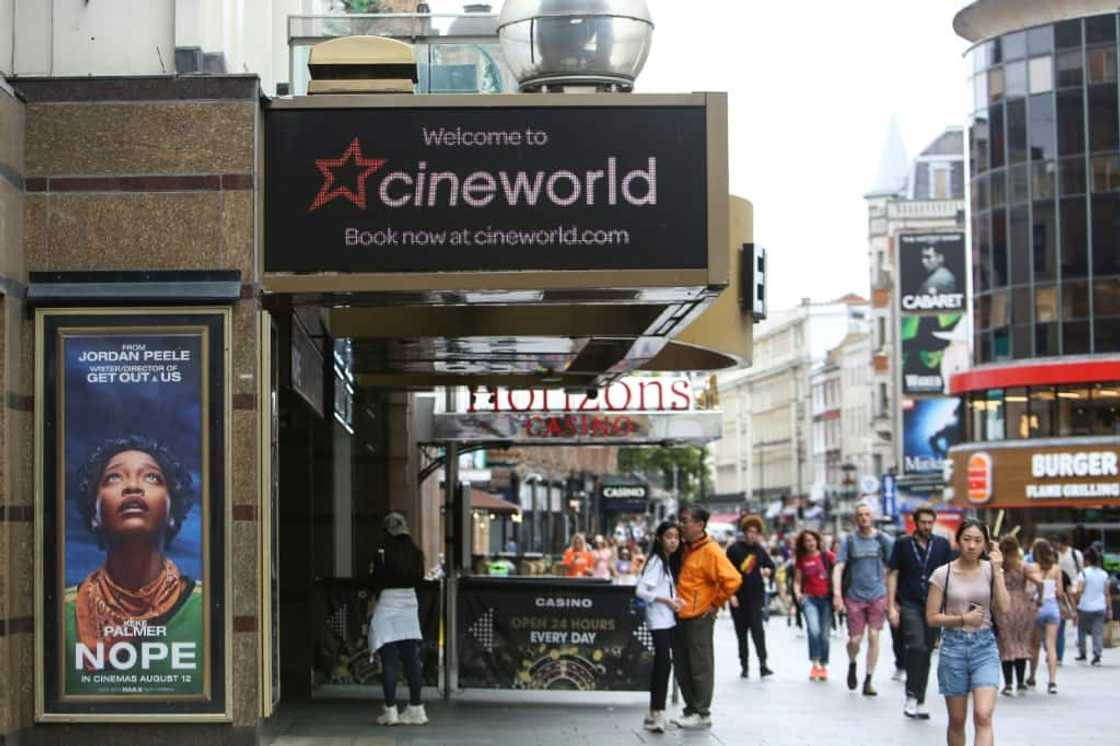

British cinema chain mulls US bankruptcy filing

Source: AFP

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

British-based cinema chain Cineworld confirmed Monday that a US bankruptcy filing is among options for the debt-laden group, which has been slammed by dwindling audience numbers.

The group, which operates hundreds of cinemas mainly in the United States, revealed last week that it was "evaluating various strategic options" to boost liquidity and potentially restructure, with demand below expectations since reopening from the pandemic.

Cineworld said in an update on Monday that those options "include a possible voluntary Chapter 11 filing in the United States and associated ancillary proceedings in other jurisdictions".

The London-listed group added it was holding talks with "many of its major stakeholders including its secured lenders".

A Chapter 11 filing "would be expected to allow the group to access near-term liquidity and support the orderly implementation of" debt reduction, it noted.

Cineworld would maintain its normal operations with "no significant impact" on staff, under such an outcome.

PAY ATTENTION: Click “See First” under the “Following” tab to see Briefly News on your News Feed!

However, it also warned of a "very significant dilution of existing equity interests".

Further announcements would be made when appropriate, it added.

Cineworld's share price has collapsed since the start of this year to stand at just three pence on Monday.

Analysts argue that its 2018 takeover of American peer Regal left it saddled with too much debt.

The chain, whose second biggest market is Britain, was then hit hard by pandemic fallout and the booming popularity of streaming.

"Cineworld's problems stem from an overly aggressive growth strategy which relied on using huge amounts of debt to buy US chain Regal," said AJ Bell analyst Russ Mould.

"This may have made Cineworld one of the largest cinema operators in the world, but bigger isn't necessarily better -- and the pandemic swiftly exposed the company's strained balance sheet."

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: AFP