Asian markets on back foot on growing US rate, China worries

Source: AFP

PAY ATTENTION: Let yourself be inspired by real people who go beyond the ordinary! Subscribe and watch our new shows on Briefly TV Life now!

Markets fell further Tuesday as investors grew increasingly fearful about another possible US interest rate hike and the prospect they will be kept elevated for some time to combat persistent inflation.

A small bounce on Wall Street was brushed off in early Asian trade, with a spike in US Treasury yields to fresh 16-year highs pushing the dollar even higher and reviving worries the world's top economy could slip into recession.

The concerns were compounded by the threat of a government shutdown in Washington as lawmakers struggled to iron out their differences on spending, leading to a warning that it could impact the US credit rating.

A recent surge in oil prices in recent months has fanned fears that central banks' attempts to bring inflation down could be thrown off track after more than a year of tightening.

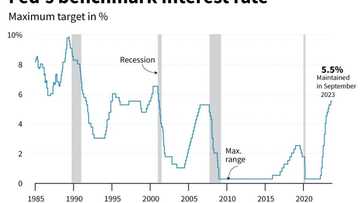

The US Federal Reserve last week indicated it could hike borrowing costs again before the year's end owing to a still-strong labour market and resilient economic data, dealing a blow to many dealers who had been hoping July's hike was the last.

Decision-makers also hinted rates might have to be kept at more than two-decade peaks for some time.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

"Rates will stay high," said Wei Li and other analysts at the BlackRock Investment Institute, adding that Treasury yields could go even higher.

"Rising long-term bond yields show markets are adjusting to risks in the new regime of greater macro and market volatility."

National Australia Bank's Tapas Strickland added that "the higher for longer view remains the prevailing theme" from the Fed meeting.

He said Fed Chicago boss Austan Goolsbee warned that not bringing inflation under control was a major risk to the economy but that the conversation would soon turn to how long to hold rates higher.

Meanwhile, Minneapolis Fed chief Neel Kashkari said he expected one more hike this year.

In early Asian trade, Tokyo, Hong Kong, Shanghai, Seoul, Singapore, Sydney, Taipei and Wellington were all in negative territory.

China's property sector woes

On currency markets, the dollar was hovering around 11-month highs near 150 yen, putting the spotlight on authorities in Japan, whose government has warned it is willing to intervene if the moves become excessive.

However, analysts do not expect the yen to strengthen any time soon owing to the Japanese central bank's refusal to move away from its ultra-loose monetary policy.

Investors are keeping a wary eye on developments in China as the country's troubled property sector comes back into focus after indebted developer Evergrande said it had missed an onshore bond repayment.

The firm had earlier announced it would have to revisit its much-anticipated restructuring, citing weaker-than-expected sales, and scrapped a meeting of creditors.

"A huge amount of work has gone into the planning and formulation of Evergrande’s restructuring plans, but if the sales forecasts underpinning the turnaround now appear unachievable, it is better to revisit the deal terms before scheme meetings are held," said Jonathan Leitch, a debt restructuring expert at law firm Hogan Lovells in Hong Kong.

Squabbling in Washington is also causing some discomfort among investors as hardline Republicans in the House of Representatives block key spending bills.

The standoff, which could cause a government shutdown if an agreement is not reached by the weekend, led Moody's to warn such a scenario would have negative implications for the country's top-tier credit rating.

A row over raising the debt limit earlier this year saw Fitch cut its rating, blaming rising deficits and political brinkmanship on Capitol Hill.

SPI Asset Management's Stephen Innes said: "In contrast to the debt limit, where Congress reached a deal due to the severe potential economic repercussions of an impasse, a government shutdown is viewed as relatively more manageable from a macroeconomic standpoint.

"However, this very fact, the less severe economic impact of a shutdown, paradoxically increases the likelihood that Congress may fail to take timely action."

Key figures around 0230 GMT

Tokyo - Nikkei 225: DOWN 0.9 percent at 32,379.85 (break)

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 17,640.21

Shanghai - Composite: DOWN 0.1 percent at 3,111.52

Dollar/yen: UP at 148.93 yen from 148.84 yen on Friday

Euro/dollar: DOWN at $1.0583 from $1.0597

Pound/dollar: DOWN at $1.2200 from $1.2213

Euro/pound: UP at 86.76 pence from 86.74 pence

West Texas Intermediate: DOWN 0.1 percent at $89.63 per barrel

Brent North Sea crude: DOWN 0.1 percent at $93.17 per barrel

New York - Dow: UP 0.1 percent at 33,006.88 points (close)

London - FTSE 100: DOWN 0.8 percent at 7,623.99 (close)

-- Bloomberg News contributed to this story --

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP