How to use Standard Bank online banking in 2024: app, login and contacts

Online banking allows people to access diverse services on the Internet. You can make deposits, withdrawals, domestic and international fund transfers, borrow and pay loans, and check your account balance and account statements, among other things. If you are a member of Standard Bank, take advantage of the Standard Bank online banking system for faster and stress-free services.

Source: UGC

TABLE OF CONTENTS

- How to use Standard Bank online banking services

- How to register for Standard Bank online banking (local accounts)

- How to register on the Standard Bank App (local accounts)

- How to register for online banking at Standard Bank (international accounts)

- How to link accounts to the Standard Bank online banking system

- Standard Bank online banking login process in South Africa

- Standard Bank Internet banking login procedure for international accounts

- How to change Standard Bank online banking password

- How to make payments via the Standard Bank online banking platform

- How can you contact Standard Bank?

- How can you access your Standard Bank account offline?

- How can you access your Standard Bank account?

- How can you check your Standard Bank account balance online?

- How can you check your Standard Bank account balance online?

- How to activate Standard Bank online banking?

- How can you unlock Standard Bank online banking?

- What is the swift code of Standard Bank?

- How can you email Standard Bank?

Like other financial institutions, Standard Bank rolled out the STD bank online banking system to help its customers access its services conveniently, efficiently, and faster. With this technology, you only need an internet-enabled device and a stable internet connection to access your personal and business accounts.

How to use Standard Bank online banking services

STD bank Internet banking is an electronic payment system that allows customers to perform numerous financial transactions online. So, if you would like to join this platform, this article explains:

- How to register on Standard Bank banking portal/website (local and international accounts)

- How to register on the Standard Bank App for local accounts

- How to link accounts to the Standard Bank online banking system

- The Standard Bank Internet banking login procedure after registration and linking accounts

- How to change Standard Bank online banking password

- How to make payments via the Standard Bank online banking platform

- How to contact Standard Bank for any inquiries

Standard Bank takes internet security seriously. You may use dual-factor authentication alongside your password to secure your online account and personal details. Read below how to use the Standard Bank internet banking portal or app in South Africa.

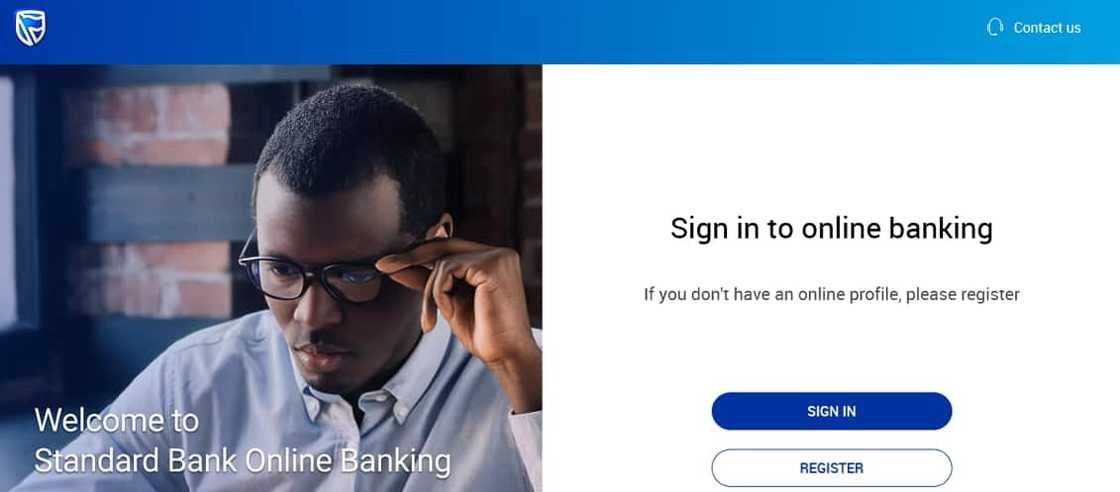

How to register for Standard Bank online banking (local accounts)

You need your ATM's PIN and a valid Business Auto Bank card, Auto Bank card, E plan card, or Mastercard Credit card to register on Standard Bank's online banking system. If you have these things, learn how to set up online banking with Standard Bank South Africa:

- Visit the Standard Bank South Africa website.

- Click "Sign in."

- Click "INTERNET BANKING" under Personal or Business, depending on whether you have a personal or business Standard Bank account.

- Click "Register."

Source: UGC

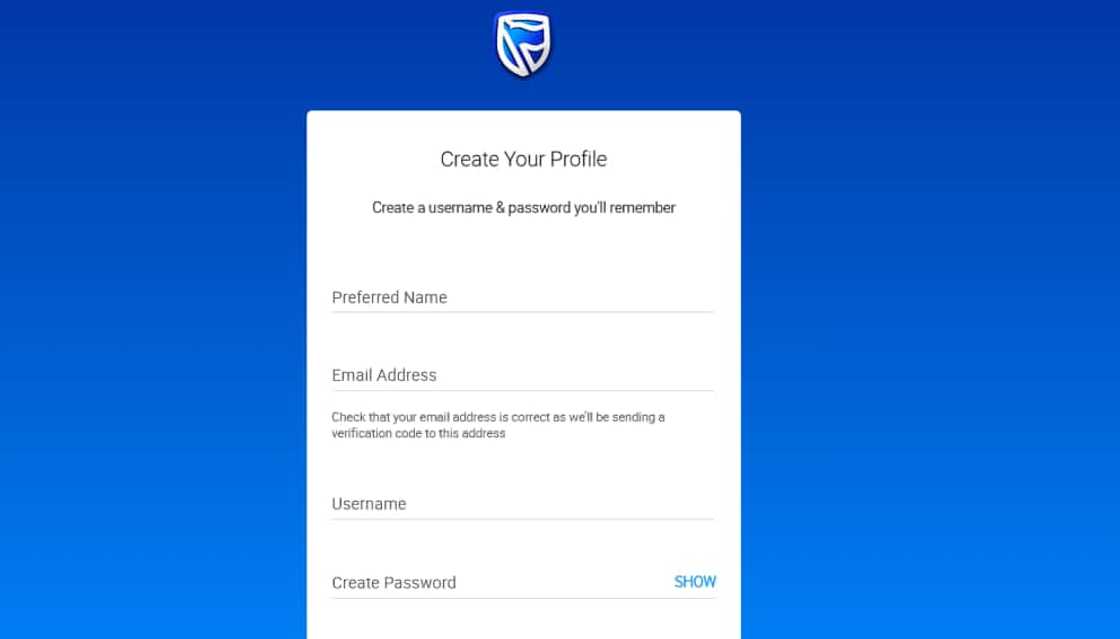

- Fill in the required details, including a password, to create your profile.

- Accept the terms and conditions.

- Click "Save," and the site will direct you to a new page.

- Enter your bank card number and ATM PIN.

- Choose your mode of communication, i.e., phone number or email address

- Click "Next," then enter the OTP code sent to your phone number or email.

- You can now log into your Standard Bank account online and access available financial services.

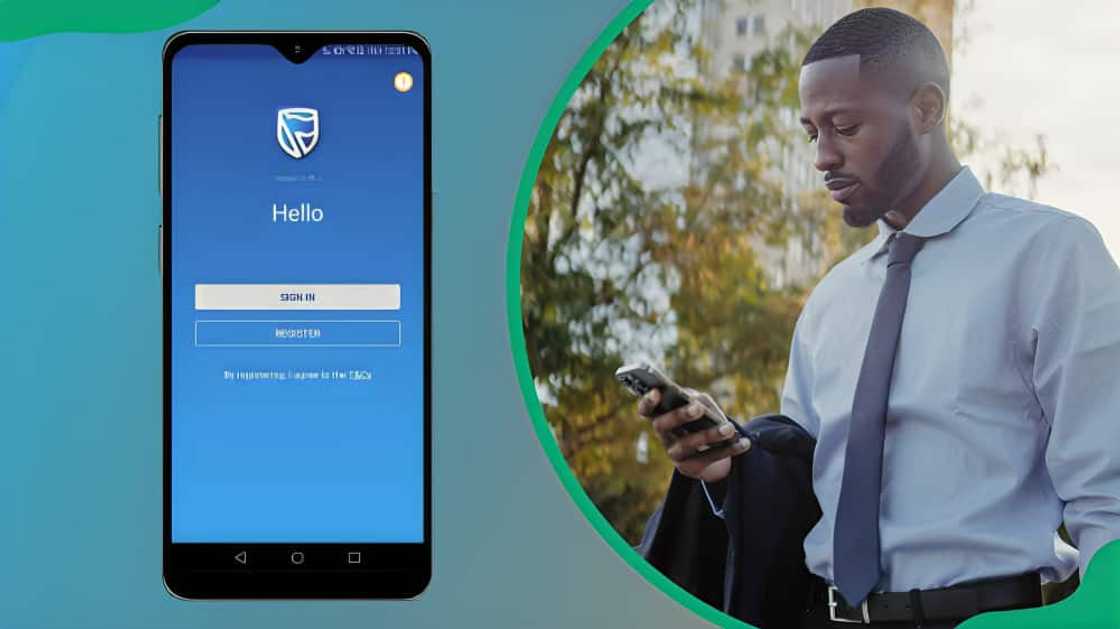

How to register on the Standard Bank App (local accounts)

Standard Bank App enables you to pay bills, reverse unauthorized debit orders, buy airtime, shop online, access loans, and do many other things through your business or individual accounts. Follow the steps below to use the Standard Bank App:

- Download the Standard Bank App from the App Store or Google Play Store.

- Fill in the required details, including a password, to create your profile.

- Link your cards and bank accounts to your banking app.

- If you do not have an account, download the app and open a MyMo account online.

- You can now access Standard Bank's online banking services via the app.

How to register for online banking at Standard Bank (international accounts)

All Standard Bank personal international bank accounts have online banking capabilities. You can manage your account and transact securely 24/7 from anywhere worldwide using the Internet banking platform/website and mobile banking app. Here is how to register for Standard Bank online banking for your international accounts:

- Visit the Standard Bank international website.

- Click "INTERNET BANKING" under "Login to Internet Banking."

- If you don't have an online account with Standard Bank, account “I’m new to Online Banking. Register."

- Fill in the required details, including a password, to create your profile.

Source: UGC

- Enter your username and password.

- Click "Sign in."

- Enter the verification code sent to your email address and select “Submit."

- If you did not receive the verification code within 15 minutes, request a new one by clicking the “Resend.”

- After the system accepts the verification code, the next step is to link your Internet banking profile with your Standard Bank accounts.

- Click “Register” and enter your details, i.e., customer name, number (as found on your welcome email or bank statement), and password (this is not the password entered earlier when registering for online banking). If you have a joint account, each person must enter personal details.

- Choose the transaction rights to activate on your online banking profile.

- If you select “Payments,” you will need a security token that generates a secure 'one-time' password each time you authorize a payment. You will also be prompted to provide delivery information for a security token to be sent to you.

- Read and accept the “Terms and Conditions.”

- The system will pop up a confirmation message for the online banking registration.

- Standard Bank's Internet Administration Unit will contact you by telephone within one working day to confirm your registration.

- A PDF confirming your successful registration will automatically download to your browser.

- Keep the Internet Client Number (ICN) and ICN Password safe because you will need them when recovering your password.

How to link accounts to the Standard Bank online banking system

Here is how to link accounts to the STD bank online banking system:

- Sign in to the Standard Bank mobile app or international website.

- Tap on the menu button at the bottom right of the screen.

- Select "Dashboards," then tap "Add New Profile."

- Choose where your accounts are held.

- Enter your online banking login credentials and a one-time password will be sent to your phone number or email address.

Source: UGC

Standard Bank online banking login process in South Africa

After completing the Standard Bank online banking registration process, follow these steps to log into your local STD account:

- Visit the Standard Bank South Africa website.

- Click "INTERNET BANKING" under Personal or Business, depending on whether you have a personal or business Standard Bank account.

- Click "SIGN IN."

- Enter your username (or email address) and click "Verify."

- Scan the QR Code on the screen with your Standard Bank app or click "SIGN IN WITH PASSWORD" and enter the password to log in.

- To scan the QR Code, open the STD mobile banking app and click "SCAN QR."

- Point your camera towards the screen and let it scan the QR code.

- Check your phone and select "Yes" to confirm you are signing into internet banking.

- Select whether to sign in with an App code, Touch ID, or Face ID.

- You have successfully signed into your Standard Bank internet banking.

- You will also receive an SMS confirming you signed into your online account.

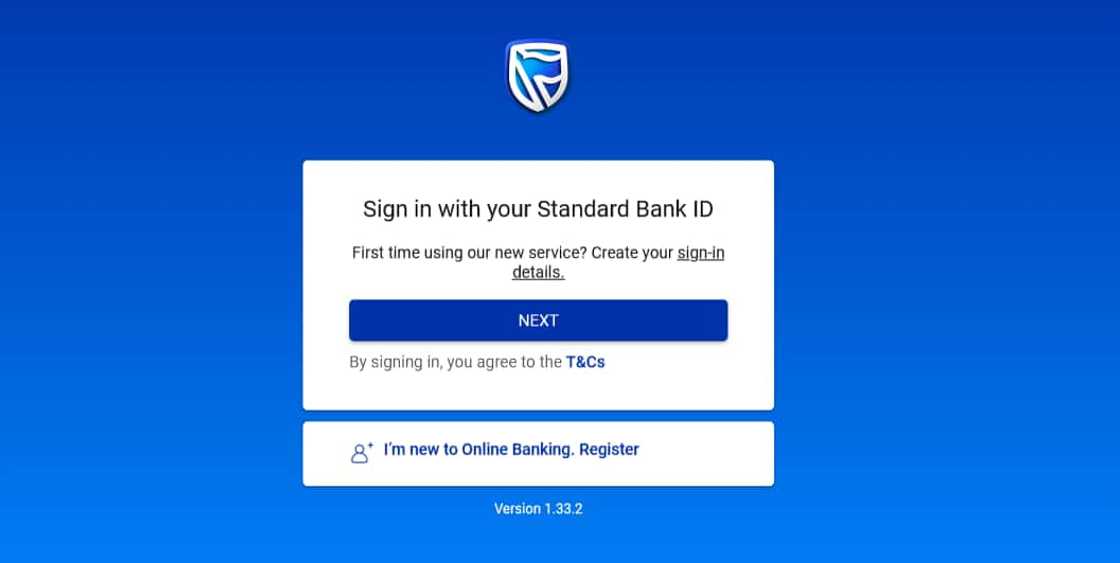

Standard Bank Internet banking login procedure for international accounts

Here is how to activate online banking with Standard Bank after opening an international STD bank Internet banking account:

- Visit the Standard Bank international website.

- Click "INTERNET BANKING" under "Login to Internet Banking."

Source: UGC

- Click "Next" under "Sign in with your Standard Bank ID."

- Enter your existing username and password.

- Click "SIGN IN."

How to change Standard Bank online banking password

If you have forgotten your password, you cannot access your account. You need to reset it to access online banking services. Follow the steps below to reset your password.

- Visit the online banking Standard Bank website (SA or international website).

- Click "Log in" or "Sign in," depending on whether website.

- Click "INTERNET BANKING" under Personal or Business, depending on whether you have a personal or business Standard Bank account.

- Click "SIGN IN."

- Enter your user name.

- Select “Forgot password.”

- Enter your username and click “Verify.”

- If you don’t remember your username, click “Forgot Username.”

- Enter your Internet Client Number (ICN) and ICN Password and click “Verify.”

- Enter the verification code sent to your email address. The code confirms your identity if entered currently.

- Enter a new password.

- The system will return you to the Standard Bank online banking login page.

- Log in with your username and new password.

How to make payments via the Standard Bank online banking platform

Standard Bank's mobile banking app or portal gives you easy access to all your saved beneficiaries. Payments can be made or scheduled anytime, wherever you have your mobile device. Additionally, you can add or remove beneficiaries from your mobile banking app or portal.

How to make a beneficiary payment

In this banking context, a beneficiary is anyone you wish to send money to through the STD bank online banking platform. Here is how to transfer funds to a beneficiary you often send money to:

- Log into your Standard Bank online banking account.

- Go to the "Account Summary" dashboard.

- Select "Transact" from the top menu bar.

- Under "Pay and Transfer," select the "Pay beneficiary."

- Select the account you want to send money to from the drop-down menu.

- Enter the amount you want to send.

- Click “Next."

- Confirm the details of the beneficiary to whom you are sending payments.

- Click "Continue."

- A green confirmation message will appear on the screen if your payment succeeds.

Source: UGC

How to make a once-off payment

A beneficiary can be a person or a business entity. Meanwhile, a beneficiary bank is the financial institution holding the account you send money to. Follow these steps to make a once-off beneficiary payment through the STD Internet banking platform:

- Log into your Standard Bank online banking account.

- Go to the "Account Summary" dashboard.

- Select "Transact" from the top menu bar.

- Click "Once-Off payment" under "Pay and Transfer."

- Select the account you want to send money to from the drop-down menu.

- Provide the name and account number of the beneficiary that will receive the payment.

- Give "Your reference" details as they appear on the beneficiary's statement.

- Choose to save the beneficiary details at this stage or not.

- Choosing "Yes" provides three ways to send them notifications.

- Provide a name that will appear on the notification the beneficiary will receive.

- Select the amount you want to send.

- Click “Next."

- Double-check all the beneficiary details.

- Click “Confirm."

- Enter the One-Time password you receive in your phone number.

- A green confirmation message will appear on the screen if your payment succeeds.

How can you contact Standard Bank?

For any inquiries, access Standard Bank's customer care desk through these contact details:

- Personal call center: 0860 123 000 (within the country) or +27 11 299 4701 (international)

- Business call center: 0860 109 075 (within the country) or +27 11 299 4633 (international)

- Email address (personal issues): information@standardbank.co.za

- Email address (business customers): bizdirect@standardbank.co.za

How can you access your Standard Bank account offline?

Use any of Standard Bank's ATMs or dial *120*2345# on your phone and follow the prompts to use the self-service cellphone banking services. The cellphone banking service allows you to pay bills, buy data, make payments, and do many other things.

Source: UGC

Is Standard Bank down?

The bank's mobile app and self-service portal on its website can go down temporarily due to technological hitches. Whenever this happens, the bank's tech team usually solves the issue in a few minutes or hours.

How can you access your Standard Bank account?

You can access your account via the Standard Bank app, ATM, cellphone banking USSD, or the self-service portal on Standard Bank's website.

How can you check your Standard Bank account balance online?

Check your account's balance through Standard Bank's mobile app or self-service portal on the bank's website.

How can you check your Standard Bank account balance online?

Check your account's balance through Standard Bank's mobile app or self-service portal on the bank's website.

How to activate Standard Bank online banking?

Visit the Standard Bank international website and click "INTERNET BANKING" under "Login to Internet Banking." After that, click "Next" under "Sign in with your Standard Bank ID." Enter your existing username and password, then click "SIGN IN."

How can you unlock Standard Bank online banking?

Use your Internet Client Number (ICN) and ICN Password to unlock your online account via the Standard Bank website. Use the bank's South African website for local accounts and international websites for international accounts.

What is the swift code of Standard Bank?

Use Standard Bank South Africa swift code SBZAZAJJ when receiving international payments through the bank's online banking system.

How to get proof of banking details Standard Bank online?

Log into your Standard Bank online banking app or website. Click "Transact" and select "Statements" under "History & Documents. Choose the account you're interested in, and the date of your statement (limited to 24 months back). After that, click the "Download" or "View" link, access your statement. You can print the bank statement and use it as proof of banking.

How can you email Standard Bank?

Email Standard Bank customer desk via information@standardbank.co.za for personal account issues/inquiries or bizdirect@standardbank.co.za for business account issues/inquiries.

You can access the Standard Bank online banking platform on your smartphone, tablet, laptop, or desktop. Also, the platform does not limit you to any mobile data network, Wi-Fi, or internet service provider.

DISCLAIMER: This article is for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Briefly.co.za published the Tyme Bank Universal branch code and swift code for money transfers. This digital banking organization allows one to use Till points and kiosks to withdraw cash in South Africa.

The company has over 14,000 Till points across the Pick 'n Pay and Boxer network and at over 700 kiosks in South Africa. These kiosks and Till points have dedicated staff ready to serve you.

Source: Briefly News

Jedidah Tabalia Jedi is a journalist with over 5 years working experience in the media industry. She has a BSc. in Human Resource Management from Moi University (graduated in 2014) and a working in progress MBA in Strategic Management. Having joined Genesis in 2017, Jedi is a passionate Facts and Life Hacks, Fitness, and Health content creator who sees beauty in everything. She loves traveling and checking out new restaurants. Her email address is jedidahtabalia@gmail.com

Peris Walubengo (Lifestyle writer) Peris Walubengo has vast experience in search engine optimization through digital content generation, research, editing, and proofreading. She joined Briefly.co.za in November 2019 and completed the AFP course on Digital Investigation Techniques. You can email her at perisrodah254@gmail.com.