irp5 form: everything you need to know including the pdf download link

South African Revenue Service (SARS) opens the tax filing season at the end of every tax year. It is the primary responsibility of all individuals and entities to make sure that they comply with their tax obligations as described by the tax regulatory system. SARS provides different ways of returning tax among them eFiling and visiting an agent. The tax body determines the income received and allowable deductions for the assessment of cumulative tax liability. IRP5 form is one of the critical documents used alongside other source documents to help SARS assess individual tax liability. So, what is IRP5?

Source: UGC

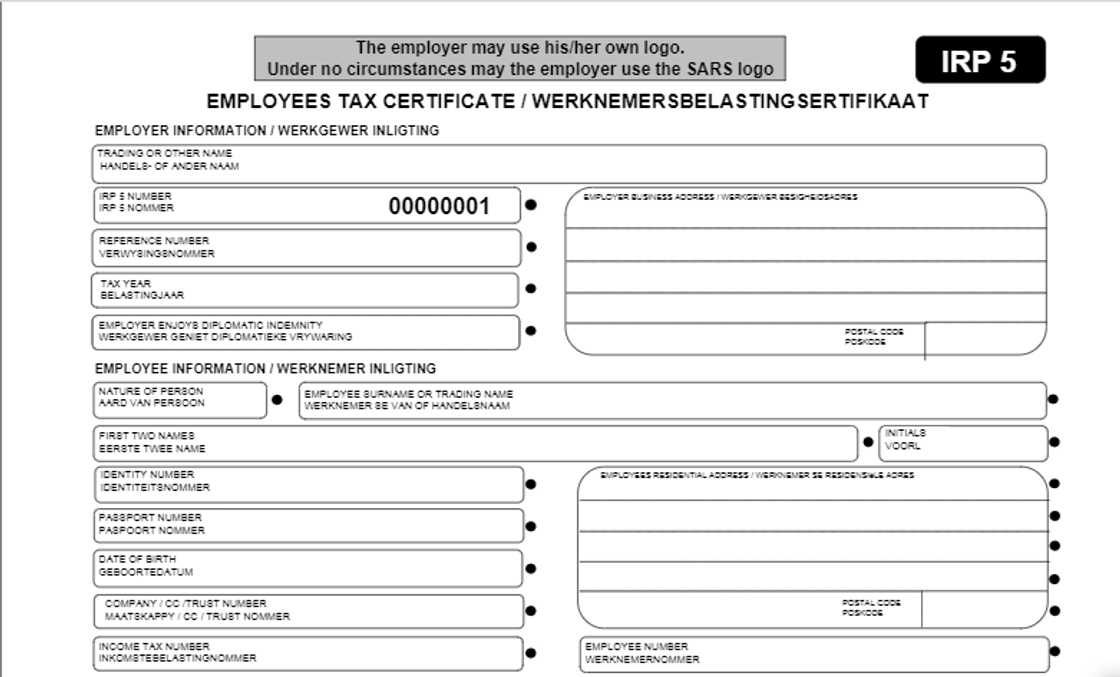

What is an IRP5 form? SARS provides that all employers should submit IRP5 on behalf of their employees. The document is particularly resourceful as it contains the income details on a specific tax period. It has all information of the tax year, employer details, and a unique certificate number. Other useful information on the certificate includes the company name, PAYE registration number, physical address, Unemployment Insurance Fund, and Skills Development Levy.

READ ALSO: SARS requirements for 2019: here is everything you need to know

IRP5 form explained

In simple terms, IRP5 SARS is a tax certificate issued to employees annually, and it contains their tax details in addition to incomes, deductions, and associated taxes. It is like a summary of your payslips throughout the working year. The document is essential for employees to accurately complete their income tax returns for the specified tax period. Upcoming sections elaborate more on IRP5 meaning and its usefulness in South Africa.

SARS tax return IRP5

SARS requires all individuals to comply with different frameworks provided under PAYE South Africa. For this reason, SARS IRP5 makes it easier for employees to complete their returns every year without experiencing difficulties. The document comes with a designated employee number, name details, identity number, birth date, postal addresses, and income tax references.

Additionally, employees who receive their salary through bank accounts will have their banking information indicated on their IRP5 form.

SARS IRP5 online and hardcopy forms

Source: Depositphotos

IRP5 forms are highly accessible for individuals to complete their tax returns within the provided deadline. Employees should scrutinize all details provided on the IRP5 certificate offered by the employer in hardcopy. In case of an error, the employer should make the necessary corrections before submitting the same to SARS. Note that employees do not have the right to update or correct information appearing on IRP5 certificate.

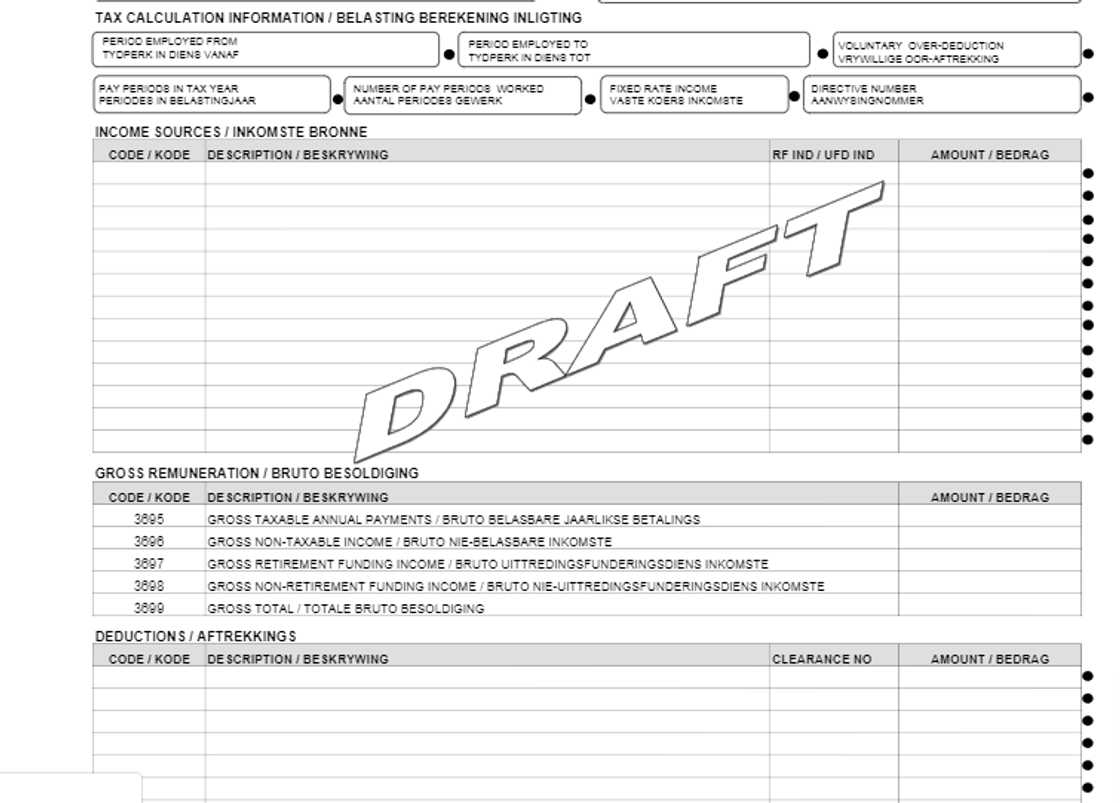

IRP5 is a reliable indicator of different tax requirements and deductions among them SARS PAYE. Provided are some of the principal source codes commonly used in IRP5 forms.

SARS income taxation

The South African Revenue Service groups income received by individuals under different classes with unique source codes as given below.

1. Income Received

3601: Income (Generally for basic salary amounts)

3605: Annual payments (Normally used for annual bonuses or once-off payments)

3606: Commission payments

3701: Travel Allowances (Subject to PAYE)

3702: Reimbursive travel allowance where the allowance is more than 12,000 km or the prescribed rate per kilometre.

3703: Reimbursive travel allowance (non-taxable) where the allowance is not more than 12,000 kilometres, the prescribed rate per kilometre, and no other compensation is paid to the worker.

3704: Subsistence allowance for local travel and/or code 3715 for foreign travel where the deemed figures and/or periods are surpassed.

3705: Subsistence allowance for local travel and/or code 3716 for foreign travel where the deemed totals and periods are not exceeded.

3713: Other taxable allowances including cell phone, entertainment, and earnings subject to PAYE)

3810: Fringe benefit – Company contribution to medical aid (figures should agree with code 4474)

Employees should understand that the income received is a Gross Employment Income (code 3699) and is subject to taxation. Additionally, non-taxable income is described under code 3696.

Source: Depositphotos

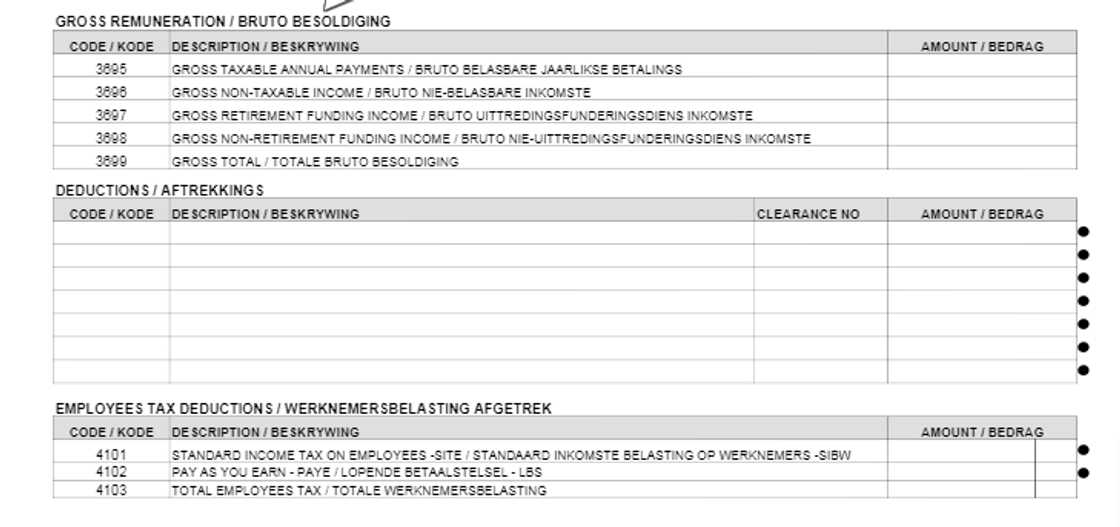

2. SARS deductions

Some of the standard deductions under SARS are provided using the following codes.

4001: Total pension fund contributions paid or deemed paid by employee (includes both employee and employer contribution)

4003: Total provident fund contributions paid or considered to be paid by employee (consists of both employee and employer contribution)

4005: Medical aid contributions paid and deemed to be paid by the employee (includes both employee and employer contribution towards a private medical aid)

4006: Total retirement annuity fund contributions paid and considered to be paid by employee

4472: Employer’s pension fund contributions paid for the benefit of the employee

4473: Employer’s provident fund contributions paid for the benefit of the employee

4474: Employer’s medical scheme contributions paid for the benefit of the employee

4582: Value of “remuneration” included in allowances and benefits (travel-related)

4497: Reflects the total deductions and contributions for the period

3. Tax credits and employee contributions

Source: Depositphotos

4102: PAYE (Indicates the amount of PAYE that was deducted from the employee and already paid during the period)

4116: Medical scheme fees tax credit (indicates the total amount of the medical scheme fee tax credits already received during the period)

4. More SARS source codes

3802: Use of motor vehicle (not operating lease)

3816: Use of motor vehicle acquired by employers via operating lease

SARS forms download

What documents do I need for tax return? IRP5 is a must-have document for employees to complete their tax returns successfully and with no erroneous omissions since it contains essential annual tax return information. If you file your tax without this form, SARS when reviewing your case may request for the form, so it is important to have it beforehand.

Are you an employer and wondering how to get IRP5 online? You can click here for IRP5 form download pdf guide. On this link, individuals and business can get all relevant SARS forms for downloading.

Employer and employee tax obligation

All withholdings and deductions proceeding from employees must be submitted to SARS every month, followed by the completion of a Monthly Employer Declaration form (EMP201). If interested in the Metal Industries Benefit Funds Administrators (MIBFA) which offers administration solutions for several industry funds, login at the website for MIBFA forms and MIBFA statements.

READ ALSO: Important insider details on tax rebate, return and refunds that you need to know

IRP5 form also called IT3 (a) is a useful form for employees to complete their tax returns. With the above details, employees should be able to fully understand their tax certificates, and employers should have enough details to properly fill the form.

READ ALSO:

- What can I claim for on my tax return South Africa

- Tax refund South Africa: Everything you need to know

- How to get a tax clearance certificate in 2019?

- How to get your tax number in 2019

- How to calculate VAT in South Africa

Source: Briefly News