US Fed's favored inflation gauge slows in October

Source: AFP

A key inflation measure used by the US Federal Reserve to set interest rates eased further last month amid declining energy and goods prices, according to government data published Thursday.

The annual personal consumption expenditures (PCE) price index rose 3.0 percent in October, down 0.4 percentage points from a month earlier, the Commerce Department said in a statement.

Stripping out volatile food and energy prices, so-called core inflation also slowed to an annual rate of 3.5 percent, which was in line with the median expectation of economists surveyed by MarketWatch.

Personal incomes also slowed last month to rise by 0.2 percent from September.

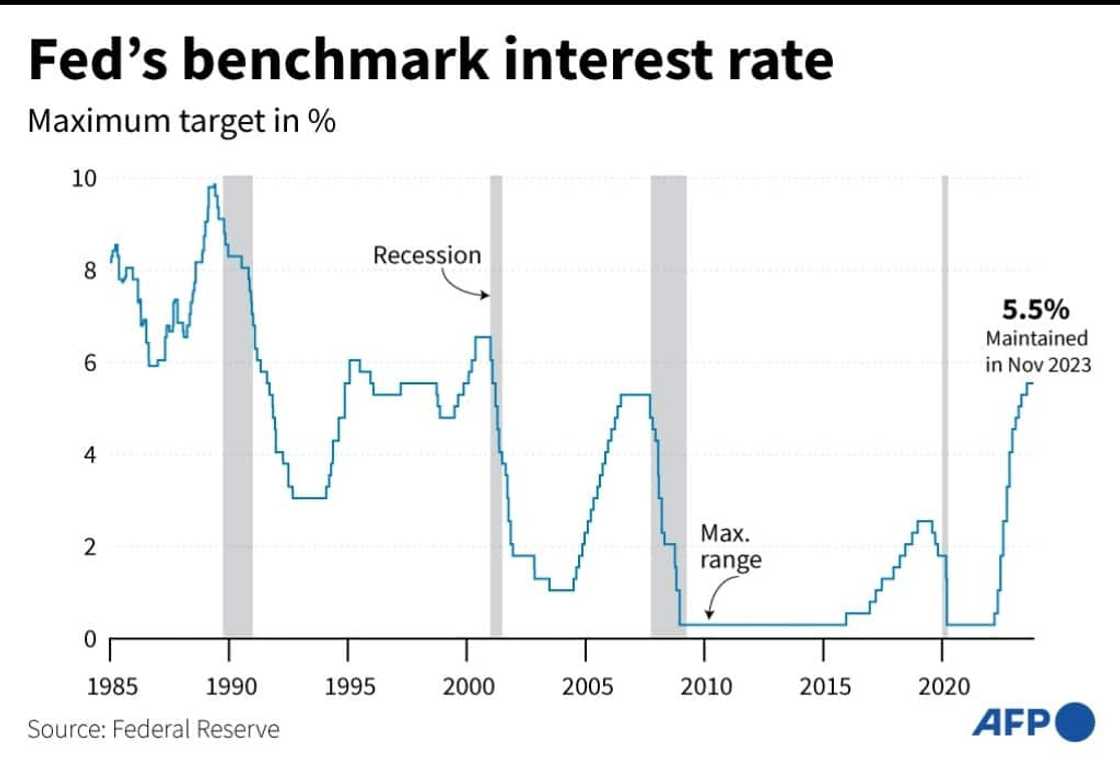

The release will provide welcome news for the Fed, which recently held its key lending rate at a 22-year high as it aims to return inflation firmly to the long-term target of two percent without triggering a damaging recession.

Cutting inflation while avoiding a downturn, commonly known as a "soft landing," is challenging to pull off, but policymakers at the US central bank have sounded increasingly optimistic they can succeed this time around.

PAY ATTENTION: Watch the hottest celebrity stories on our YouTube channel 'Briefly TV'. Subscribe now!

A Fed survey published Wednesday indicated the US economy is slowing, and the job market is cooling, providing further signs of a possible soft landing ahead.

Energy, goods prices fall

On a monthly basis, PCE inflation was virtually flat in October, while core PCE rose by 0.2 percent from September, the Commerce Department said Thursday.

Energy prices fell by 2.6 percent from a month earlier, while goods prices declined by a more modest 0.3 percent.

Meanwhile, services and food prices both increased by 0.2 percent, helping to keep monthly PCE inflation in positive territory.

October's PCE data is likely to further raise the already firm expectations that the Fed will hold interest rates steady for a third consecutive meeting in mid-December.

"A sustained easing in price pressures will support a steady policy stance" from the Fed, High Frequency Economics Chief US Economist Rubeela Farooqi wrote in a note to clients.

Source: AFP

"We expect the Fed’s next move will be a rate cut, likely by the middle of next year," she added.

Interest rates 'restrictive'

New York Fed President John Williams told a conference in the city on Thursday that he thought the Fed's rate-setting committee "has reached a restrictive stance of monetary policy."

He predicted that economic growth would continue to slow next year, while the unemployment rate would rise slightly -- which would provide further proof that the Fed's high interest rate environment is cooling the world's biggest economy.

Williams said his assessment was "that we are at, or near, the peak level of the target range of the federal funds rate," referring to the Fed's benchmark lending rate.

"I expect it will be appropriate to maintain a restrictive stance for quite some time to fully restore balance and to bring inflation back to our two percent longer-run goal on a sustained basis," he added.

Futures traders currently assign a probability of 96 percent that the Fed will stand firm on December 12-13, according to CME Group data.

PAY ATTENTION: Сheck out news that is picked exactly for YOU - click on “Recommended for you” and enjoy!

Source: AFP