How to register for Absa online banking in 2024: Detailed guide

Absa offers a wide range of digital banking services designed for customer convenience and safety as more South Africans continue to adopt online and mobile banking. To access the services, you must register for Absa online banking; this guideline shows you the steps to take.

Source: UGC

Digital banking is quickly gaining momentum in South Africa as banks move away from traditional financial transactions to keep up with the evolving industry. The country’s Big Four, including Absa, FirstRand, Nedbank, and Standard Bank, continue to pursue large-scale digital transformation programs aimed at increasing customer satisfaction and reducing overall enterprise costs.

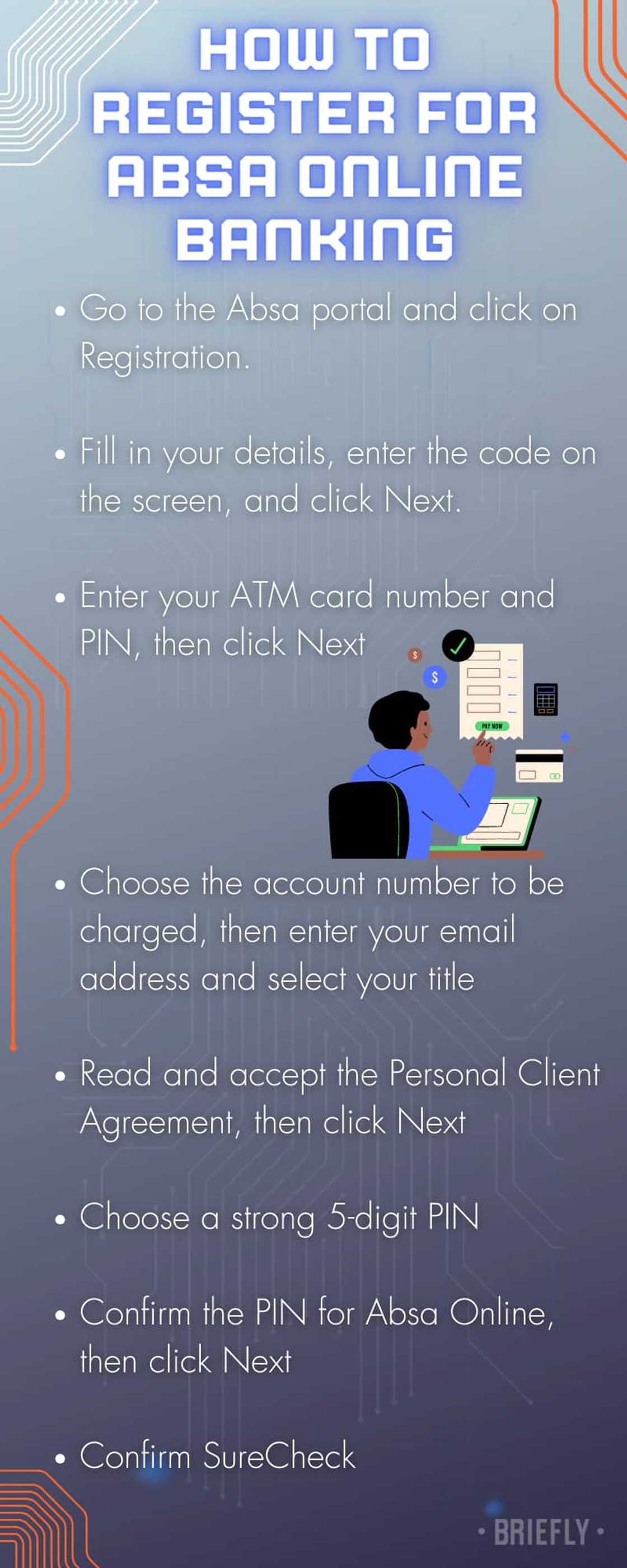

How to register for Absa online banking

The registration process for Absa online banking is simple and easy. The steps are as follows;

- Go to the Absa portal and click on Registration.

- You will be redirected to the Absa Online Registration page, where you will fill in your details, enter the code on the screen, and click Next.

- Enter your ATM card number and PIN, then click Next

- Choose the account number to be charged, then enter your email address and select your title

- Read and accept the Personal Client Agreement, then click Next

- You will be redirected to the Absa Online Security Information section, where you will choose a strong 5-digit PIN

- Confirm the PIN for Absa Online, then click Next

- Confirm SureCheck

- You are now registered to use online banking

Source: Getty Images

How to open an Absa bank account online without going to the bank

South Africans can open an Absa bank account online via the Absa Banking App, which is available on the Android Play Store and the Apple App Store. Anyone with a valid South African ID can become an account holder by following these steps;

- Download the Absa Banking App

- Choose the account you want to open

- Provide information about yourself

- The bank will verify your cell phone number for safety purposes

- Send a selfie, which the bank will use to do a facial matching with the Department of Home Affairs to confirm who you are

- Provide your residence details

- Give details on what you do for a living and your income

- Click Apply

How to activate my Absa mobile banking app

If you cannot log in to the Absa banking app because it is deactivated due to your card being locked or for other reasons, you will have to visit the nearest branch to have it unlocked. You can also contact the bank on 0860 008 600 for general account enquiries.

Absa Access: login

Absa Access is a single sign-on platform that allows customers to manage their finances with speed and intelligence. It gives corporate clients a one-dashboard experience to access their complete business portfolio. To log in to the service, you must receive an emailed invitation to Absa Access.

Source: Getty Images

Registering for Absa online banking is an easy and convenient process that can be done anywhere and anytime. All you need is an Android phone, tablet, or laptop and access to the internet.

Source: Original

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions. Any action you take upon the information presented in this article is strictly at your own risk and responsibility.

READ ALSO: What is the BRICS currency, and how much is it worth? Here are the facts

Briefly.co.za highlighted all you need to know regarding the proposed BRICS currency. The US dollar currently dominates the global economy, and the bloc plans to create a currency to dethrone it.

Source: Briefly News