Fed official signals willingness to hike interest rates full percentage point

Source: AFP

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

US Federal Reserve Governor Christopher Waller signaled Thursday he may support a full percentage point interest rate hike this month -- the biggest increase in more than 30 years and a further indication of the central bank's determination to crush sky-high inflation.

And although rising borrowing costs and blistering price surges have raised fears of recession, Waller said he believes the economy can avoid a downturn thanks to the strong US job market.

The Fed in March began aggressively raising borrowing costs to try to cool demand amid the impact of the Ukraine war, which has hit global supplies of food and oil, and Covid-19 lockdowns in China, which have impeded manufacturing of products from iPhones to cars.

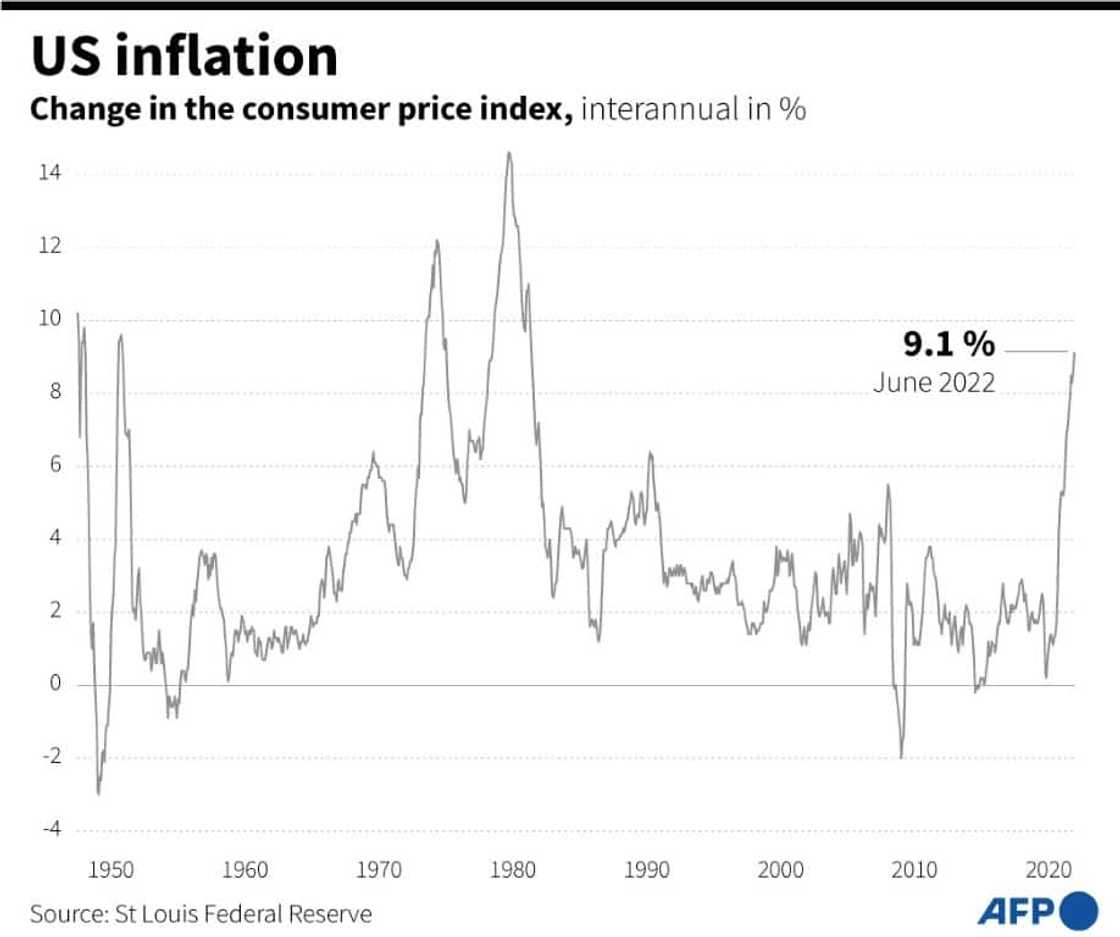

But data so far have not shown significant signs of easing, and instead reports this week contained a worrisome rebound in inflation last month, with consumer prices surging 9.1 percent.

Increased costs for gas, food and housing has squeezed American families and heaped pressure on President Joe Biden, whose approval ratings have taken a battering from the relentless rise in prices.

Waller previously expressed support for another 75 basis point hike at the policy meeting later this month, but said Thursday he will be watching key reports on retail sales and housing coming in before then.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

"If that data come in materially stronger than expected it would make me lean towards a larger hike at the July meeting to the extent it shows demand is not slowing down fast enough to get inflation down," Waller said in a speech to an economic conference.

While US central bankers universally favor attacking inflation, he is the first to hint at the giant step, although he said he still expects a repeat of last month's decision.

The Fed's moves so far have marked "the fastest pace of tightening in close to 30 years," Waller said, but the large move in June "was not an over-reaction" given the repeated strong inflation readings since the beginning of the year.

Source: AFP

"With inflation so high, there is a virtue in front-loading tightening," he said. "Getting there sooner will bolster the public's confidence that we can get inflation down" so that high prices do not become entrenched in the economy.

A full point rate hike certainly would be the biggest since 1990, and likely the most aggressive since a decade earlier when then-Fed chief Paul Volcker strangled the economy to clamp down on runaway inflation.

After what Waller called the "major league disappointment" in the inflation data, the government is due to release June retail sales on Friday, followed by new home sales on July 26 -- the first day of the Fed's two-day policy meeting -- which will be key to showing how consumers are reacting to rising rates.

'I just don't see it'

Waller said the Fed erred last year in "betting the farm" on the expectation that price spikes would be transitory, thinking that supply chain snarls caused by the pandemic would recede quickly.

Policymakers should have acted sooner to begin removing stimulus, by slowing the massive bond purchases conducted during the Covid-19 downturn to support the financial system, he said.

He downplayed the recent upsurge in recession fears, saying a downturn is unlikely given the very tight labor markets.

"I believe it can be avoided," he said, noting that the economy can cool and reduce the surplus of job vacancies without a big uptick in unemployment, which he said is close to the lowest in seven decades.

"I just don't see it," he said of the recession chances, noting that GDP data, which was negative in the first quarter and trending lower in the second is likely to be revised upwards.

"The labor market would have to really deteriorate" for there to be a recession, he said, but policymakers will have to cool demand to ease wage and price pressures.

"That's just what we have to do, I'm sorry. It's the job (the Fed) is given by Congress."

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: AFP