How to get your tax number in 2022: Essential information

Research how to get your tax number from the South African Revenue Service (SARS). There are two categories of taxpayers: residents and non-residents. The government taxes residents depending on their worldwide income and non-residents based on their South African income. SARS uses your tax number to track your Income Duty payment progress and other related information. Please note that SARS does not provide your tax number to another person unless he/she is your tax practitioner or has Power of Attorney (POA) to conduct your tax affairs.

Source: UGC

The government uses taxes to provide the people with basic goods and services at a subsidized cost or free of charge. It is sad to know that shameless corrupt leaders fill their pockets with your money, but this should not encourage you to evade paying your Income Duty.

If every person living in South Africa would step back and refuse to pay levies, the high cost of living will make life in this country a nightmare. Continue paying your levies as you look for ways to stop corruption in the government. Read on to learn how to get your Personal Income Duty number.

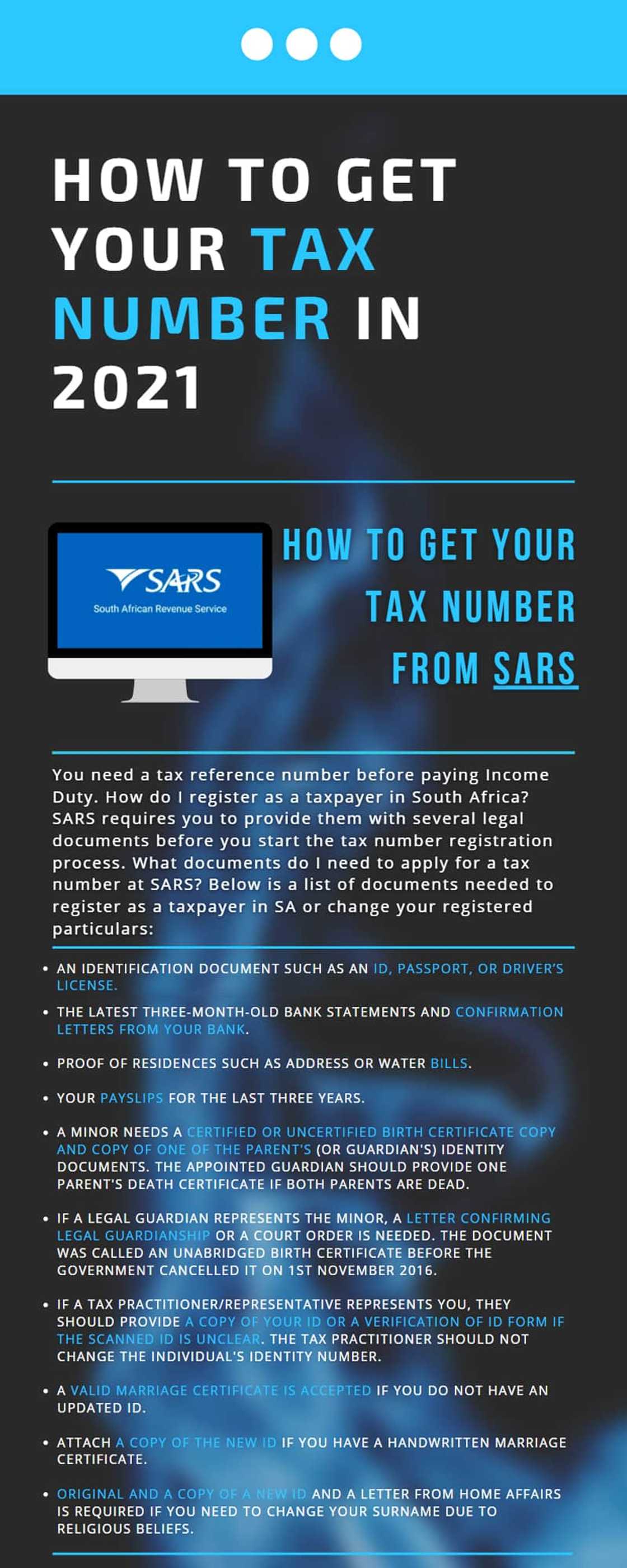

How to get your tax number from SARS

You need a tax reference number before paying Income Duty. How do I register as a taxpayer in South Africa? SARS requires you to provide them with several legal documents before you start the tax number registration process. What documents do I need to apply for a tax number at SARS? Below is a list of documents needed to register as a taxpayer in SA or change your registered particulars:

- An identification document such as an ID, passport, or driver’s license.

- The latest three-month-old bank statements and confirmation letters from your bank.

- Proof of residences such as address or water bills.

- Your payslips for the last three years.

- A minor needs a certified or uncertified birth certificate copy and copy of one of the parent's (or guardian's) identity documents. The appointed guardian should provide one parent's death certificate if both parents are dead.

- If a legal guardian represents the minor, a letter confirming legal guardianship or a court order is needed. The document was called an unabridged birth certificate before the government cancelled it on 1st November 2016.

- If a Tax Practitioner/Representative represents you, they should provide a copy of your ID or a Verification of ID Form if the scanned ID is unclear. The Tax Practitioner should not change the individual's identity number.

- A valid marriage certificate is accepted if you do not have an updated ID.

- Attach a copy of the new ID if you have a handwritten marriage certificate.

- Original and a copy of a new ID and a letter from Home Affairs is required if you need to change your surname due to religious beliefs.

How to get your tax number online

Can you register for a tax number online? Once you get the required documents, note that you can no longer get your SARS Income Duty number online. In the past, SARS requested individuals to download form IT77 and fill it online, but it discontinued the form. Meanwhile, a company can apply using the tax number form IT77C.

You must visit the nearest SARS branch to register for Personal Income Duty and make an appointment before visiting the branch. Take your documents to any police station for certification before taking them to the SARS office if you doubt their legitimacy.

File your Income Duty online via the eFiling platform. Furthermore, use the same platform to change your personal details instead of visiting a SARS branch, but both services are available only to people who have tax numbers.

How do I get my first tax number from SARS?

The SARS branch's staff member will register you after handing in the required documents and offer you your new number on the spot. Do not leave the office without the new number. Ask the SARS employees details about eFilling and other Income Duty-related issues.

You are probably done registering but wondering, "how do I get my tax reference number?" SARS will post a letter containing your 10-digit Income Duty number later, mostly within 21 days after registration. The SARS letter is a form of an IT150/Notification of registration.

If you do not get the mail, track your registration process by contact SARS via 0800 00 7277. Please have your ID number for it will be needed by the official during the call.

What happens if I forget my tax number?

Source: Twitter

Do not tense when you forget your tax number. SARS had this in mind long before requesting people to register; hence they already have a solution for you. So, where do you find your Income Duty reference number when you find yourself in this situation? There are three alternatives to go about it:

- Ask your employer.

- Check the number on your previous tax returns' correspondence from SARS or tax documents like a retirement annuity, medical or pension forms.

- Visit a nearby SARS office or call them on 0800 00 7277 and have your ID number with you.

Can I get a tax number if I am unemployed?

SARS discourages employers request first-time job seekers' Income Duty Reference Numbers for job interviews because it puts unnecessary strain on both the prospective employees and SARS branches.

SARS does not require an individual to have an Income Duty number when employed for the first time. It encourages employers to utilize the following options for obtaining Income Duty numbers for employees so that employees do not have to visit the SARS branches:

- SARS e@syFile.

- Bundled registration on e@syFile for up to 100 employees at a time and a maximum of 1,000 employees per month.

- Employers can register individual employees on eFiling.

- Registered tax practitioners can use the file upload option in Excel or CSV file format on eFiling.

Source: Twitter

Several unique cases require a South African resident or non-resident to use the 10-digit SARS tax number even if they are unemployed but were employed in the past. Check your IRP5 or payslip from your employer, as your Income Duty reference number may appear there. Some of these circumstances include:

- Buying a house.

- Buying and selling shares.

- Starting a business in your name.

- Receiving a travel allowance.

- Becoming a director of a company or a member of CC.

- If you had PAYE deducted from your income within the year.

You are now familiar with how to get your tax number. Is there no excuse not to have it? Please note that the state treats not having a tax number as a crime. Mzansi's mass media often enlightens people about this.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: List of crucial taxes in South Africa you need to know about

Briefly.co.za published an enlightening article about vital taxes in South Africa. When did tax start in South Africa? The history of tax is traceable over a century ago. The government exempts some people are excepted from some levies.

South Africa is among the world's fastest developing countries. Do you want to slow down your country's progress? If not, then pay levies. It is not easy to pay levies, but your country needs you as much as you need it.

Source: Briefly News