Fundi loan requirements explained: what you need to qualify and apply

Fundi Student Loan requirements, including employment, proof of income, and a positive credit rating, must be met before the finance provider can cover your education-related expenses. The loan is available to students or working professionals aiming to upskill, but cannot afford to cover their studies.

Source: UGC

TABLE OF CONTENTS

Key takeaways

- Fundi Student Loan funds studying expenses for learners at accredited educational institutions across South Africa, including public universities, private colleges, or TVET colleges.

- The applicant must not be under debt review and should have a positive credit score to meet Fundi Student Loan eligibility.

- Learners are required to start making repayments one month after their Fundi Student Loan is approved.

How does Fundi Loan work?

Fundi Loans cover a range of educational expenses, including tuition fees, registration fees, outstanding balances, textbooks, accommodation, and technological devices like laptops. Their loan products are divided into various categories, including:

- Study Loans: Covers the fee for programs offered by universities and colleges across South Africa

- Short Courses Loans: Quick loans to cover fees for short courses

- Accommodation Loans: Helps learners pay accommodation rent in smaller, affordable instalments

- Executive Loans: Cover specialist programs in a certain field of study

- MBA Funding: Funds specialist or generalist-MBA qualifications

- Study Device Loans: For learners who want to purchase technological devices like laptops, tablets, and mobile phones for their studies.

- Educational Tools Loans: Funding to help students cover study-related equipment like textbooks, a musical instrument, safety equipment, or a stethoscope.

Fundi Student Loan applications are often assessed based on the applicant's ability to afford the monthly repayments. In some cases, a joint household income (from a spouse, partner, or family member) may be considered to help with affordability.

Source: Getty Images

Who qualifies for Fundi Loans?

The Fundi Student Loan is available to learners who have received their matric certificate or employees looking to further their studies. They have to meet the following requirements to qualify:

- Must have South African citizenship

- Must be over 18 years old

- Must be employed. Government employees should have a 'persal' number

- Must be making a monthly income of R2,500 after deductions

- Must have a positive credit score and not be under debt review

- You need to be enrolled or accepted at an accredited South African educational institution, including public universities, private colleges, or TVET colleges.

Before applying for the loan, ensure you have these Fundi Student Loan documents:

- A certified South African ID document

- Proof of income

- A valid South African bank account

- An official acceptance letter or proof of registration from the school

Source: Getty Images

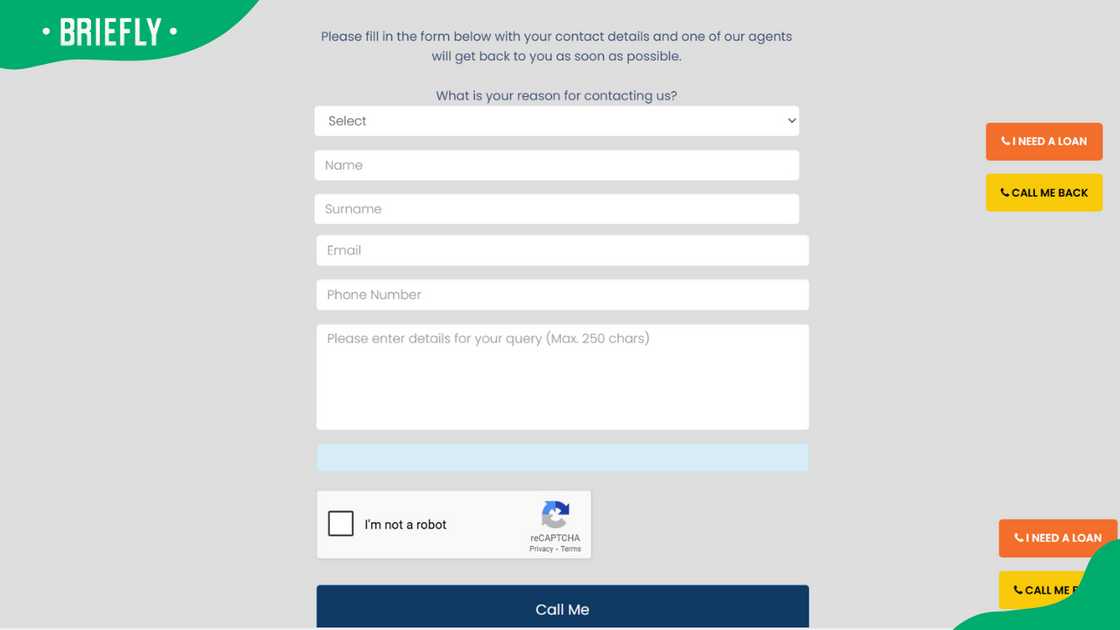

How to apply for Fundi Student Loan

The Fundi Student Loan application is done online with assistance from their agents. Follow these simple steps:

- Open the official Fundi website

- Select the Solutions section at the top of the page

- Choose Educational Loans

- Click on 'Know More' under Study Loans

- Fill in the requested details, including your name, email, phone number, and details for your query.

- Click on Call Me to send your details to Fundi

Source: UGC

- Wait for a call from one of Fundi's agents, who will tell you about the next step.

- After reviewing your details, they will require you to hand over the necessary documents that will help them decide if they will approve your loan request.

Learners can get a quick estimate of their potential loan instalment using the Fundi Loan Calculator. This will help you determine if you can afford repayments based on your financial situation before you proceed with the student loan application.

How to apply for a Fundi Device Loan?

A Fundi Device Loan covers the cost of essential digital study tools, including a laptop, smartphone, and tablet. You can visit any of their branches across the country or follow these steps to get started with the online application:

- Visit the official Fundi website

- Select the Solutions section at the top of the page

- Choose Educational Loans

- Scroll down to Study Device Loans and click on 'Know More'

Source: UGC

- Fill in your personal information and details of your query in the form that appears.

- Click on Call Me and wait for a call from a Fundi agent to take you through the rest of the application process and the documents to submit.

How long does it take for Fundi to pay?

After applying for a student loan, the education finance provider takes a few business days to process and verify your details. Once it is approved, Fundi will send the funds directly to your school or the relevant service provider for things like accommodation and study devices. You do not handle the money yourself to ensure the funds are used for their intended purpose.

Do you pay back Fundi?

Fundi is a loan, not a bursary, and students have to repay. You are expected to start paying back your Fundi Student Loan one month after it has been approved.

You will work with Fundi to establish a plan for monthly repayments, which are often deducted from your salary or from your bank account via a debit order. The amount of repayment instalments depends on the loan amount, the interest rate used, and the duration of the loan.

Learners are also encouraged to repay early without any penalty if they have the means. The interest rate you are offered is based on factors such as your credit score, income level, and the size and term of the loan.

Source: Getty Images

Fundi Student Loan contact details

Fundi has 35 branches spread across South Africa. You can visit any of their offices, most of which are within or near college campuses, or contact them via:

- Call centre: 0860 55 55 44

- Reception: 011 670 6100

- Support email: support@fundi.co.za

- Head office: Hendrik Potgieter Rd and 14th Ave, Weltevreden Park, Roodespoort, Johannesburg

Source: Getty Images

Conclusion

Understanding the Fundi Student Loan requirements should help you get the funding you need to finance your education. Financial planning is also essential to ensure you get a favourable repayment plan.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Read also

Where is the Bad News Bears 2005 cast now? See what the former Little League stars are up to

READ ALSO: What is the SARS consent form for NSFAS and where to get it?

Briefly.co.za highlighted the purpose of the SARS Consent during your NSFAS application. The crucial document authorises NSFAS to access and verify your parents, guardians, or spouse's financial information directly from SARS.

The verification process helps NSFAS determine whether you qualify for financial aid based on your household income. The applicant needs to sign the consent form.

Source: Briefly News