"The only way that you can get around that is being consciously aware that you have to make sure the structures are equally fair to women," she told AFP.

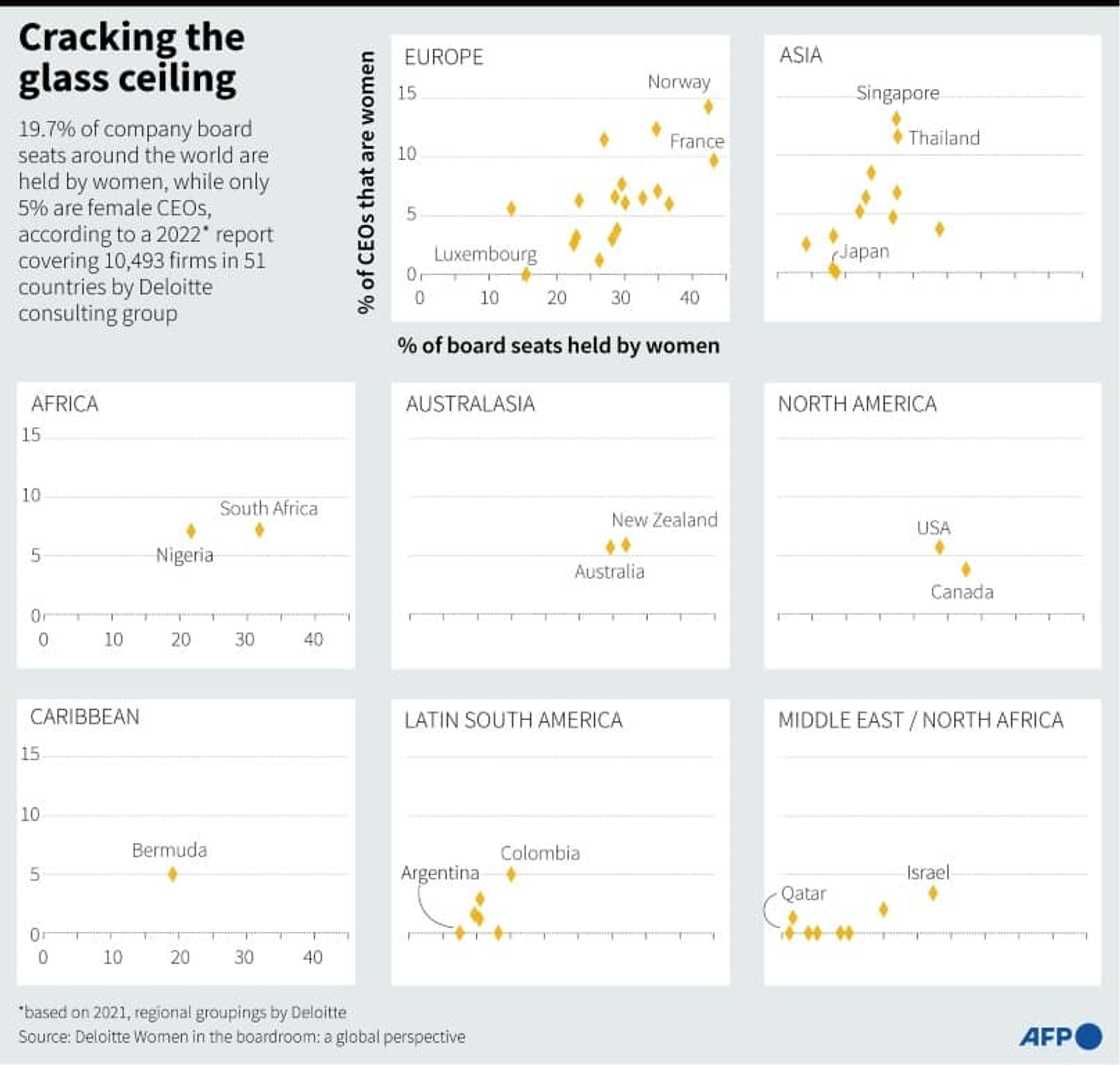

A Deloitte survey of 10,500 companies in 51 countries with data from 2021 found that while about one in five board members were women, just one in 20 chief executives were.

In the United States, women represented about a quarter of board members but less than six percent of company directors.

In Britain, women occupied roughly 30 percent of seats on boards but only six percent were executives.

Quotas for women bosses

Some countries have legislated to fix the gender imbalance -- such as France.

The country topped Equileap's ranking for gender equality in companies, based on various criteria including pay, leave and protection from harassment.

In 2011, France introduced a law that set a quota for boards: they must have a minimum of 40 percent women.

The changes "will bear fruit in the long term," said Diane Segalen, chair of recruitment consultancy Segalen + Associes.

According to Deloitte's report, over 40 percent of board members in France in 2021 were women.

Ariane Bucaille, a partner at Deloitte, called the quotas a "great accelerator".

But while there is a rise in the number of women on executive committees, she said, "it is more in functions such as human resources and marketing."

Source: AFP

Currently, only three of the companies listed on France's leading stock market index, the CAC 40, have women chief executives.

In Germany, Belen Garijo of Merck is the only female CEO of a company listed on the DAX index of blue-chip firms.

Last year in Italy, Giuseppina di Foggia became the first woman to head a major listed company in the country after she was appointed CEO of public energy distributor Terna.

In Spain, most companies on the country's stock exchange are run by men, except Zara owner Inditex, headed by Marta Ortega -- daughter of the firm's founder -- and Santander bank under executive chairwoman Ana Botin, who took over the post from her late father.

Investors' role

A recent report by 25X25 found that women occupy a "remarkably low" proportion of senior management positions, such as finance director, that are stepping stones to become CEO.

To change this, France introduced a law in 2021 that set a target of at least 30 percent of women in executive roles from 2026, increasing to 40 percent by 2029.

This law, Bucaille said, "will encourage certain advancements. But it's inevitably slow."

Source: AFP

Quotas or not, Cemlyn-Jones said it is important to transform the system. And for that, investors will have to play a role.

"If their investment decisions are made 100 percent by white men from a very small social background, obviously, that's going to ripple all the way through the system," she said.

"The investment cycle has to be made accountable. And questions should be asked, like, 'how are these investment decisions being made?' How is it tolerated that these fund managers are saying: 'Don't bother about gender?' We don't want to hear that."

Recruitment director Segalen said she is nevertheless confident that women's representation will grow.

"I believe it is going to happen with the following generation, that got started in the 2000s," she said.

"They have elder women who are inspiring role models."

Source: AFP