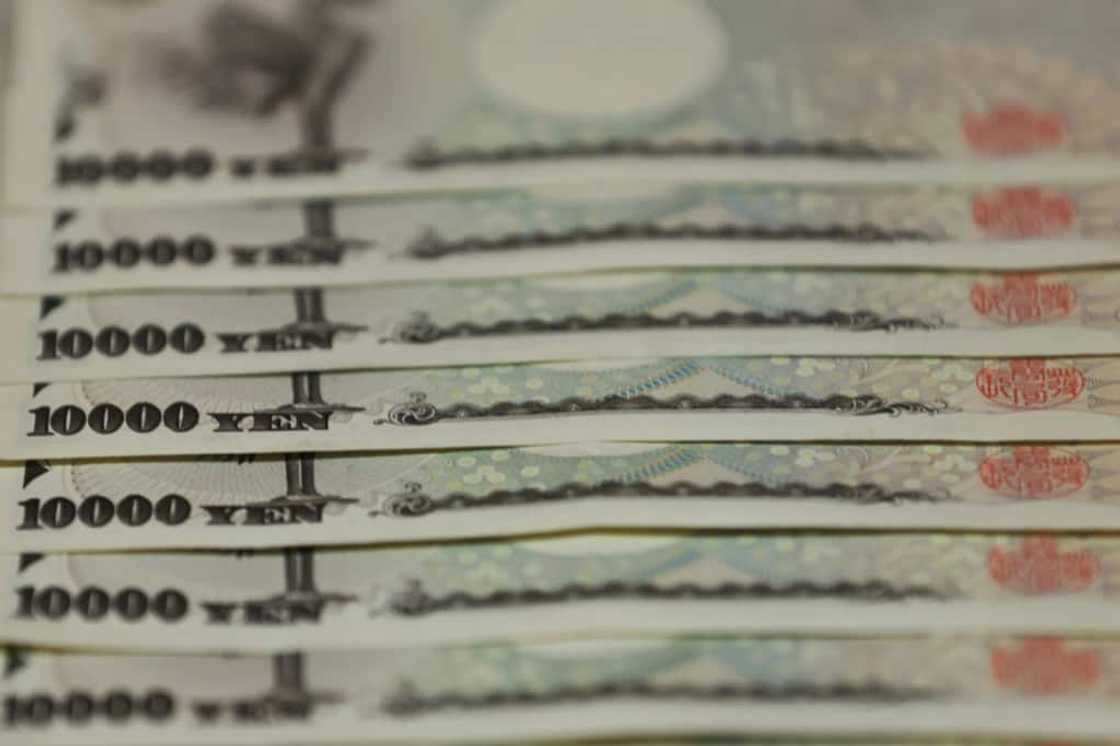

Yen sinks to new 24-year low against dollar

Source: AFP

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

The yen plunged to a new 24-year low against the dollar on Thursday as Japan sticks with its long-standing monetary easing policies in contrast to tightening by the US Federal Reserve.

One dollar was more worth more than 140 yen for the first time since 1998 in European afternoon deals, as the greenback also strengthened against other currencies.

The yen has been falling against the dollar from around 115 in March, prompting analysts to point to the possibility of government intervention.

The steep decline has mainly been driven by the differing approaches of the Bank of Japan and other central banks including the Fed, which have raised interest rates to tackle soaring inflation fuelled by the Ukraine war.

David Forrester, senior FX strategist at Credit Agricole CIB in Hong Kong, said breaching 140 yen per dollar marked an "important technical level".

"Previously, if you look at when the Bank of Japan has intervened to buy the yen, it's usually been around these levels," he told AFP.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

The Japanese currency fell 0.6 percent to hit 140.13 yen per dollar at around 1425 GMT.

Earlier on Thursday, Japan's top government spokesman repeated comments about the importance of stability in forex markets, saying that "rapid changes are undesirable".

But he did not give any indication that special measures, like the finance ministry instructing the BoJ to buy the yen against other currencies to bolster its value, were on the cards.

With volatility increasing, "the government plans to monitor the trend of the foreign exchange market carefully with a high sense of urgency," Hirokazu Matsuno told reporters.

Government intervention?

Last week, Fed Chair Jerome Powell declared his commitment to aggressive rate hikes, eliminating hope that the US central bank may soften its position to avoid an economic slowdown.

But policymakers at the Bank of Japan have refused to abandon easy-money measures put in place a decade ago, aimed at generating growth in the world's third-largest economy and sustained price rises of around two percent.

Also, "higher energy prices throughout the year have been a big weight on Japan's trade balance and current account balance... but that has eased a little bit recently," Forrester said.

Inflation in Japan is at its highest in seven years, and prices for items excluding fresh products rose 2.4 percent on-year in July -- but the BoJ sees these increases as temporary, and says it is committed to its current policy.

"Inflation in Japan is not only accelerating but broadening out beyond just food and energy price inflation," which is starting to indicate "that maybe the BoJ does have to shift its stance a little", Forrester said.

"If they're stubborn on that front, then the ministry of finance may have to intervene, to reduce imported inflation due to the weaker yen," he added.

Although it makes imported goods more expensive in Japan, a weaker yen can also inflate the profits of Japanese companies selling products overseas, including major firms such as Toyota and Nintendo.

On Wednesday, Prime Minister Fumio Kishida announced a further relaxation of the country's strict border rules to allow tourists on package tours, but without a guide.

The decision was made partly "from the viewpoint of taking advantage of a cheap yen", he told reporters.

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: AFP