SA Unrest: State-Owned Insurer Sasria Needs More Money to Pay Out Claims

- The South African Special Risk Insurance Association says the claims made due to the unrest in July are more than what the company has

- In the past decade, Sasria says approximately R9 billion went into the company and now it is faced with close to R25 billion in claims

- The National Treasury has been approached to assist the company and may pay R3.9 billion which Sasria says is not enough

PAY ATTENTION: Click “See First” under the “Following” tab to see Briefly News on your News Feed!

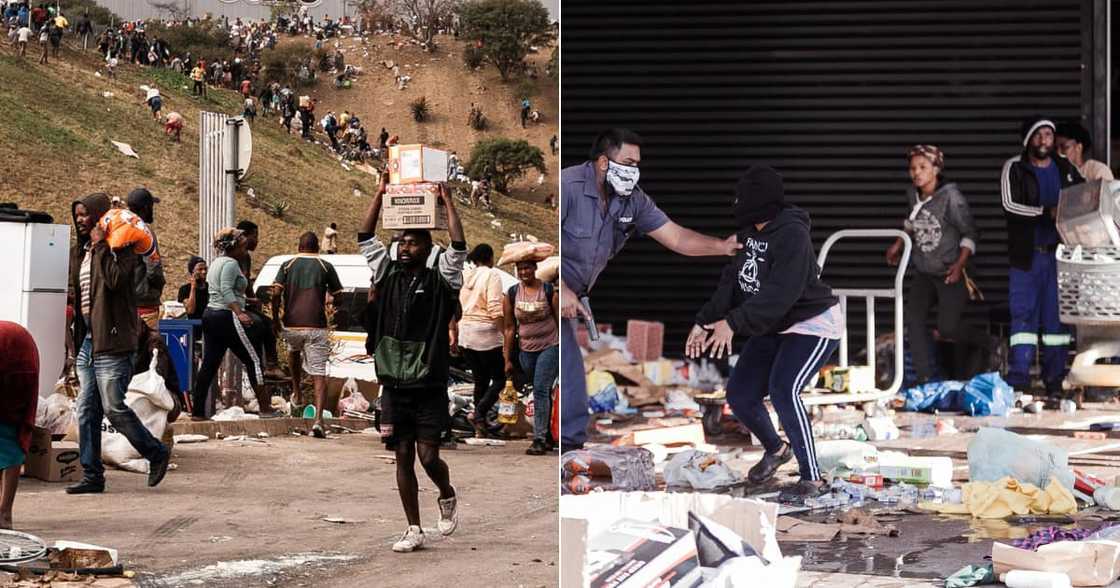

JOHANNESBURG - The damage caused by the violent protests, looting and damage of buildings was too extensive for the South African Special Risk Insurance Association (Sasria) to pay out all the claims.

Businesses suffered billions in losses that Sarisa currently doesn't have, according to BusinessLIVE. The government-owned insurer says the current budget is severely inadequate to help businesses that have been impacted by the riots.

Source: Getty Images

Sasria is now looking to the National Treasury assistance. National Treasury has offered R 3.9 billion to help the insurance company meet its obligation to affected businesses, however, Sasria Chairperson Moss Ngoasheng says it is still not enough.

According to CapeTalk, in the past 10 years, Sasria has only been able to collect R 9 billion and now it needs to pay out approximately R25 billion in claims.

PAY ATTENTION: Never miss breaking news – join Briefly News' Telegram channel!

Sasria managing director Cedric Masondo says the company's Solvency Capital Requirement is now below 100%, which is new to the company because it previously had an SCR triple the requirement, according to Fin24.

The Prudential Authority makes it a requirement for companies to have an SCR of 100% and should it go below that, companies are mandated to inform the Authority. Sasria is also mandated to indicate to the Authority how it will achieve an SCR of over 100%.

Masondo says the cash injection from the National Treasury should be able to help the company get back to where it once was by next year March.

Like Ngoasheng, Masondo maintains that the R3.9 billion will not meet the financial needs of the company and that they will require more.

Business News: Sasria says it is prepared for the biggest claim in years

Briefly News previously reported that South African Special Risk Insurance Association (Sasria) managing director Cedric Masondo has just made his way into a massive issue that may not be able to be sorted out with the amount of money Sasria has.

Due to the disorder in KwaZulu-Natal and Gauteng, insurance claims that have accumulated due to the looting and damages are quickly adding up. The insurance policies of businesses most likely included specialised cover related to damages resulting from riots, granted by the South African Special Risk Insurance Association (Sasria).

According to Sasria, a claim must meet a set of criteria. This includes any action that is strategised or targetted to cause loss or damage in an attempt to expand any political agenda or to cause any social or economic change; or in protest against any state or government.

Source: Briefly News