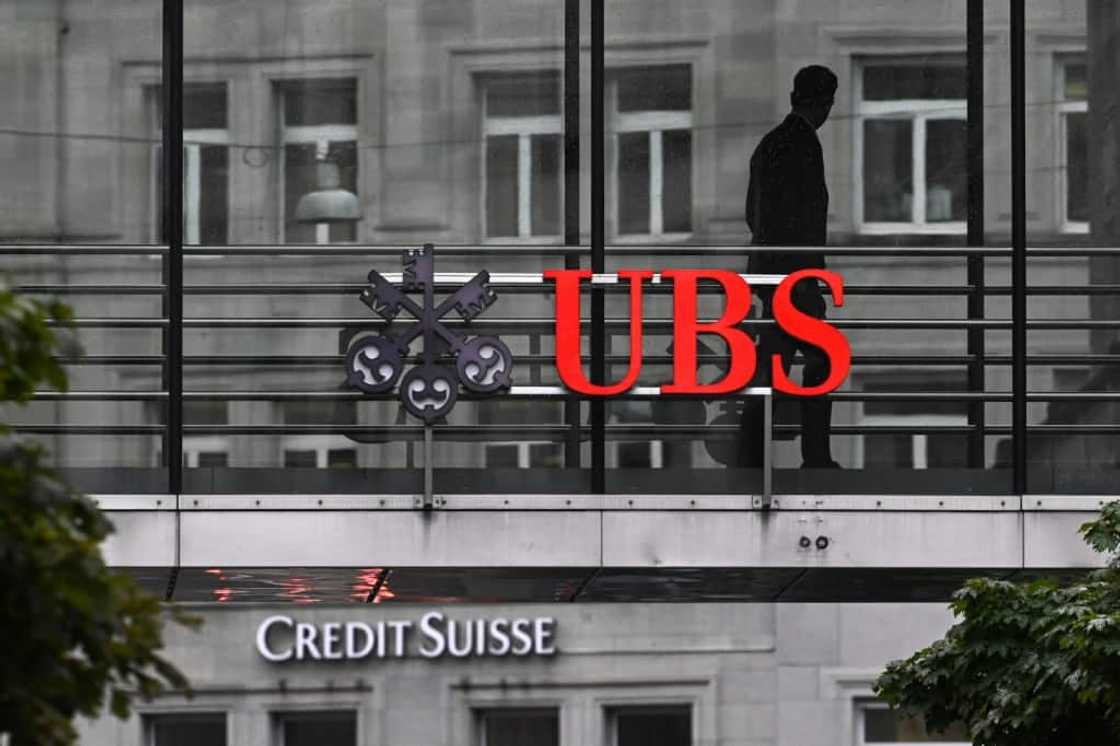

UBS posts first quarterly loss since 2017 on Credit Suisse costs

Source: AFP

PAY ATTENTION: Watch our new ranking show on YouTube now! Click here or search BIAS TEST on Briefly TV channel.

UBS posted a larger-than-expected loss in the third quarter on Tuesday, the first quarterly drop since 2017 as it integrates Credit Suisse after taking over its fallen Swiss banking rival.

Switzerland's largest bank said the net loss in the third quarter stood at $785 million (732 million euros). Analysts surveyed by the AWP news agency had been expecting a smaller loss of $430 million.

The last time it was in the red was in the fourth quarter of 2017.

UBS, however, said that it had "now stabilised Credit Suisse and continued to grow our franchise" as it raked in $22 billion in net new money into its wealth management business in the quarter.

UBS was strong-armed by Swiss authorities into buying Credit Suisse for $3.25 billion in March over concerns that its domestic rival could go under and spark a global financial crisis.

At the time, investors had gasped at the risks UBS was taking on with the purchase.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

But by August, the bank said it would not need the billions in support offered by the Swiss government and central bank to offset any surprises that might pop up in its stricken rival's accounts.

UBS said that the third quarter included integration-related expenses of $2 billion between July and September.

The bank said it had offered $500 million to "selected employees" of Credit Suisse prior to the acquisition in order to convince them to stay on board.

"We are executing on the integration of Credit Suisse at pace and have delivered underlying profitability for the Group in the first full quarter since the acquisition," UBS Chief Executive Officer Sergio Ermotti said in a statement.

'Clear progress'

Despite the loss, UBS shares jumped by more than three percent in morning deals on the Swiss stock exchange as analysts said the bank's overall results were positive.

The bank reported an underlying profit before tax of $800 million.

Credit Suisse posted a positive inflow of net new money for the first time since the first quarter of 2022 at $3 billion.

UBS also said net new deposits totalled $33 billion, with $22 billion coming from Credit Suisse clients.

"UBS has made clear progress since the close of the deal -- but it continues to face a huge task," said Andreas Venditti, analyst at Vontobel wealth management firm.

The challenges include retaining clients and key staff along with deep restructuring and cost cutting, he said.

"This will require significant time and management attention," Venditti said.

UBS said in August it plans to fully absorb Credit Suisse's century-old Swiss division and slash 3,000 jobs across the country.

It aims to complete most of the integration by the end of 2026, with more than $10 billion in cost savings by then.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP