Bernanke: Depression scholar who faced global financial crisis

Source: AFP

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

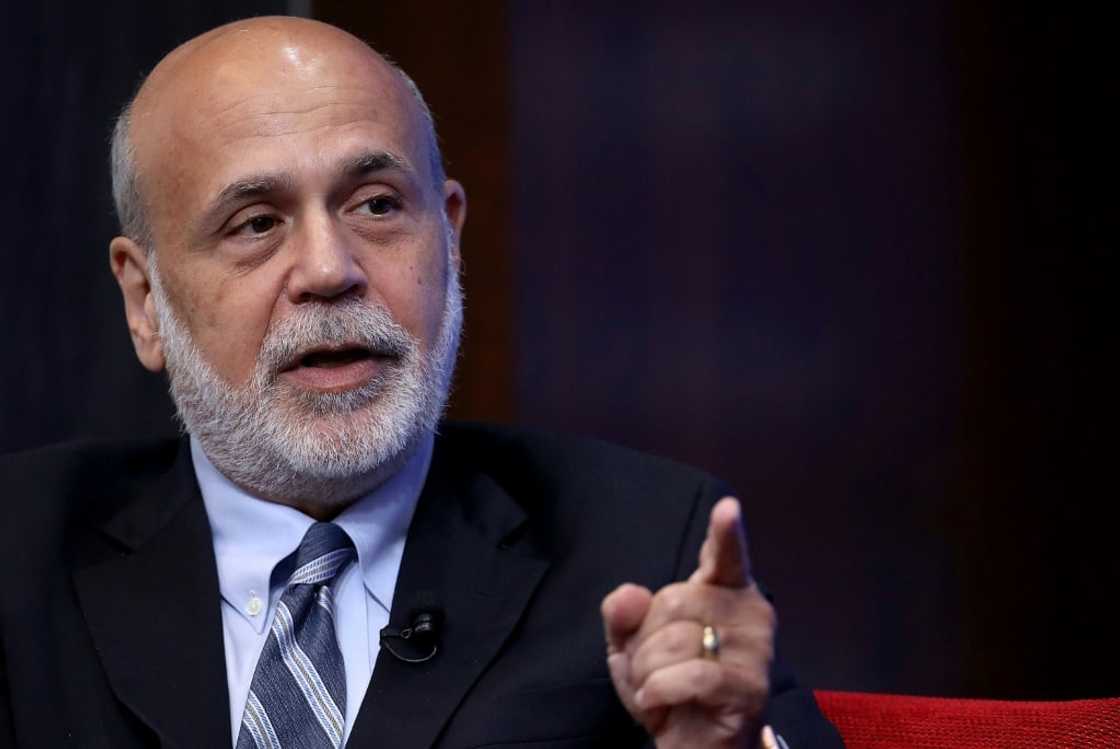

Ben Bernanke, who shared the Nobel Economics Prize on Monday, is a scholar of the Great Depression who helped to steer the United States through another major financial crisis as Federal Reserve chief.

Bernanke took over as Fed chair in February 2006, just before the collapse of the US housing market that triggered a global crisis of epic proportions.

Many analysts say Bernanke's aggressive and unorthodox moves allowed the central bank to prop up the financial system and keep credit flowing, therefore avoiding a repeat of a 1930s-style calamity.

His critics, though, argue that he did little to avert the crisis and may have helped fuel the problems when he was a Fed governor in 2002-2005 under then-chairman Alan Greenspan and subsequently headed the Council of Economic Advisers under former president George W. Bush.

The Nobel jury awarded the prize to Bernanke, 68, along with fellow US economists Douglas Diamond and Philip Dybvig for having "significantly improved our understanding of the role of banks in the economy, particularly during financial crises, as well as how to regulate financial markets."

Bernanke was singled out for his analysis of "the worst economic crisis in modern history" -- the Great Depression in the 1930s. He published a book on his essays about the topic and co-authored another about the 2008 financial crisis.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

He is now a senior fellow at the Brookings Institution think tank in Washington and a senior adviser to the asset management firms Pimco and Citadel -- appointments that raised concerns about the "revolving door" between Washington and Wall Street.

'Creative leadership'

In recognition for his actions during the global financial crisis, he was named TIME magazine's "Person of the Year" for 2009.

TIME honored the former Princeton University professor as "the most important player guiding the world's most important economy."

"His creative leadership helped ensure that 2009 was a period of weak recovery rather than catastrophic depression," TIME senior writer Michael Grunwald wrote.

Grunwald said at the time that Bernanke still wielded "unrivaled power over our money, our jobs, our savings and our national future."

Bernanke served as central bank chief under Bush and was kept on the job by the Republican leader's Democratic successor, Barack Obama.

The former central banker has stressed the importance of transparency in the Fed's communications, stepping away from Greenspan's turgid, jargon-laden statements.

And unlike his predecessor, Bernanke talked often to reporters.

Joseph Brusuelas, a director at Moody's Analytics, once said that the Fed's unorthodox response to the global financial crisis was "without precedent" as it slashed its policy rate to zero and "flooded the financial system with liquidity."

The Fed's moves, Brusuelas said, "slowly rebuilt confidence in the banking system."

Jeffrey Sachs, economist at Columbia University, said "a depression seemed possible" at the time of the Lehman Brothers collapse in September 2008, but action by central banks "prevented financial markets from crashing."

Lehman 'blunder'

But others criticized him for failing to better predict the severity of the economic crisis: in 2007, when the first signs of the subprime mortgage crisis emerged, Bernanke assured Congress that the fallout would be limited.

Others accuse Bernanke of failing to act quickly to cut interest rates once the scale of the crisis emerged. The Fed instead adopted a go-slow posture on cutting rates, before making an emergency cut in January 2008.

Among Bernanke critics, the late economist Allan Meltzer at Carnegie Mellon University said the Lehman collapse represented a mistake of historic proportions.

"Allowing Lehman to fail without warning is one of the worst blunders in Federal Reserve history," he wrote in a Wall Street Journal essay.

Bernanke was born on December 13, 1953 in Augusta, Georgia, to a pharmacist father and a schoolteacher mother. He grew up in a Jewish household, a minority in the heavily Christian community.

He spent his childhood in Dillon, South Carolina -- a farm town with a population of 7,500 -- and was a star scholar, achieving a near-perfect score in the Scholastic Aptitude Test (SAT), a university entrance exam.

He studied economics at Harvard and graduated with top honors in 1975, then went on to obtain a PhD in economics from the Massachusetts Institute of Technology.

He worked at Princeton for 17 years before joining the Federal Reserve Board in 2002.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP