US debt vote passage boosts Asian markets, Fed now in view

Source: AFP

PAY ATTENTION: Empowering lives, one story at a time. Briefly News launched a YouTube channel Briefly TV. Subscribe now!

Asian markets mostly rose Thursday after the US House passed a bill to avoid a painful default, as traders turn their attention to the Federal Reserve's next policy meeting and China's struggling economy.

After weeks of brinkmanship, Democrats and Republicans came together to push through an agreement to lift the debt ceiling in rare bipartisan cooperation.

Hardline Republicans had warned they would shoot the deal down, saying it did not have enough spending cuts, and some Democrats were also angry at the reductions made.

The bill now goes to the Senate before President Joe Biden can sign it off, allowing the government to borrow more cash to service its mammoth debts.

Failure to do so before the cash run out -- said to be June 5 -- would have resulted in a default that many warned would hammer the global economy and markets.

After the vote, Biden said in a statement: "Tonight, the House took a critical step forward to prevent a first-ever default and protect our country's hard-earned and historic economic recovery.

PAY ATTENTION: Click “See First” under the “Following” tab to see Briefly News on your News Feed!

"The only path forward is a bipartisan compromise."

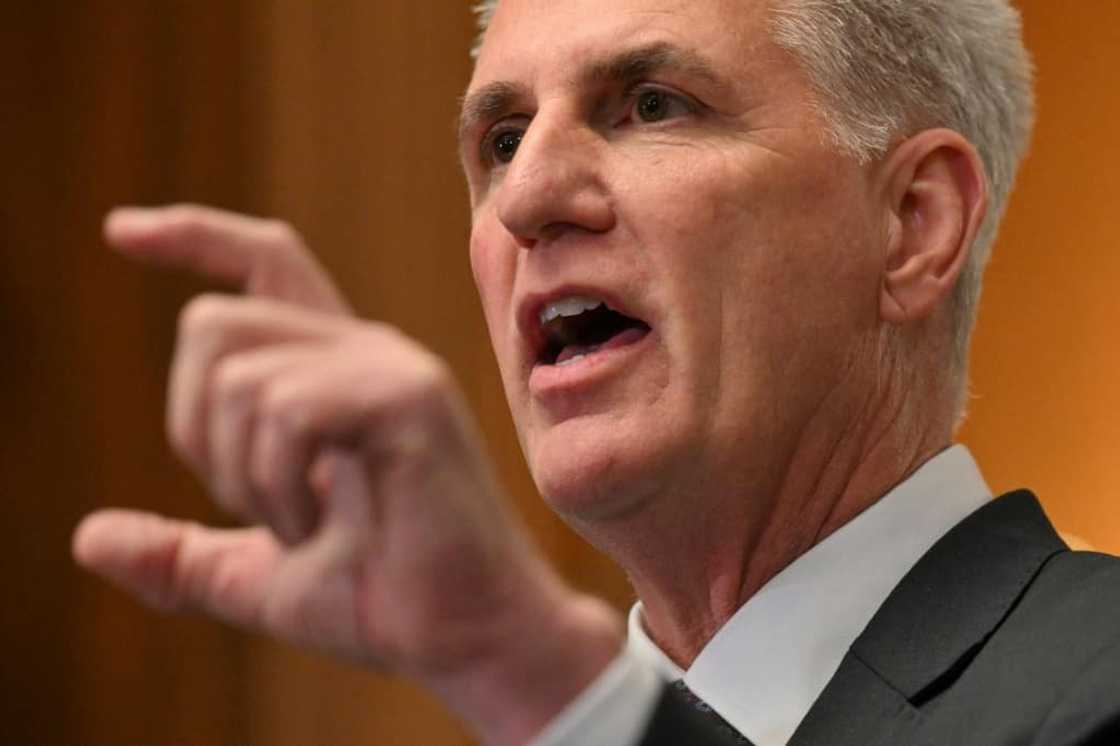

House Speaker Kevin McCarthy, who drew up the deal with Biden after weeks of wrangling, said: "Passing the Fiscal Responsibility Act is a crucial first step for putting America back on track.

"It does what is responsible for our children, what is possible in divided government, and what is required by our principles and promises."

China worries linger

Asian investors welcomed the passage in early trade. Hong Kong, Tokyo, Shanghai, Sydney, Singapore, Wellington and Manila all rose, though Seoul and Taipei struggled.

But while the threat of a default by Washington has receded for now, traders continue to fret.

Focus will now turn to the release of US jobs data on Friday, which will be pored over for an idea about the state of the world's top economy.

Continued strength in the labour market has been a key factor in the Fed's decision to keep hiking rates for more than a year as it tries to rein in inflation.

Data showing an unexpected jump in job openings on Wednesday did little to soothe investor concerns the central bank could lift again later this month.

The figures come after the Fed's preferred gauge of inflation picked up pace in April.

Still, suggestions from some officials that they should take a breather from hiking at the next policy meeting provided investors with a little hope.

"Market calls that the Fed is done hiking won't be able to shake off this labour market strength if Friday's (jobs) report confirms this trend," said OANDA's Edward Moya.

"Wage pressures will push inflation higher, which should seal the deal for more Fed rate hikes."

Also weighing on sentiment is concern about China's economy, which continues to show signs of fragility as the initial rally after the lifting of zero-Covid measures last year fades.

Figures showing the country's vast manufacturing sector contracted further last month were the latest to highlight the big job Beijing faces in kickstarting growth. But there was some good news in a private survey Thursday suggesting it had expanded slightly.

Key figures around 0230 GMT

Tokyo - Nikkei 225: UP 0.3 percent at 30,976.43 (break)

Hong Kong - Hang Seng Index: UP 0.6 percent at 18,348.60

Shanghai - Composite: UP 0.2 percent at 3,210.26

Euro/dollar: DOWN at $1.0690 from $1.0695 on Wednesday

Dollar/yen: UP at 139.40 yen from 139.30 yen

Pound/dollar: DOWN at $1.2440 from $1.2442

Euro/pound: DOWN at 85.91 pence from 85.93 pence

West Texas Intermediate: UP 0.4 percent at $68.39 per barrel

Brent North Sea crude: UP 0.5 percent at $72.98 per barrel

New York - Dow: DOWN 0.4 percent at 32,908.27 (close)

London - FTSE 100: DOWN 1.0 percent at 7,446.14 (close)

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP