Oil market surges on shock output cuts

Source: AFP

PAY ATTENTION: Celebrate South African innovators, leaders and trailblazers with us! Click to check out Women of Wonder 2022 by Briefly News!

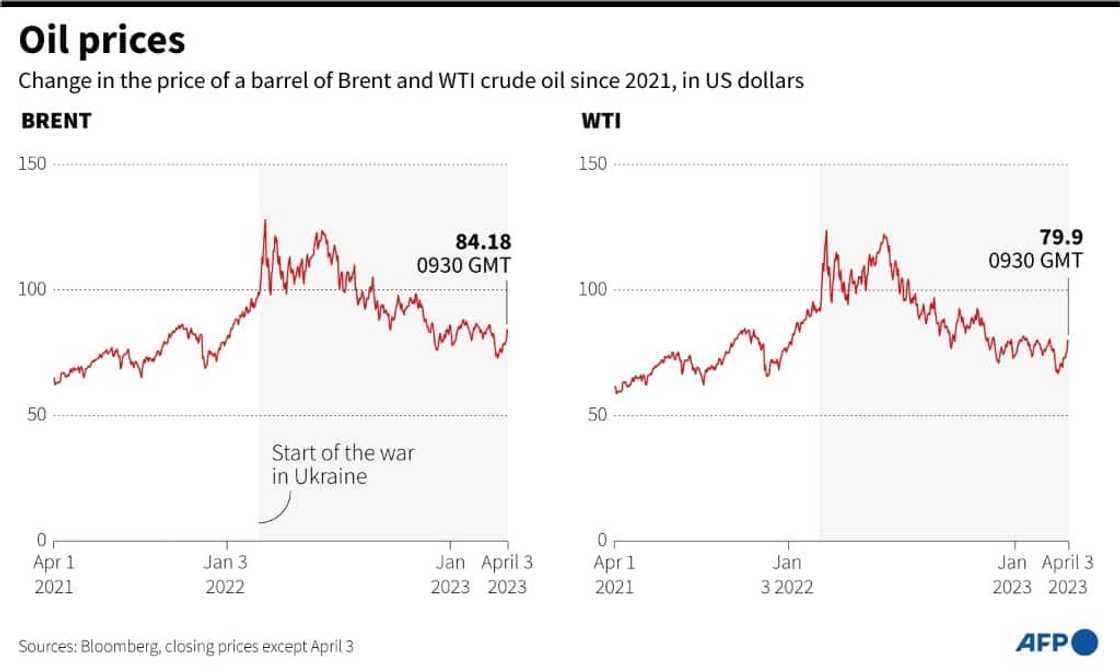

World oil prices soared Monday while equity markets mostly won modest increases after several top producers led by Saudi Arabia sprang surprise output cuts.

Crude futures surged almost eight percent at one stage, a day after multiple members of the OPEC+ exporters' alliance unexpectedly slashed production by a total of more than one million barrels per day.

The shock reduction will start in May and last until the end of the year, with OPEC+ saying Monday the move involves Algeria, Gabon, Iraq, Kazakhstan, Kuwait, Oman, Saudi Arabia and the United Arab Emirates.

It came on top of a decision from Russia -- also an OPEC+ member -- to extend a cut of 500,000 barrels per day.

The oil cartel had already angered Washington in October by slashing production by two million barrels per day.

OPEC+ said in a statement on Monday that Sunday's move was a "precautionary measure aimed at supporting the stability of the oil market."

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

Source: AFP

The Kremlin also defended the decision, saying it was "in the interests of global energy markets for world oil prices to remain at a good level."

"Whether other countries are happy with this or not is their business," Kremlin spokesman Dmitry Peskov told reporters.

Petroleum shares rally

The news sparked bumper gains for energy companies and lifted London and Paris stock markets, although Frankfurt dipped. On Wall Street, both the Dow and S&P 500 advanced, while the Nasdaq dipped.

"We had another week-end with event risk but it wasn't the banks this time. It was OPEC," said LBBW's Karl Haeling, adding that markets were taking the news in stride.

Shares in US oil giant ExxonMobil and France's TotalEnergies rose more than five percent, while Britain's BP and Shell were more than four percent higher.

Oil giants enjoyed record profits last year as crude prices soared.

The weekend development also fanned concerns over a fresh spike in consumer prices that could put pressure on central banks to push interest rates even higher -- and dent the global economy.

Central banks have been hiking rates in efforts to tame high inflation.

"There's real concern that the surprise decision... will prompt central banks to maintain interest rates higher for longer, due to the inflationary impact, which will hinder economic growth," said Nigel Green, head of financial consultancy deVere Group.

But Ian Shepherdson, chief economist at Pantheon Macroeconomics, said the importance of OPEC's action should not be overstated.

"Movements in oil prices will, in time, again become an important driver of near-term shifts in inflation," Shepherdson said in a note. "For this year, though, all the underlying drivers of core inflation are headed in the same direction, and we see nothing to fear from this latest, modest rebound in oil prices."

Key figures around 2300 GMT

Brent North Sea crude: UP 6.3 percent at $84.93 per barrel

West Texas Intermediate: UP 6.3 percent at $80.42 per barrel

New York - Dow: UP 1.0 percent at 33,601.15 (close)

New York - S&P 500: UP 0.4 percent at 4,124.51 (close)

New York - Nasdaq: DOWN 0.3 percent at 12,189.45 (close)

London - FTSE 100: UP 0.5 percent at 7,673.00 (close)

Paris - CAC 40: UP 0.3 percent at 7,345.96 (close)

Frankfurt - DAX: DOWN 0.3 percent at 15,580.92 (close)

EURO STOXX 50: DOWN 0.1 percent at 4,311.05 (close)

Tokyo - Nikkei 225: UP 0.5 percent at 28,188.55 (close)

Hong Kong - Hang Seng Index: FLAT at 20,409.18 (close)

Shanghai - Composite: UP 0.7 percent at 3,296.40 (close)

Euro/dollar: UP at $1.0908 from $1.0839 on Friday

Pound/dollar: UP at $1.2420 from $1.2337

Euro/pound: DOWN at 87.79 pence at 87.86 pence

Dollar/yen: DOWN at 132.35 yen from 132.86 yen

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP