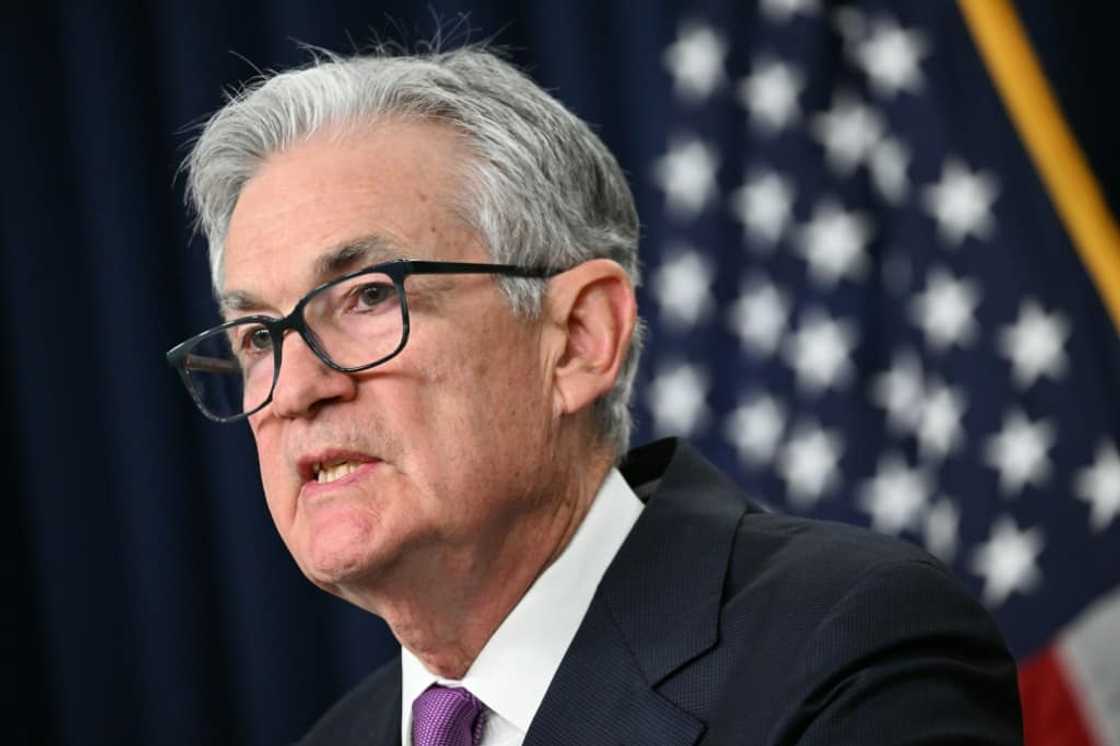

US inflation is 'still too high': Fed Chair Powell

Source: AFP

PAY ATTENTION: Watch the hottest celebrity stories on our YouTube channel 'Briefly TV'. Subscribe now!

US inflation is "still too high" despite a recent slowdown, Federal Reserve Chair Jerome Powell said Thursday, leaving the door open for a new interest rate hike.

Additional evidence of "persistently above-trend growth," or a reversal of the recent decline in job openings and softening of wage growth could cause the Fed to reconsider its current rate pause, he told a conference in New York.

If the US economy develops in this way, it "could put further progress on inflation at risk and could warrant further tightening of monetary policy," he said in a speech that was briefly disrupted by climate change protesters.

The Fed recently slowed its aggressive campaign of monetary tightening which lifted its benchmark lending rate to a 22-year high, as it looks to slow down inflation without pushing the US economy into recession.

Headline inflation, as measured by the Fed's favored gauge, has more than halved since peaking in June last year, but remains stuck above its long-term target of two percent.

"Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal," Powell said.

"We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters," he continued, adding that the Fed would proceed "carefully" at future interest rate meetings.

Monetary policy is 'restrictive'

Powell said the Fed's current policy stance is "restrictive," suggesting that monetary policy was working to put "downward pressure on economic activity and inflation."

But he warned that "a range of uncertainties, both old and new," were complicating monetary policy.

"Doing too little could allow above-target inflation to become entrenched," he said.

"Doing too much could also do unnecessary harm to the economy," he added.

Recent data points to the continued strength of the US economy supported by resilient consumer spending, while the tight labor market is showing some signs of softening.

The Fed's upcoming decisions will be "based on the totality of the incoming data, the evolving outlook, and the balance of risks," he said, echoing previous comments.

Futures traders currently assign a probability of more than 95 percent that the Fed will announce it will hold interest rates steady on November 1, following its next meeting, according to data from CME Group.

Geopolitical tensions threaten economy

In a highly unusual move, Powell also addressed the ongoing conflict between Israel and Hamas militants in Gaza.

"Geopolitical tensions are highly elevated and pose important risks to global economic activity," he said.

"Speaking for myself, I found the attack on Israel horrifying, as is the prospect for more loss of innocent lives," he continued.

The Fed's role is to monitor what economic implications these developments could have, he added.

Analysts have voiced concerns that the Israel-Hamas war could spread into a broader regional conflict in the crude-rich Middle East, with implications for oil production.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP