Mineral-hungry clean tech sees countries seeking to escape China's shadow

Source: AFP

PAY ATTENTION: Let yourself be inspired by real people who go beyond the ordinary! Subscribe and watch our new shows on Briefly TV Life now!

With a clean energy transition hungry for more minerals, representatives from dozens of countries and industry met in Paris on Thursday looking to shore up deliveries against supply chain snarls and geopolitical tensions.

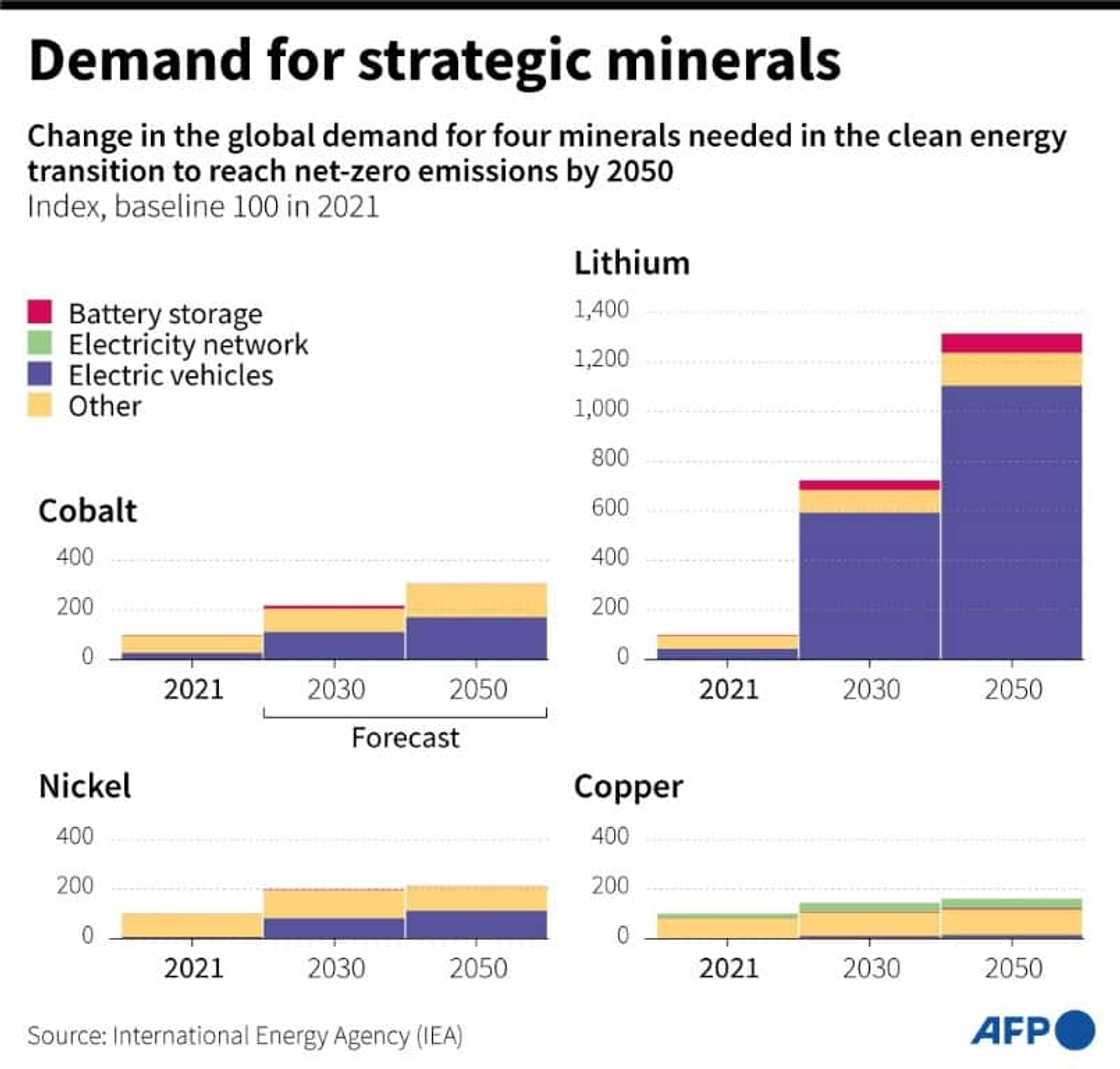

The International Energy Agency (IEA), which hosted the conference, has noted "spectacular" growth in renewable power and electric vehicles that is likely to cause fossil fuel demand to peak this decade -- and also see demand for critical minerals surge.

Copper is a crucial component for wind turbines, while electric car batteries need lithium, cobalt and nickel.

While these minerals are found across the world, the concentration of processing, particularly in China, has caused concerns over sustainability amid trade and geopolitical tensions.

IEA chief Fatih Birol told delegates the "major challenge" countries face is how to ensure more diverse supplies, with other major issues including sustainability -- both environmental and social -- and how to increase recycling.

And the world needs to move quickly, he said.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

"Clean energy transitions are moving faster than many people realise," he said, adding that more than 80 percent of all new power plants built this year used renewable energy sources.

Delegates from more than 40 countries attended the meeting -- though China and Russia, another major producer, were absent -- looking to define a new metals diplomacy.

Debates centred on ways to reorganise the system, with memories of the breakdown in global supply chains during the Covid pandemic still fresh.

That and Russia's invasion of Ukraine wreaked havoc in commodity markets, with prices spiking in 2021 and early 2022, though they began to stabilise late last year, the IEA has said.

"We cannot replace the fossil fuel dependency with a raw material one," said Thierry Breton, commissioner for the EU's internal market, adding that the bloc was considering new legislation aimed at boosting mining and refining capacity.

The United States, which has pledged to be a clean energy leader with its climate and trade policies, also called for increased international cooperation.

Resource race

The IEA has flagged concerns that projects and processing are clustered in a small number of countries.

It says China processed 74 percent of the world's cobalt in 2022, 65 percent of lithium and 42 percent of copper.

Source: AFP

In an interview with AFP earlier this month, Birol said this concentration was a key challenge.

"Which is not something against China, but if you put all the eggs in one basket it is really not a sustainable choice," he said.

Many mineral-rich countries such as Indonesia, Peru and the Democratic Republic of Congo have seen mining booms in recent years, with some aiming to pin their development on these resources.

Indonesia's Energy and Mineral Resource Minister, Arifin Tasrif, also called for a new foundation for global cooperation on critical minerals, highlighting that recycling would also play a crucial role.

The IEA says the energy sector was the main factor behind a tripling in overall demand for lithium between 2017 and 2022, as well as a 70 percent jump in demand for cobalt and a 40 percent rise for nickel.

The IEA predicts that if countries increase their climate ambitions in line with its projections for the energy sector to decarbonise by mid-century, demand for critical minerals will grow by three-and-a-half times by 2030, exceeding 30 million tonnes.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ click on “Recommended for you” and enjoy!

Source: AFP