How to calculate PAYE on salary 2022: step-by-step guide

Learn how to calculate PAYE on salary for your good. The knowledge will help you understand your actual salary. You will be able to plan your expenses and savings accordingly, unlike before when your attention was on the gross salary. Your gross salary should never be your basis for budgeting because it is way more than what lands in your bank account.

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

Source: UGC

SARS (South African Revenue Service) requires employers to collect taxes from employees on its behalf. It is overwhelming for businesses to simultaneously manage their employees while teaching them how to calculate PAYE on salary.

How to calculate PAYE on salary

PAYE is income tax deducted from your salary before you receive it. There are several ways for calculating PAYE in South Africa. Although SARS professionals use all techniques, an employee should learn how to calculate tax from salary using the simplest one before advancing to other techniques. It is the most straightforward, especially when dealing with variable income.

How do you calculate PAYE?

SARS uses one's annual income to determine their PAYE tax liability. Therefore, when computing for PAYE, consider the rebates, deductions, and tax thresholds provided by SARS.

PAY ATTENTION: Follow Briefly News on Twitter and never miss the hottest topics! Find us at @brieflyza!

There are pre-tax, post-tax, voluntary and mandatory deductions, but your employer only focuses on mandatory pre-tax deductions when calculating your PAYE. Here are vital things to note and steps to follow when computing your PAYE:

1. Calculate your annual gross income.

Computing the annual gross income for fixed and variable salaries differs

I.) Fixed salary

Getting your annual gross income is straightforward if you earn a fixed salary. Use this formula to calculate it:

Employee's gross annual salary = monthly salary * 12

II.) Variable salary

It is more involving to compute PAYE for employees who receive variable incomes. The computation formula is:

Employee gross annual salary = (sum of monthly remuneration to the current date/number of remuneration months) * 12

For instance, Mark received R10,000 in September, R12 000 in October, and R15 000 in November. If November is the current month of PAYE calculation, his gross annual earnings will be;

Employee gross annual salary = ((R10 000 + R12 000 + R15 000)/3)*12 = R148,000

2. Factor in regular deductions such as provident funds.

SARS limits a person's deductions to about 27.5% of the employee's gross remuneration. Moreover, the uppercut is set at R350000 for tremendous income employees. Use this formula.

Deductions = (Sum of monthly RAF, pension, etc.)*12

3. You should also note that monthly travel allowances are a special case.

The employer has to determine how the employee spends their travel allowances. If one spends 20% of the allowance on business trips, 80% will be subject to PAYE deductions. Meanwhile, if the person travels 80% of their working time for official duties, 20% of their travel allowance is taxable.

I.) More than 80% travel rate

Travel allowance deduction = (monthly travel allowance*12)*20%

II.) Less than 80% travel rate

Travel allowance deduction= (monthly travel allowance*12)*80%

4. Take into consideration SARS rebates, deductions, and tax thresholds.

Ideally, if the taxable income falls below the thresholds, the employee will incur no deductions. Check out the 2023's Tax thresholds table below.

5. Consider PAYE statutory rates before calculating the employee’s due PAYE.

Start by identifying the tax bracket where your employee falls before working out the payable tax. Check out the current SARS' PAYE statutory rates table is below.

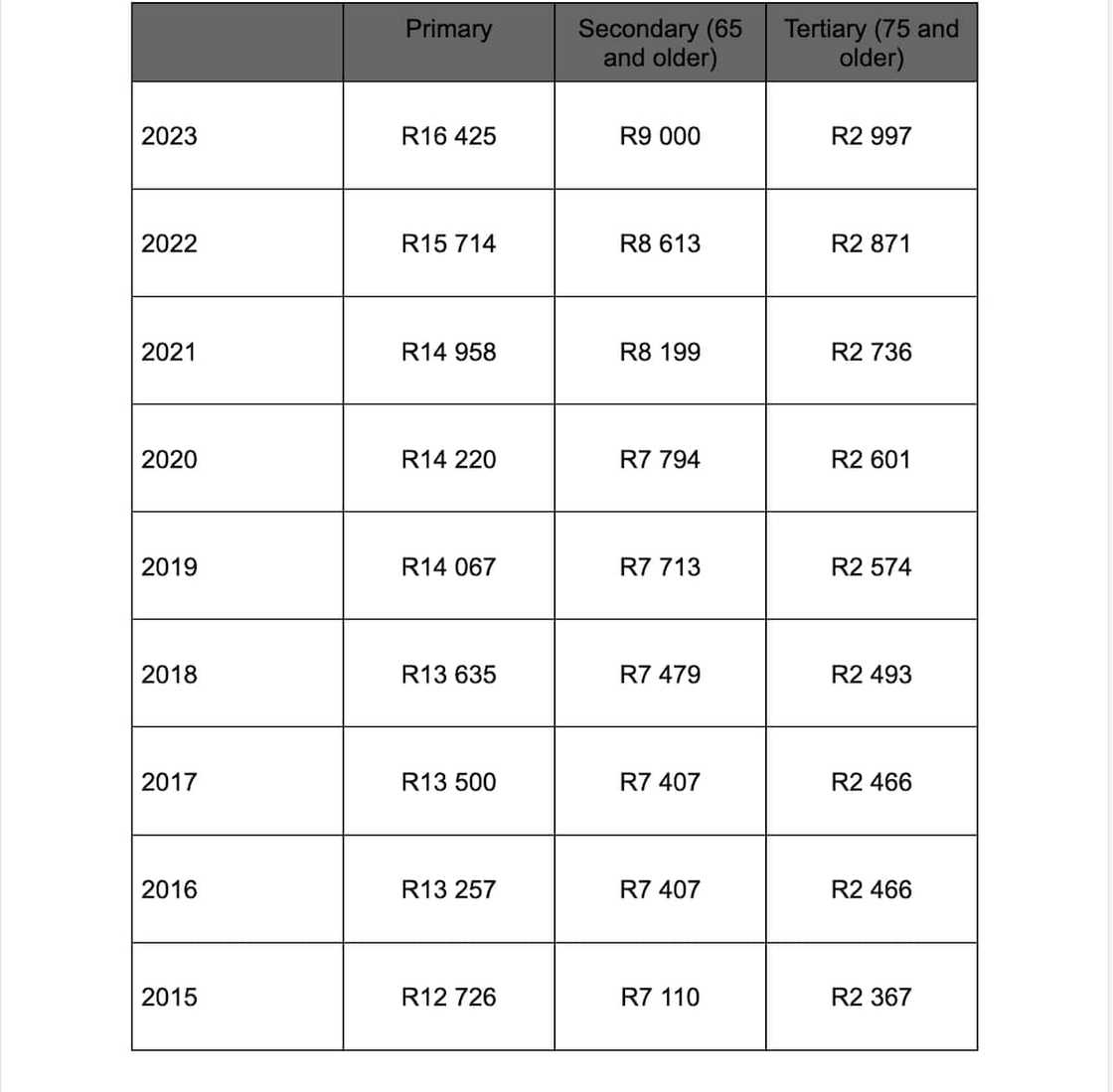

6. Deduct rebates from the tax payable. The current rebates rates table is below.

PAYE = (Total tax payable – total rebates) / 12

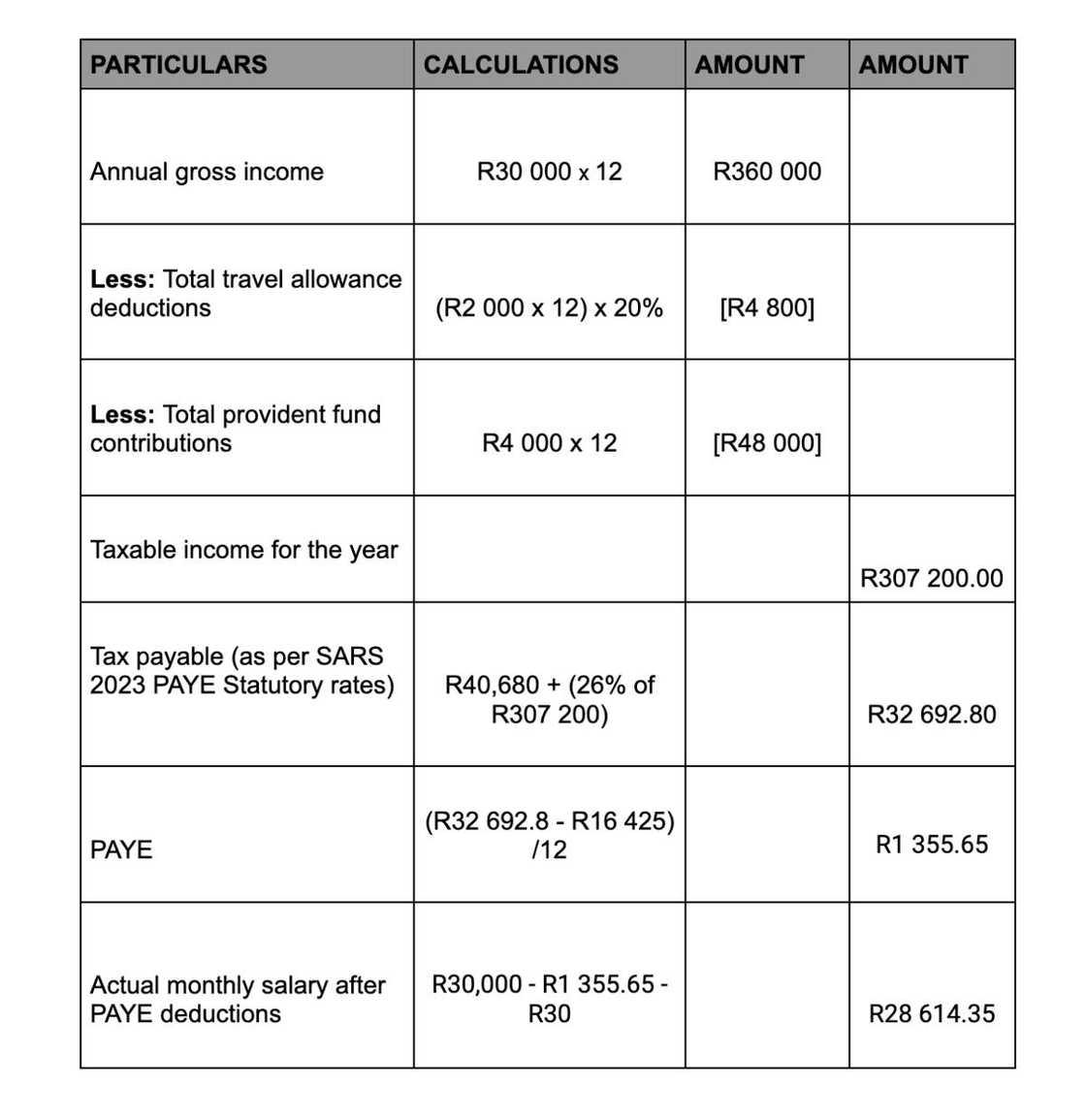

A sample of PAYE calculations in South Africa

Assuming a 25-year-old South African employee earns an R30 000 monthly salary, R2 000 travelling allowance, and pays provident fund contributions of R2000 per month. She also travels 80% of the total time you are working. Her PAYE calculations are as follows:

Source: UGC

Taxable income = Annual gross salary - Pension / Provident / RAF - 20% of travel allowance

Total travel allowance deductions: (R2 000 x 12) x 20% = R4 800

(If 80% of your travelling costs is business-related, SARS will tax 20%, and vice versa is also true.)

Total Provident fund contributions: R4 000 x 12 = R48 000

(limited to 27.5% of salary, limited to R350k)

Taxable Income = Annual Income - all deductions

R 360,000 - R4 800 - R48 000

Taxable income for the year: R307 200

According to SARS's 2023 tax year rate tables (see below), this employee's Taxable income falls in the 226001- 353100 bracket. Therefore, your PAYE will be:

Tax payable = R40,680 + (26% of Rf307 200) = R32 692.8

PAYE = (Total tax payable – total rebates) / 12

(R32 692.8 - R16 425)/12 = R1 355.65

Your home pay = Gross salary - PAYE - UIF

(UIF (Unemployment Insurance Fund) is levied at 1% of your gross income (at most R177.12)

R30,000 - R1 355.65 - R30 = R28 614.35

Your home pay = R28 614.35 per month

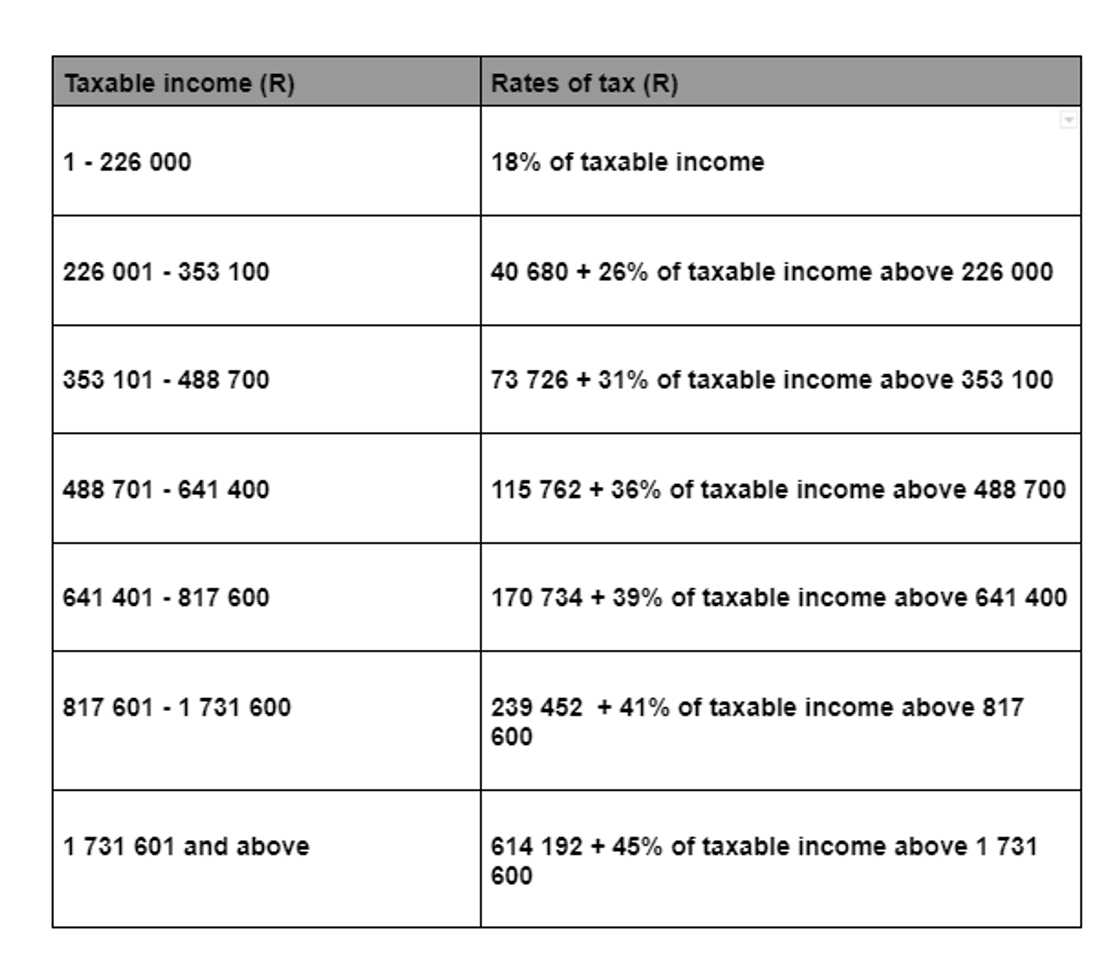

What percentage is PAYE in South Africa?

SARS released a tax table for 1st March 2022 to 28th February 2023. The new rates of tax for individuals are as follows:

Source: UGC

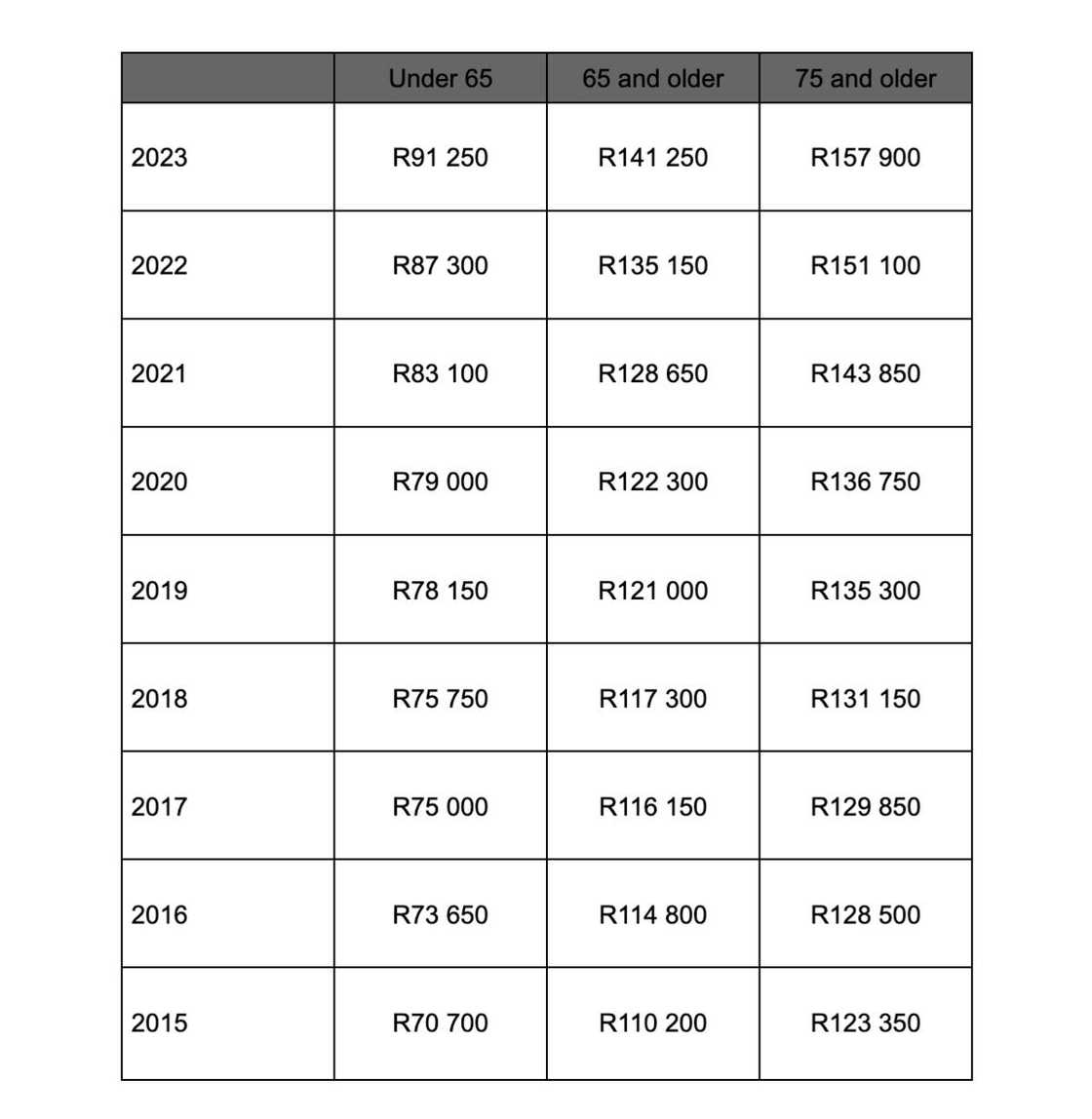

What is the tax threshold in South Africa?

Employers determine the age of the employer before calculating the PAYE. One's age determines the age bracket of the threshold and rebates the employer should use in the calculations. The income tax threshold is the income level at which a person begins paying income taxes. If your taxable income is above the tax threshold (see below), you must register as a taxpayer with SARS.

Source: UGC

How does tax rebate work in South Africa?

The income tax rebate is an incentive that reduces the amount of tax that a person has to pay. In other words, it is a refund on taxes when an individual's tax liability is less than the taxes the person has paid. 2023's income tax rebates in South Africa will be as follows:

Source: UGC

More relevant information about PAYE

PAYE must be paid within 7 days after the end of the month, during which the amount was deducted. If the last day for payment falls on a weekend or public holiday, pay on the last business day before the public holiday or weekend.

SARS requires the employer to fill the EMP201 (Monthly Employer Declaration form) after making PAYE payments. In addition, the employer indicates the amount of money paid, allocations for SDL, PAYE, UIF (Unemployment Insurance Fund), Employment Tax Incentive (ETI), and other things, where necessary.

A distinct Payment Reference Number (PRN) will be generated on the EMP201 to link the actual payment with the relevant EMP201 payment declared. These are PAYE's payment alternatives.

- Electronic payments (EFT)

- Payments at a bank: approved banks include Standard Bank, Albaraka Bank Limited, FNB, ABSA, Bank of Athens, Habib Bank Zurich (HBZ), HSBC, Capitec, Nedbank, or Mercantile branches.

Note that SARS does not accept manual payments, and cheques are returned to the client. Also, employers who remit, or have chances of exceeding the R10 million mark of the Employees' Tax within a year, must hand in Employees' Tax declarations and pay via electronic methods. For further help with PAYE calculations, contact SARS today.

SARS head office contacts

South Africa, Gauteng’ Pretoria, Lehae La SARS building

Phone 1: (012) 422 4000 (customer care)

Phone 2: 0800 00 2870 (Corruption hotline)

Is PAYE compulsory in South Africa?

A company or employer must register for PAYE with SARS if they have employed people and put them on salaries.

Do foreigners pay PAYE in South Africa?

Non-residents are taxed on their South African-based sources of income. It is called a residence-based tax system.

Who must pay tax in South Africa?

You are liable to pay income tax if you earn more than:

I.) The 2023 year of assessment (1st March 2022 – 28th February 2023)

- R91 250 if you are younger than 65 years.

- If you are 65 - 75 years, the tax threshold (the amount above which income tax becomes payable) is R141 250.

- For taxpayers aged 75 years and older, this threshold is R157 900.

II.) The 2022 year of assessment (1st March 2021 – 28th February 2022)

- R87 300 if you are younger than 65 years.

- If you are 65 - 75 years, the tax threshold is R135 150.

- For taxpayers aged 75 years and older, this threshold is R151 100.

III.) The 2021 year of assessment (1st March 2020 – 28th February 2021)

- R83 100 if you are younger than 65 years.

- If you are 65 - 75 years, the tax threshold is R128 650.

- For taxpayers aged 75 years and older, this threshold is R143 850.

You can check out more rates in the tables above.

How does a minor pay income tax?

A minor has a federal income tax liability depending on how much money they made, how they made it, their standard or itemized deductions amount, and the credits they are eligible for.

How do you work out PAYE on salary?

If you are no good at manual calculations, use the automatic SARS Income Tax Calculator for 2023. The Pay as You Earn calculator has a simplified process. Key in your income, age bracket, and other details for it to do the calculations.

How much tax do I pay on my salary in South Africa?

Income tax is a broad topic. For instance, if your payslip has many deductions and benefits, you would not know how much you are paying unless you calculate it.

Is PAYE calculated on gross or net salary?

To get a more accurate figure, it is recommended to learn how to calculate PAYE on salary in gross rather than in net. Please note that:

- A pension fund contribution may be tax-deductible depending on whether the pension fund is "approved" or "unapproved."

- Employees who work only part of a year are liable to benefit from a rebate.

- Disability Benefit Contributions are part of the employee's fringe benefits and are no longer tax-deductible.

- Lastly, file tax returns whenever SARS opens its eFiling system.

Learning how to calculate PAYE on salary is the best way to monitor your finances. To avoid being scammed by some dubious employers, you should know how much money SARS is deducting from your earnings.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

READ ALSO: Apply for the UIF certificate of compliance online 2022: All you need to know

Briefly.co.za also shared detailed information regarding how to apply for the UIF certificate of compliance online. A certificate of compliance is a legal statement that verifies that specific criteria have been met.

It is a formal declaration that an individual or corporation has adhered to a set of requirements. These certificates are granted for various reasons depending on the circumstances, and they are usually drafted and signed by official institutions.

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: Briefly News