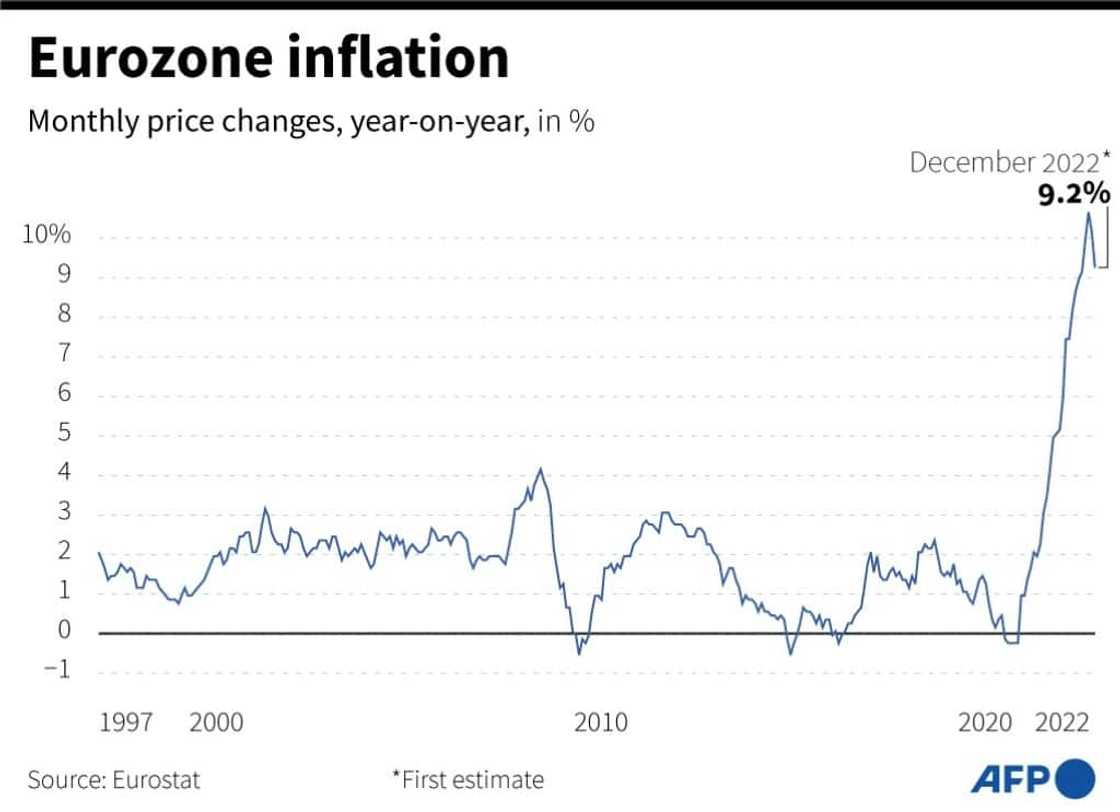

Eurozone inflation falls for second month

Source: AFP

PAY ATTENTION: Celebrate South African innovators, leaders and trailblazers with us! Click to check out Women of Wonder 2022 by Briefly News!

The eurozone's annual inflation rate fell for a second month in a row, to 9.2 percent in December, driven by easing energy prices, official data showed Friday, bringing some relief to Europe in the new year.

Boosted by the slowdown in the rate of energy cost rises, inflation fell last month from 10.1 percent in November, according to EU statistics agency Eurostat.

It is the first time the rate is in single digits since September.

Consumer prices had reached a record 10.6 percent in October, caused by sky-high energy prices buffeted by Russia's war in Ukraine. That is five times higher than the European Central Bank's target.

Analysts had expected the inflation rate in the single currency area to drop again but the fall was larger than predicted by Bloomberg and FactSet, which foresaw 9.5 percent and 9.7 percent respectively.

Energy costs rose 25.7 percent in December compared to 34.9 percent a month earlier. Food and drink costs also rose.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

"All told, the early 2023 data releases confirm that the more apocalyptic scenarios envisaged a few months ago will be averted," Andrew Kenningham, chief Europe economist at Capital Economics said in a note.

The figures were unlikely to convince the ECB to stop raising interest rates, analysts warned, since the rate of core inflation, which excludes energy and food prices, actually rose in December.

"The eurozone economy is at best stagnating, and persistent core inflation means the ECB will feel duty-bound to press on with its tightening cycle for a while yet," Kenningham said.

More rate raises

"It is likely that the peak in inflation is behind us now, but far more relevant for the economy and policymakers is whether inflation will structurally trend back to two percent from here on," said Bert Colijn, senior eurozone economist at the ING bank.

Colijn noted that core inflation was "still adjusting with a lag" which the ECB had taken "a very hawkish stance towards... and has indicated that it will hike through a mild recession to bring inflation structurally down to two percent".

ECB chief Christine Lagarde last month promised to tame rampant inflation and warned the eurozone to brace for more rate hikes in 2023.

Source: AFP

"We are raising interest rates and we will raise them further, at a steady pace, until they are at a level which ensures a timely return of inflation to our two-percent medium-term target," Lagarde said in a message on December 23.

Among the 20 countries that use the euro, including Croatia which joined this month, Spain has the lowest inflation rate, reaching 5.6 percent in December, Eurostat said.

France and Germany this week reported falls in consumer prices in December, further raising hopes that Europe may be past the peak of inflation.

Across the Atlantic, officials from the US Federal Reserve also indicated there would be more rate hikes this year to keep prices under control.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP