5 Ways To Increase Your Black Friday-Cyber Monday Revenue This Year

Source: Original

Black Friday-Cyber Monday (BFCM) can make or break your Q4 – or your whole year.

You’ve spent months putting everything into place: your offers, your ads, your influencers, your logistics. Everything is ready to go.

But what happens when your shoppers hit “buy” at checkout?

According to research, online businesses in SA lose up to 30% of revenue due to issues in the payment software that powers their checkout. That’s the difference between a very good – or a very bad – 2025.

And it doesn’t include abandoned carts.

So, in advance of BFCM, I spoke to Jonatan Allback, CEO & co-founder of NjiaPay - South Africa’s first all-in-one Payment Management Platform (PMP for short – very different to a PSP). NjiaPay processes tens of thousands of transactions every month, so they know what’s needed to ensure you don’t lose a single rand in revenue this BFCM.

They suggested five steps to boost your BFCM funnel and ensure your store is ready.

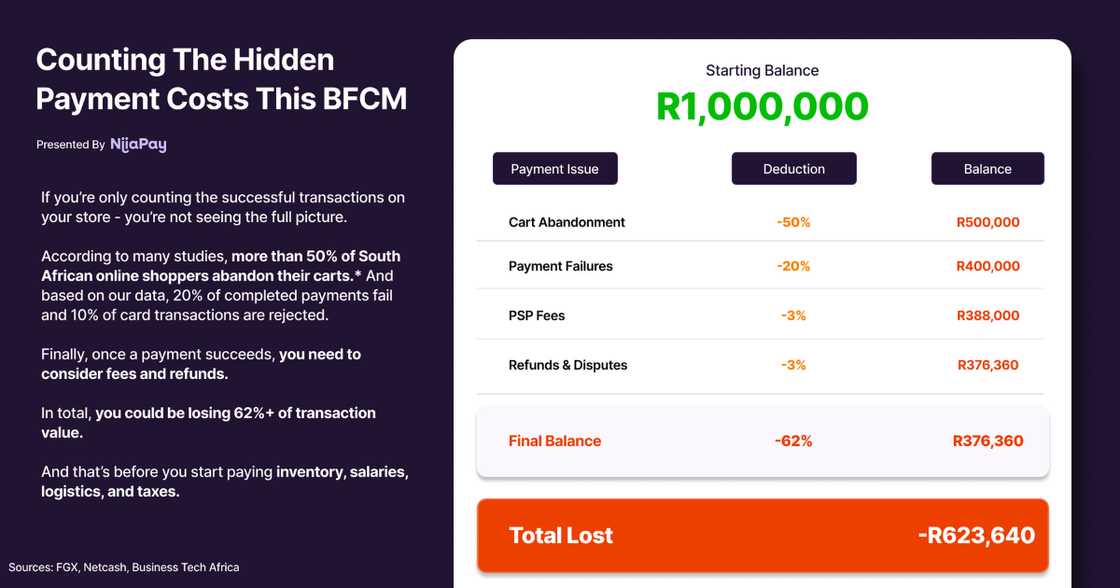

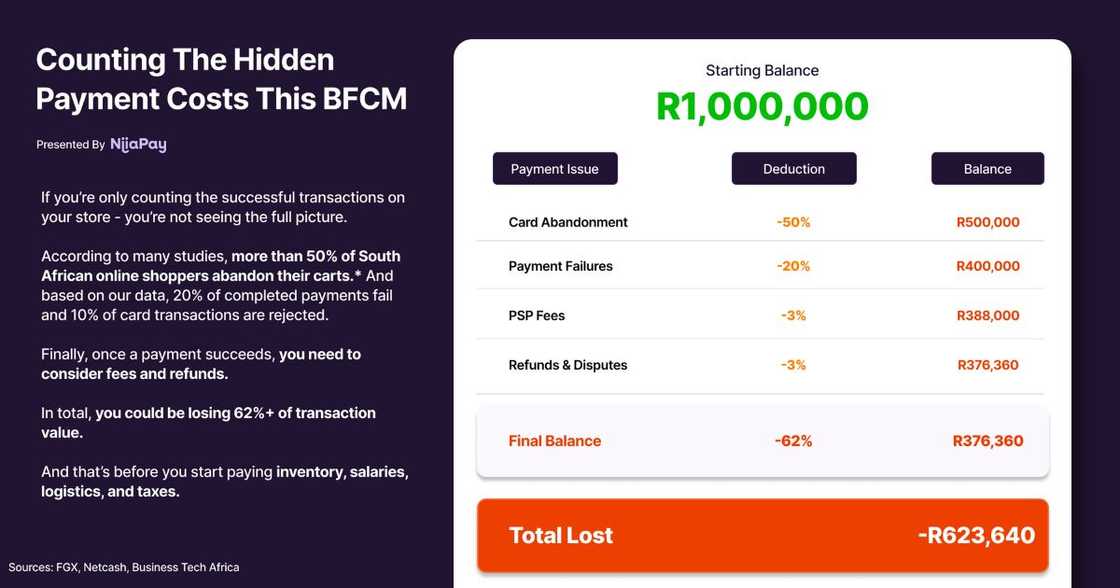

1. Understand the risk to your revenue

Let’s use a simple example.

Say you run a Shopify store and you have R1m in order value in shopping carts. You might think that’s R1m in the bank, but you’re wrong.

Your PSPs and payment software could be costing you hundreds of thousands through outages, declined transactions, and other issues – not to mention fees.

Here’s a simple graphic to explain:

Source: Original

What’s worse: This isn’t just happening during BFCM - it’s happening every day.

How do you fix this?

You could hire a software engineer to audit and fix every piece of your payment stack. But that’s expensive, and BFCM starts in 1 week.

Or you could install NjiaPay. It automates your revenue recovery with a suite of tools that includes a conversion-optimised checkout, a smart payments routing engine, built-in fraud protection, and real-time transaction data. They recently released a WooCommerce plugin and a Shopify App that take 15 minutes to install on your store.

After all, you didn’t start your business to spend all day worrying about payments.

2. Black Friday? Try Black November

That part where I said you have three weeks to prepare for BFCM?

I lied. It’s already started.

Black Friday isn’t a day anymore - it’s a month-long campaign. South African retailers started launching deals November 1st. Your competitors are ahead, and your customers are spending their money.

But you can catch up if you act fast.

And if you missed BFCM, you still have time to prepare for Christmas.

3. Optimise for mobile

I don’t need to tell you that most of your customers will be shopping on their phones – you know this. It’s 2025.

However, you likely still designed your mobile website or app on a desktop. So you’re probably missing bugs, slow load times, clunky forms, broken redirects, and misplaced “Buy” buttons that only appear on a real-life mobile device.

Get your team to open your website and app on their phones and start testing every page, every product listing, and every button. Make real purchases like a real human would. Tell everyone to screenshot and report the bugs they find.

One bug could derail your entire BFCM campaign - so it’s time to get forensic.

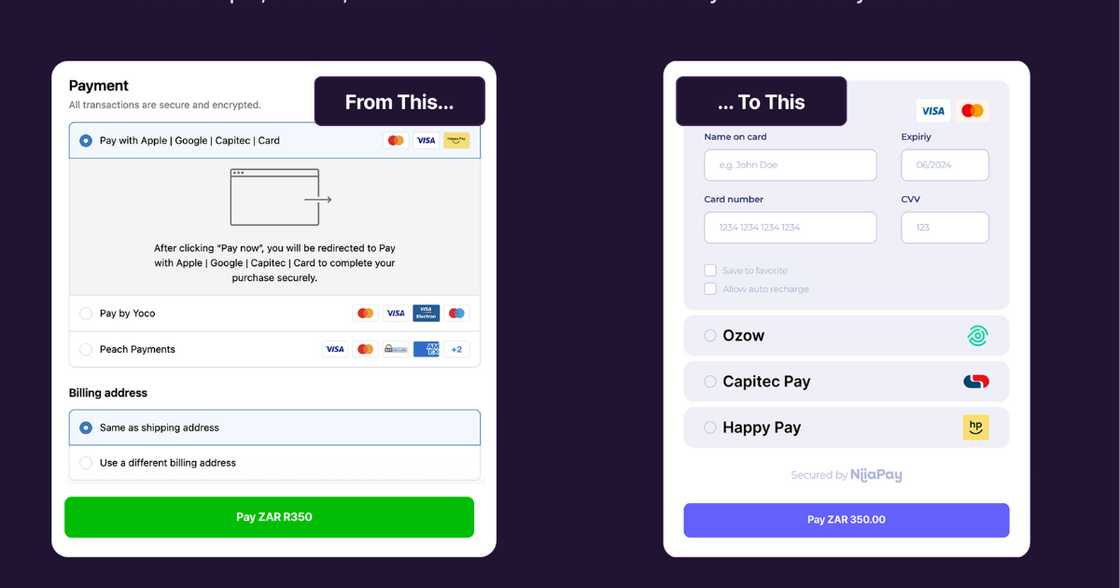

4. Fix your checkout

NjiaPay’s PMP includes a mobile-first checkout that dynamically routes payments to the best payment method for each shopper, reducing abandoned carts and boosting conversions. It’s branded in your colours and easy to use.

They report that some customers have seen a 25% increase in checkout conversions once they switched to the NjiaPay checkout.

Source: Original

5. Get your payments stack BFCM-ready

Every PSP and payment method on your store must be working and ready for the BFCM surge.

Don’t wait until everything starts crashing to start looking for issues. It’s too late. That money is gone.

The NjiaPay team recommend the following tests to ensure your payment backend is ready:

- Test your checkout, PSPs, and payment methods for various purchase types and across different devices and browsers.

- Monitor PSPs for uptime (is it always online?) and latency (how quickly does it process transactions?)

- Analyse October’s conversion rates on your checkout by device and payment method, and prioritise the best-performing for BFCM.

- Review failed transactions and inconsistent approvals to identify consistent failures early and switch if needed.

- Have your PSPs on speed dial.

If this sounds too technical, NjiaPay is offering a free payment walkthrough for anyone who books a demo during BFCM. They’ll also show you how their PMP works.

For example, if the first PSP in your checkout fails, it automatically routes the payment to a second. This happens so fast, your customers won’t notice.

Second, their platform displays every failed transaction on every payment method as it occurs. Your customer support team can explain what happened to customers and suggest an alternative.

Third, if one payment method keeps failing, you can replace it with a more reliable one using NjiaPay’s no-code payment method configurations.

Be ready this Black Friday-Cyber Monday

The difference between record profits and a difficult conversation with your accountant could come down to a faulty PSP.

Don’t take the risk.

Speak to NjiaPay. They’re helping South African businesses, such as Melon Mobile, Anytime Fitness, and Conservio, reduce failed transactions, increase authorisation rates, and recover lost revenue on one platform.

Source: Briefly News