Asian markets take a breather after Fed rate pause rally

Source: AFP

PAY ATTENTION: Watch the hottest celebrity stories on our YouTube channel 'Briefly TV'. Subscribe now!

Asian markets turned negative Tuesday after their latest rally as high hopes the US Federal Reserve has finished hiking rates gave way to profit-taking.

Investors were unable to maintain the momentum seen after US officials hinted that the era of rising borrowing costs was over, while a jump in Treasury yields Monday revived jitters that there could still be one more lift to come.

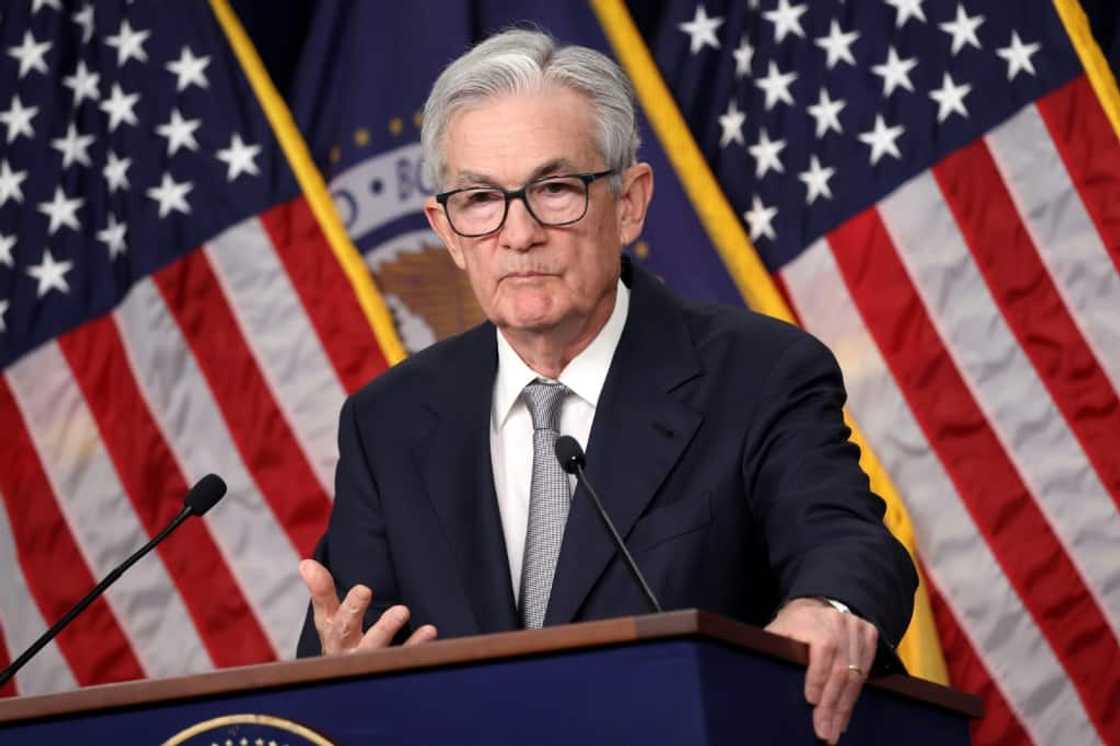

Speeches by a number of decision-makers this week including governor Jerome Powell will be analysed for clues about the outlook, with some officials still reluctant to call an end to the tightening cycle.

That comes even as a string of figures in recent weeks have indicated that while it remained resilient, the world's number two economy was showing signs of slowing, and a jobs report Friday suggested the labour market was also softening.

On Monday, Minneapolis Fed chief Neel Kashkari said: "Before we declare that 'we’re absolutely done, we've solved the problem', let's get more data and see how the economy evolves."

He told Fox News that "we need to let the data keep coming to us to see if we really have got the inflation genie back in the bottle so to speak".

Still, markets are betting on a number of rate cuts next year totalling more than 100 basis points.

All three main indexes on Wall Street ended slightly higher Monday, though the gains were tempered by a pick-up in 10-year Treasury yields, which came as a large amount of US debt hits the market.

Asian equities were on the back foot, with Hong Kong among the biggest losers after a three-day rally worth more than four percent, while Tokyo, Shanghai, Sydney, Seoul, Singapore, Wellington and Jakarta were also down.

Seoul was off more than two percent, having soared more than five percent in reaction to the reimposition of a ban on short selling.

Taipei and Manila bucked the trend.

"We're in a trading range probably for the next month or so until we get clear indications on what inflation's going to really do, core inflation, and what the Fed’s going to do," Max Wasserman at Miramar Capital told Bloomberg Television.

"We'll find out either way though. We're through the majority, if not all, the Fed tightening."

Traders will be keeping tabs on a meeting this week between US Treasury Secretary Janet Yellen and Chinese counterpart He Lifeng in San Francisco, hoping for a further thawing of long-chilled ties between the economic superpowers.

The two-day get-together comes ahead of an expected one-on-one between presidents Joe Biden and Xi Jinping on the sidelines of the APEC summit later this month.

Key figures around 0230 GMT

Tokyo - Nikkei 225: DOWN 1.0 percent at 32,394.86 (break)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 17,739.15

Shanghai - Composite: DOWN 0.5 percent at 3,044.63

Dollar/yen: UP at 150.12 yen from 150.00 yen on Monday

Euro/dollar: DOWN at $1.0708 from $1.0723

Pound/dollar: DOWN at $1.2337 from $1.2342

Euro/pound: DOWN at 86.80 pence from 86.85 pence

West Texas Intermediate: DOWN 0.4 percent at $80.47 per barrel

Brent North Sea crude: DOWN 0.5 percent at $84.79 per barrel

New York - Dow: UP 0.1 percent at 34,095.86 (close)

London - FTSE 100: FLAT at 7,417.76 (close)

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP