How to qualify for a Capitec temporary loan | Everything you need to know

Loans come in handy when there is a need, whether you have an emergency or are starting a business. Loanings have helped many, and people are always looking for the fastest, most convenient ways to acquire one with the minimum interests. Capitec has come forth to provide quick loaning services for its customers, with some of the lowest interest rates in South Africa. So, how do you qualify for a Capitec Temporary loan?

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

Source: Getty Images

Capitec Bank is a South African retail bank. With 120,000 clients opening new accounts each month, the bank was the second largest retail bank in South Africa as of August 2017.

What is a temporary loan?

A temporary loan is a form of credit service that is obtained to meet a brief demand for funds on the borrower's or their business's part. Given that it is a form of credit, it entails paying back the principal plus interest by a specified due date, often one year after receiving the loan.

Capitec loan services

The bank offers various loan services, including personalized, home, and credit card services. As long as you meet the requirements for each type, you are eligible to get one.

Does Capitec offer temporary loans?

Yes, indeed. Capitec temporary loans are short-term loans offered by the bank to many South Africans. A credit facility is loaded into your account as a Capitec short-term loan. This money is available to you anytime you need it.

At Capitec, applying for this service is quick and simple. To be eligible, you must be at least 18 years old. Capitec will make sure that the money is transferred to your bank account as quickly as possible once your application for a temporary credit is granted.

How to apply for a loan at Capitec

Source: Getty Images

To get a Capitec instant loan, you must have met all the requirements mentioned. These requirements include:

- Being a current client of the bank

- An excellent credit history

- The minimum age of 18

- Possess a steady and dependable income

Since you are a Capitec Bank customer and the institution already has your documents in their system, you do not need to provide them to apply for loaning services. These documents include identification, proof of residency, paystubs, etc.

There are various ways to get temporary loaning services at the bank, including:

- Online

- Visiting any Capitec branch

- Via phone

1. Capitec loan online

You might need to download an application form before submitting your application online.

You have 14 days from the time you begin the online application to finish it.

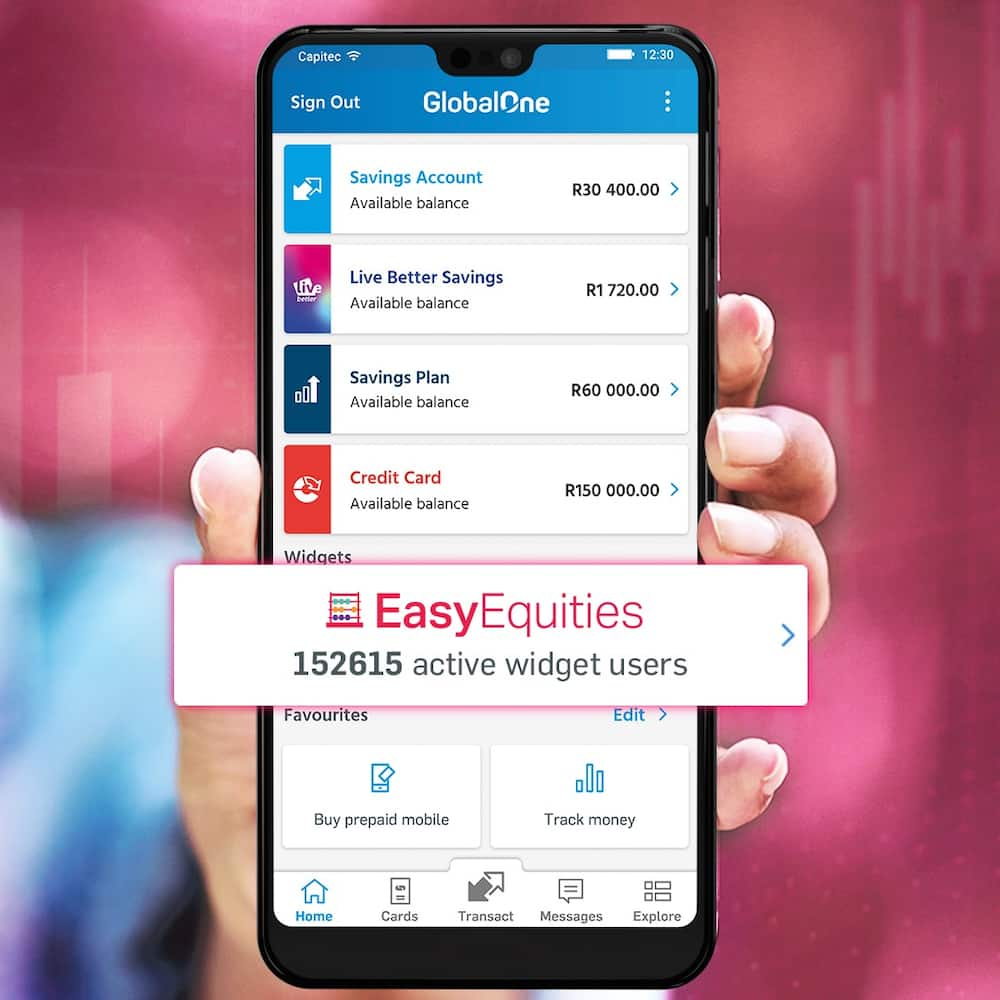

Online applications must be submitted with a working email address. This enables the bank to provide you with an application form and account number for salary redirection. You can also submit your application using the Capitec banking app.

2. Phone application

You only need to call the bank to submit a phone application. One of their helpful employees can get assistance with the application form.

3. Branch application

An application form is available at every branch in your area. Wait for your application to be approved after filling out the form. The bank does not charge registration or application costs for a short-term loan.

This implies that applying to Capitec Bank is free of charge. The main distinction between applying for a Capitec temporary loan online and over the phone is that the latter requires you to provide details about your employment and monthly income immediately.

Loan repayment

Source: Facebook

Once you have withdrawn debt from the bank and agreed on the repayment date, you can clear your credit via the following means.

1. Salary deduction

The monthly sum will be taken from your payslip and sent to the bank on your behalf if you choose this method, which your employer handles.

You cannot delay or skip any payments since a service fee will be applied to the temporary loan balance during the loan's length. The best feature is the ability to change the payment method once during the loan period. This can be done online, by phone, or in person at a bank branch.

2. Direct deposit

The bank will withdraw the monthly amount directly from your account if you select direct deposit. If you use direct deposit, there is no chance that you will overlook payments or unintentionally exceed your Capitec debit limit. This is a result of everything being mechanized.

3. ATM card

In South Africa, this method is acceptable everywhere VISA cards are accepted. You can add funds to your bank account and withdraw and view your account's balance with an ATM card.

How much do I qualify to borrow at capitec bank?

With a personal loan from this bank, you can borrow up to R250,000, and the lowest interest rate is 12.9 per cent. But only your salary and credit history will determine how much money and the interest rate you can get. The more money you can borrow, the greater your wage must be.

Does Capitec give loans to the unemployed?

You are not eligible to borrow from Capitec if you are unemployed, do not own a business, or lack the documentation necessary to demonstrate a steady source of income.

Can I get a loan at Capitec without a payslip?

Unfortunately, you cannot apply for a personal loan with Capitec Bank if you do not have a pay stub. Providing proof of income is one of the prerequisites for applying for a personal loan since the bank requires assurances that the borrower will be able to pay the monthly fees.

So, there you have all the details you need to know about applying for a Capitec temporary loan. The bank has made it easy for anyone eligible to borrow and has created a conducive environment for repayment.

REA ALSO: 80 small business ideas in South Africa that actually work in 2022

Briefly.co.za recently listed 80 of the best small business ideas in South Africa in 2022.

People no longer choose to retire at age 60 and rely only on pensions for the remainder of their life. Many people are now interested in pursuits that directly feed the passions that make life enjoyable for this reason.

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: Briefly News