How it went down: Three accounts of the Lehman bankruptcy

Source: AFP

PAY ATTENTION: Have you recorded a funny video or filmed the moment of fame, cool dance, or something bizarre? Inbox your personal video on our Facebook page!

A key catalyst for the 2008 global financial crisis, the bankruptcy of Lehman Brothers still reverberates for those who lived through it. Here are the accounts of three who were there.

Paolo Battaglia, neophyte banker

Source: AFP

After interning in the summer of 2007, the young Italian felt mainly excitement in July 2008 at landing a job in Lehman's private equity division in London.

"It was the start of a new adventure, my first job out of school," Battaglia recalled. "At the time, Lehman was a prestigious and rewarding place to work."

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

"Of course, I was aware it was not an easy moment for the industry and for Lehman in particular, but until the very last day, nobody expected Chapter 11 as a realistic outcome," he said, referring to bankruptcy protection proceedings.

When it became clear Lehman would not survive as a stand-alone entity, the thinking was that it would be acquired by another heavyweight such as Bank of America or Barclays.

But on Monday, September 15, 2008, Battaglia and other employees arrived at the office to find bankruptcy administrator PWC distributing leaflets in the lobby, "basically instructing employees not to enter into any transactions anymore," he recalled.

Everything changed overnight.

"It was a surprise that things stopped so abruptly," said Battaglia who considered himself lucky to have worked in a division that was more shielded from the layoffs.

He worked through mid-2010 for a fund that was bought by Lehman colleagues before moving to Goldman Sachs, where he still works.

"I got the best I could have in a very unfortunate situation. The options were very limited."

"I am sure events were thoroughly scrutinized and if nobody was charged it was because there was no crime," he said. "We tend to associate bankruptcies with crime but it was just another business venture going bad."

Battaglia views the recent crises hitting Credit Suisse and a slew of US regional banks as completely different, saying, "there are much more policy tools and experienced knowledge of regulators and markets to manage this kind of situation than 15 years ago."

William Dudley, troubled regulator

Source: AFP

William Dudley had a full schedule on the weekend before Lehman Brothers' Monday morning bankruptcy -- first a conference at Princeton University, then the wedding of a friend attended by associates in finance.

Dudley, who was vice president of the Federal Reserve Bank of New York at the time, went ahead with these events.

"You can't really start cancelling things because that makes people even more nervous about what's going on," he said. "It was very strange going to the wedding and acting like nothing much is going on."

Dudley had spent the early part of Saturday morning working on a plan to save Lehman.

"In reality, the story for me begins a bit earlier because Dick Fuld was on the board of directors of the Federal Reserve of New York so I had some interactions with him through 2007 and 2008," Dudley said of Fuld, who led Lehman from 1994 until its demise in 2008.

"I was quite concerned that (Fuld) was in denial about the risks that the economy was facing, the financial system in general and Lehman Brothers in particular."

Dudley shared his views with colleagues in the summer of 2008, but "my memo landed with a resounding silence," Dudley said.

When Lehman filed for bankruptcy protection, the initial reaction "was not that bad," Dudley recalled.

But the situation quickly shifted into a contagion as investors rushed to withdraw funds and cover their exposure.

Could Lehman have been saved?

"Right behind Lehman, there were other (groups) in trouble like AIG," said Dudley.

"Maybe I should have been more forceful," he said. "But it might have been too late already."

But recent bank troubles have been more visible compared with 2008, Dudley said. "You actually knew why the firms were getting into difficulties."

Oliver Budde, whistleblower

Source: AFP

Oliver Budde resigned from Lehman Brothers in 2006, troubled by company practices. But the attorney was back at Lehman on the fateful morning when the firm filed for bankruptcy protection.

"I was actually at the building on the Monday morning when pandemonium broke out, when everyone started walking out with their stuff," he recalled.

There was "a lot of sadness, a 'can't believe this is happening' sort of shock," he said.

In the early afternoon, Budde spotted Fuld "sneaking out the back way and leaving in his black Mercedes limousine with his own driver.

"I took a picture," he said. "It's a souvenir for me."

Budde, who was living in Vermont at the time, spent the evening commiserating with former colleagues.

"I had seen that these men were not to be trusted," he said. "In one sense, I was vindicated by Lehman's bankruptcy."

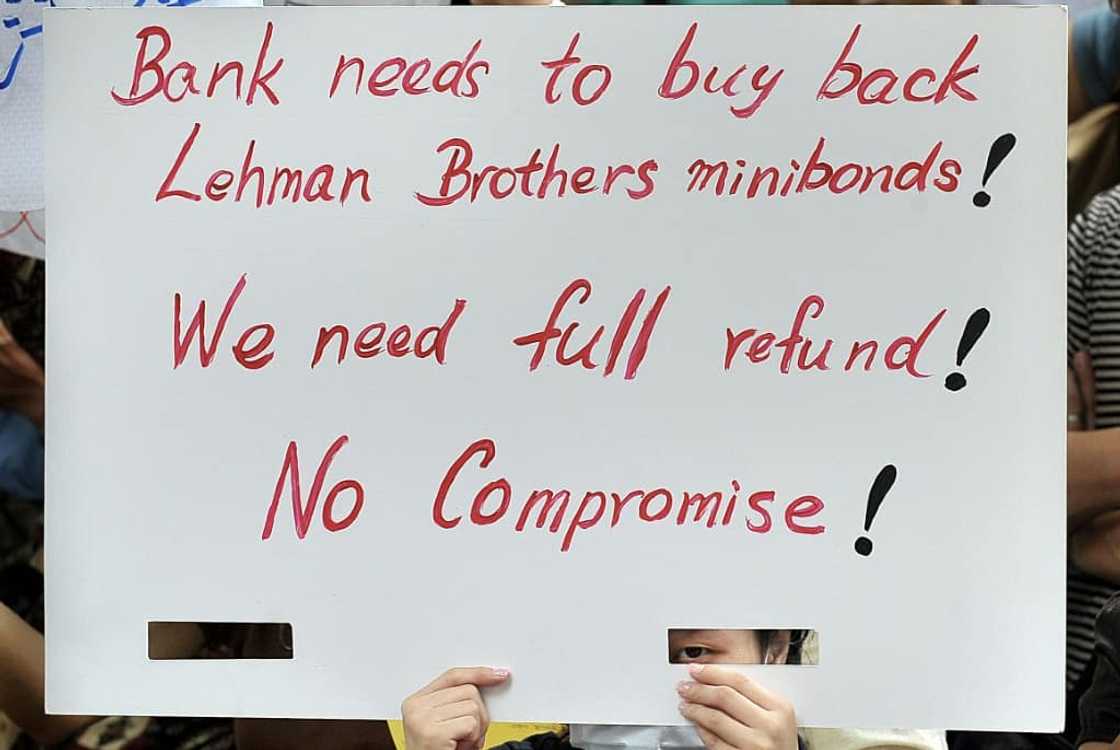

Budde had left his job as vice president and assistant general counsel in 2006, troubled by what he saw as tricks that top executives used to inflate their compensation and not disclose it to investors.

The firm made no changes even after regulators revamped the rules in 2008 to improve transparency.

"It was still hidden," he said. "It was outrageous to me. So that's when I became a whistleblower."

Between April and September of 2008, Budde sent five emails to US authorities, while copying Lehman's board and legal staff.

"No one ever contacted me, even afterward," Budde said.

"I'm quite proud of my actions. I did the right thing by reporting my concerns to the authorities."

Lehman could have been saved through a managed sale to Barclays, but the British firm "got a much better price" for major Lehman assets it acquired during the bankruptcy proceeding.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP