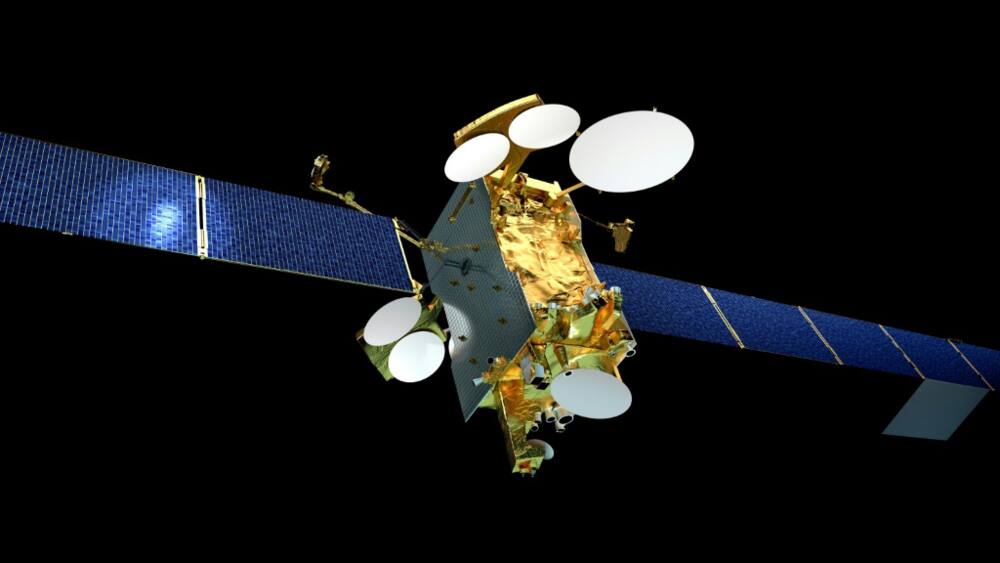

European satellite giant SES to buy US rival Intelsat

Source: AFP

PAY ATTENTION: Let yourself be inspired by real people who go beyond the ordinary! Subscribe and watch our new shows on Briefly TV Life now!

European satellite group SES will acquire US rival Intelsat for $3.1 billion, the companies said Tuesday, seeking to compete in a race for space-based internet service led by Elon Musk's Starlink.

The merger, which follows year-long talks, comes as Musk already has a constellation of internet satellites while Amazon has launched its own tests.

"In a fast-moving and competitive satellite communication industry, this transaction expands our multi-orbit space network," SES chief executive Adel Al-Saleh said in a statement.

SES and Intelsat said in a joint statement that 60 percent of the combined group's revenue would come from "high growth segments" and generate an annual core profit of 1.8 billion euros ($1.9 billion).

"The combination will create a stronger multi-orbit operator with greater coverage," the statement said.

The boards of both companies unanimously approved the transaction, which they expect to close in the second half of 2025 pending approval from regulators.

The move comes four years after Intelsat filed for Chapter 11 bankruptcy protection in the United States and launched a broad restructuring programme to tame its debt.

Founded in 1964 as an intergovernmental consortium to own and manage a constellation of communications satellites, then privatised in the early 2000s, Intelsat now has more than 50 geostationary satellites.

SES for its part last year generated sales closing in on two billion euros ($2.15 billion), a nine percent increase.

But it ended the year in the red with net losses of 34 million euros as video transmission receipts slid amid competition from fiber-optic video streaming services.

The groups distributes transmission capacity to more than 8,000 TV broadcasters across the globe.

The sector faces growing competition for space-based internet service, which satellite operator Eutelsat says could be worth $16 billion by 2030.

Musk's Starlink has taken the lead with a system promising broadband service even in the most remote locations.

Starlink says it has placed 5,000 satellites in low Earth orbit and has 2.3 million customers. It aims to deploy nearly 30,000 satellites.

Amazon, the company founded by Jeff Bezos, launched two test satellites last year as part of its Project Kuiper to deliver internet service from space. It aims to have more than 3,200 satellites in low orbit.

China plans to launch 13,000 satellites as part of its GuoWang constellation, while Canada's Telesat will add 300 and German start-up Rivada is eyeing 600.

That will be in addition to the European Union's Iris project -- 170 satellites -- and the 300-500 satellites planned to be launched by the US military's Space Development Agency.

Eutelsat has merged with Britain's OneWeb in efforts to compete in the market.

PAY ATTENTION: Сheck out news that is picked exactly for YOU - click on “Recommended for you” and enjoy!

Source: AFP