SARS eFiling for income tax return: how to file and submit in 2024?

Did you know that filing tax returns signifies you are a responsible and honest citizen? Filing enables you to know if you have any tax due and the amount. The South African Revenue Service (SARS) is responsible for collecting all revenues due and ensuring optimal compliance with tax and customs legislation. Learn how to submit tax returns on eFiling now.

Source: UGC

South African taxpayers are required to submit a tax return to SARS during the annual tax season. Learning how to submit tax returns on eFiling is crucial for tax-paying citizens and residents. When completing your return, you should have your supporting documents within reach.

How to submit tax returns on eFiling

Tax returns in South Africa are filed annually by tax-paying citizens. Failure to do this attracts penalties. Discover how to submit tax returns on eFiling today.

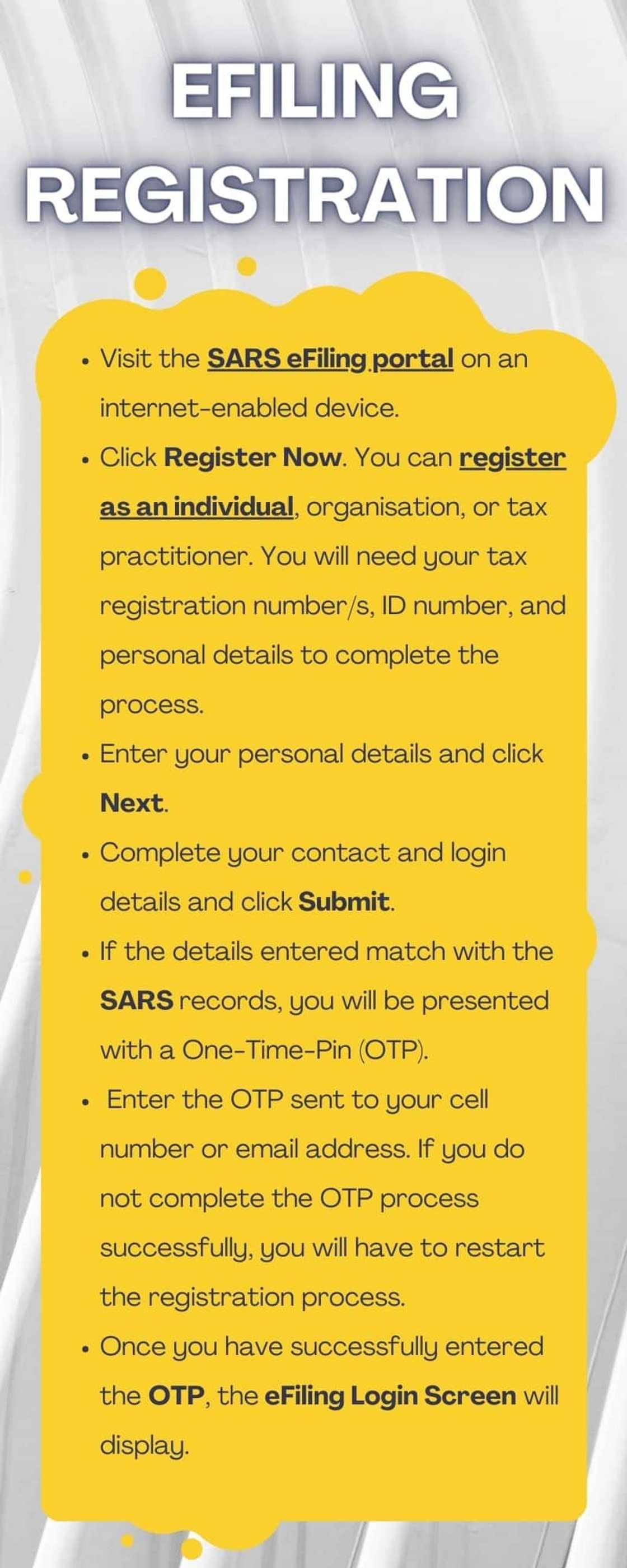

eFiling registration

Before you can submit tax returns on eFiling, you should complete the registration process. Registration for and the use of eFiling is free. All you need is internet access. Below are the steps you should follow to complete the process.

- Visit the SARS eFiling portal on an internet-enabled device.

- Click Register Now. You can register as an individual, organisation, or tax practitioner. You will need your tax registration number/s, ID number, and personal details to complete the process.

- Enter your personal details and click Next.

- Complete your contact and login details and click Submit.

- If the details entered match with the SARS records, you will be presented with a One-Time-Pin (OTP).

- Enter the OTP sent to your cell number or email address. If you do not complete the OTP process successfully, you will have to restart the registration process.

- Once you have successfully entered the OTP, the eFiling Login Screen will display.

SARS eFiling for income tax returns

You can file your income tax returns by making use of SARS eFiling or MobiApp. Follow the steps below to complete the process.

- Register for eFiling on the SARS eFiling website.

- Log into your account.

- Complete the online income tax return form. The first page of the form contains several questions regarding the nature of your tax affairs. Once you complete this part, you will automatically tailor the tax return to your specific tax requirements.

- Submit the form.

Source: UGC

Supporting documents needed when filing tax returns

When completing your return, you should have your supporting documents at hand. You may need to refer to some of them. However, you are not required to submit them to SARS.

- IRP5/IT3(a) certificate(s) from your employer.

- Financial statements.

- Medical certificates and documents required for amounts claimed and those covered by medical aid.

- Pension and retirement annuity certificates.

- Banking details.

- Information relating to capital gain transactions, if applicable

- Travel logbook for people who receive a travel allowance

- Completed confirmation of diagnosis of disability

- Tax certificates received in respect of investment income (IT3(b))

- Approved Voluntary Disclosure Programme Agreement between you and SARS for years before 17th February 2010, where applicable.

eFiling services

The eFiling website offers the services listed below.

- Advance Tax Ruling (ATR)

- Additional Payments

- Air Passenger Tax payments

- Change of Personal Details (IT77/RFC)

- Complete history of eFiling usage

- Customs payments

- Notification Tool

- Pay-As-You-Earn (EMP201 return)

- Personal Income Tax(ITR12)

- Provisional Tax (IRP6)

- Request for Tax Clearance Certificate

- Request for Tax Directive

- Secondary Tax on Companies (IT56)

- Security Transfer Tax(STT)

- Skills Development Levy (included on the EMP201 and EMP501 return)

- Stamp Duty

- Tax Calculators

- Tax Practitioner Registration

- Transfer Duty

- Trusts (IT12R)

- Unemployment Insurance Fund (included on the EMP201 and EMP501 return)(Note: UIF filing is done separately via www.ufiling.gov.za)

- Value Added Tax (VAT201)

- VAT Vendor Search

Source: UGC

Benefits of eFiling

Below is a list of the benefits of using the eFiling website for your annual income tax returns.

- It is a free, simple, and secure way of filing your returns.

- It eliminates waiting in queues and wasting time finding parking or worrying about office hours.

- eFilers are allowed given more time to make their submissions and payments.

- You can view all your submissions, payments, and electronic correspondence whenever you wish.

- You receive SMS and email reminders when submissions are due.

How much do you have to earn to submit a tax return in South Africa?

Not all taxpayers need to submit an income tax return. You are liable to pay income tax in 2024 if you earn more than R91,250 if you are younger than 65 years. The tax threshold for people 65 years of age to below 75 years is R141,250, while that for taxpayers aged 75 years and older is R157,900.

How do you submit your tax return on eFiling in 2024?

You log into your SARS eFiling website to submit your returns. Once logged in, complete the online income tax return form and submit it.

Can you submit your IRP5 online?

Yes, you can. It is one of the services SARS offers online.

How do you claim SARS tax return on eFiling in 2024?

You can make a claim by requesting a refund by completing Part A of the REV1600 form. Next, email it to lbqueries@sars.gov.za

All taxpayers are encouraged to learn how to submit tax returns on eFiling. This knowledge will help them to submit their income tax returns as required by the SARS.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Source: UGC

Briefly.co.za recently published the water use license application process. Water remains a scarce resource in South Africa and needs to be used sparingly to avoid problems in the future.

The Department of Water and Sanitation has put laws governing water use. If you need a water license, you should get more information on the application process and documents needed.

Source: Briefly News

Ruth Gitonga (Lifestyle writer) Ruth Gitonga has a background experience in Mass Communication for over six years. She graduated from the University of Nairobi with a degree in Mass Communication in December 2014. In 2023, Ruth finished the AFP course on Digital Investigation Techniques. She has worked for Briefly.co.za for seven years now. She specializes in topics like lifestyle, entertainment, travel, technology, and sports. Email: gitongaruth14@gmail.com.

Cyprine Apindi (Lifestyle writer) Cyprine Apindi is a content creator and educator with over six years of experience. She holds a Diploma in Mass Communication and a Bachelor’s degree in Nutrition and Dietetics from Kenyatta University. Cyprine joined Briefly.co.za in mid-2021, covering multiple topics, including finance, entertainment, sports, and lifestyle. In 2023, she finished the AFP course on Digital Investigation Techniques. She received the Writer of the Year awards in 2023 and 2024. In 2024, she completed the Google News Initiative course. Email: cyprineapindi@gmail.com