“Financial Literacy Is Needed”: Mzansi Outraged by How Lady Blew R13.9M Lotto Win in 3 Months

- One lucky South African lady had tongues wagging after cleaning her R13.9 million Lotto winnings in three months

- The woman’s reckless spending gagged the rest of Mzansi after appearing on an episode of I Blew It

- The lady’s story made its rounds again on TikTok and caused quite the conversation in a thread of over 1.4K comments

- Briefly News spoke with financial expert Fulufhelani Mashapha about how to make smart financial decisions

- A financial advisor shared ways for lotto winners to spend money wisely while still maintaining their wealth

Don't miss out! Join Briefly News Sports channel on WhatsApp now!

A popular Mzansi Magic original show exposed how some South Africans lack financial literacy. In a recent episode, the show looked into how a woman blew almost R14m in just three months.

Source: Getty Images

The famous show I Blew It interviews people who completely wiped their bank accounts after winning huge sums of money.

Mzansi outraged by how lady blew R13.9M in 3 months

South Africans were outraged by how a Mzansi woman wiped out her R13.9 million lotto winnings in just 90 days. The lady, Moipone, had sent her boyfriend to play the game for her and returned with an amusing ticket.

PAY ATTENTION: Briefly News is now on YouTube! Check out our interviews on Briefly TV Life now!

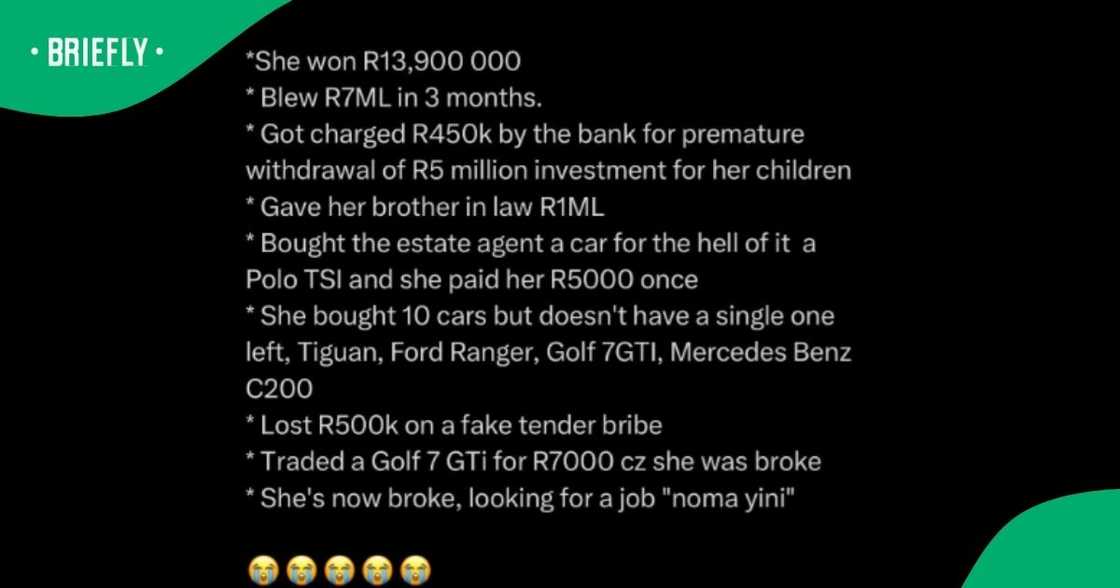

The lady had hit the ultimate jackpot and scored almost R14 million rand. Without a proper plan, the woman recklessly spent her fortune. She first chopped off R7 million in the first three months of winning the lottery.

Moipone then got charged almost half a million by the bank after prematurely withdrawing R5 million that she had put aside for her children. She blessed her brother-in-law with R1 million just for existing, bought her estate agent a car and sprinkled R5K on top of it.

The lady bought 10 cars that she no longer owns today and lost half a million on a fake tender bribe. During her dry days, she sold one of her cars for R7K and was in desperate need of a job.

The viral clip was shared by a TikTok user @harambe022.

See the TikTok post below:

Source: TikTok

Briefly News spoke with financial expert Fulufhelani Mashapha to explore practical ways individuals can make smart and sustainable financial decisions.

She stated that the core principle stays unchanged: living below your means is crucial. This means your total spending should always be less than your income, creating room to save or invest. Ultimately, financial success isn't about how much you make—it's about how much you can keep each month.

Source: Getty Images

Financial advisers share tips with lotto winners

Andrea Carr explained to Briefly News the best ways for lottery winners to invest their money:

“If you’ve won the lotto in South Africa — congratulations! The best way to invest your winnings is to secure your financial future while allowing your money to grow. Here’s a smart approach to managing and investing your lotto winnings. My advice would be to. Don't rush into any big decisions, open a high-interest savings account while you work out what is the best way to invest / spend this money.

“Look at a notice account (something like a 32 day notice account which has a higher interest rate and it means you need to give 32 days' notice before withdrawing your funds) – and it means your money is “locked up” for the contracted notice period, and that’ll save you from making spontaneous decisions – and it also just keeps it safe.

Read also

“Those were some bad friends”: Woman shares story of how she blew R1.2 million cash out from RAF

“Clear your expensive debt first: If you have any high-interest debt (credit cards, personal loans), pay it off first. Also look at paying down your bond if you already have one. Hire a Professional to advise and guide you (it is highly recommended to find a financial advisor who can prove he is certified to give financial advice, and comes with legitimate and verifiable references, and is affiliated to large retail banks, or investment companies – this will give you peace of mind that you’re dealing with a legitimate individual).

“They can also recommend an estate planner to protect your wealth for you and your family in the long term. They’ll look at your individual and personal financial situation and make recommendations based on that – the best investments are low-risk, long term options, and a mix of different investment options is always best (e.g. unit trusts are medium-risk, as is a property investment. Something offshore has higher risk, but better potential returns.”

Mzansi stunned by how lady spent R13.9 million in three months

South Africans on the social media platform were amazed by the woman’s behaviour and shared their opinion in the comments section.

Have a look at some reactions below:

@Gaby shared:

“Moipone is God's favourite, allegedly she won R5 million again.”

@Walla D pointed out:

“Money always finds those that don't know how to control it.”

@Kwamahlangu Printers clarified:

“Being rich is not about money, it's the mindset.”

@mbali said:

“It was gonna last me for the rest of my life.”

@T💋 commented:

“Financial Literacy is needed. It’s a life skill.”

Understanding Sudden Wealth Syndrome

Coming into a lot of money all at once might sound like a dream, but experts warn it can quickly become a nightmare. Sudden Wealth Syndrome (SWS) is a real psychological condition that affects people who receive large sums of money unexpectedly, whether through a lottery win, inheritance or even a major legal payout. While the initial excitement is understandable, many people find themselves overwhelmed by the rapid lifestyle changes that follow.

According to experts, people affected by SWS often feel isolated from old friends who either start treating them differently or expect handouts. There’s also a lot of pressure to make smart financial moves, and many people simply don’t know where to start. Without proper guidance, they can become easy targets for scams or make poor investment choices. Some even experience anxiety, depression or guilt, especially if they feel unworthy of the money.

Read also

"I would faint": Hairstylist shares how she got scammed by client with fake money, SA stunned

The worst part? Many people who suddenly become rich end up bankrupt within a few years. It’s not just about spending too much, but also about being unprepared for the emotional and social shift that wealth can bring.

According to Investec, getting professional advice early is wise. Working with financial planners, setting healthy boundaries with others, and taking time before making major decisions can help protect both your money and your mental health.

Briefly News shares 3 more stories about millions

- A young South African lady gave Mzansi chest pains after sharing how she made her first million at 17 while awaiting matric results

- One passionate lady wowed South African reality show fans after she shared her winning Big Brother Mzansi strategy to cashout R2 million

- Mzansi people had major heartburn after one salary reviewer shared an engineer's beefy payslip with a salary of R1 million

Hilary Sekgota, human interest head of desk at Briefly News, contributed to this article.

Source: Briefly News

Chuma Nontsele (Human Interest Editor) Chuma Nontsele is a human interest journalist for Briefly News (joined in 2024). Nontsele holds a Diploma in Journalism and started her career working at Daily Maverick as a news reporter. Later, she ventured into lifestyle and entertainment. Chuma has 3 years of experience as a journalist. You can reach her at chuma.nontsele@briefly.co.za

Andrea Carr (Head Tech Research and Development and Homeownership advisor) Andrea Carr is Head: Tech R&D as well as a Homeownership advisor. With over 19 years of experience in banking, management consulting, and, most recently, ideation and delivery of a platform business, Andrea focuses on translating real-world problems into practical solutions.