The VBS scandal explained: A timeline of major developments

What happens when greed and corruption infiltrate the sacred halls of finance, leaving a trail of devastation in its wake? This explains the VBS scandal in South Africa. It revealed a complicated tangle of fraud, political interference, and mismanagement that led to the bank's failure.

Source: Twitter

TABLE OF CONTENTS

- Explaining the VBS scandal

- What are the VBS allegations?

- Key players in the VBS scandal

- Timeline of major developments

- VBS busted (11 March 2018)

- Questions about VBS's book (18 March 2018)

- Dodgy buyers revealed (1 April 2018)

- The VBS freebies are exposed (29 April 2018)

- Forensics reveals the fraud (24 June 2018)

- Bribery networks exposed (8 July 2018)

- Political ties are confirmed (5 August 2018)

- VBS's cross-national connection (5 August 2018 and beyond)

- Liquidation (13 November 2018)

- Legal actions and consequences

- Impact on customers and municipalities

- Frequently asked questions

The collapse of VBS Mutual Bank spelled overwhelmingly devastating consequences for several municipalities, depositors, and local communities. The VBS scandal has left many questioning the integrity of the country's banking system. Read on to learn more.

Explaining the VBS scandal

The VBS Mutual Bank scandal involved large-scale financial corruption, with an estimated R2 billion in funds misappropriated. The bank's co-founder, Wilson Muvhulawa, during an interview with the Business Day, said:

VBS Bank is the fastest-growing bank in South Africa and we believe it is a threat to other banks. They are now trying by all means to keep us where we are.

What are the VBS allegations?

The VBS bank scandal summary was revealed in 2018 when the South African Reserve Bank (SARB) placed the mutual bank under curatorship due to irregularities and liquidity issues.

According to a paper on the Corruption Watch site, a forensic inquiry led by an advocate, Terry Motau, uncovered looting that implicated top individuals. At the heart of the act was the manipulation of depositors' funds through dishonest deposit suspense accounts

These unreal accounts allowed the conspirators to hold up money in corporations possessed by themselves, family members, and cronies.

Key players in the VBS scandal

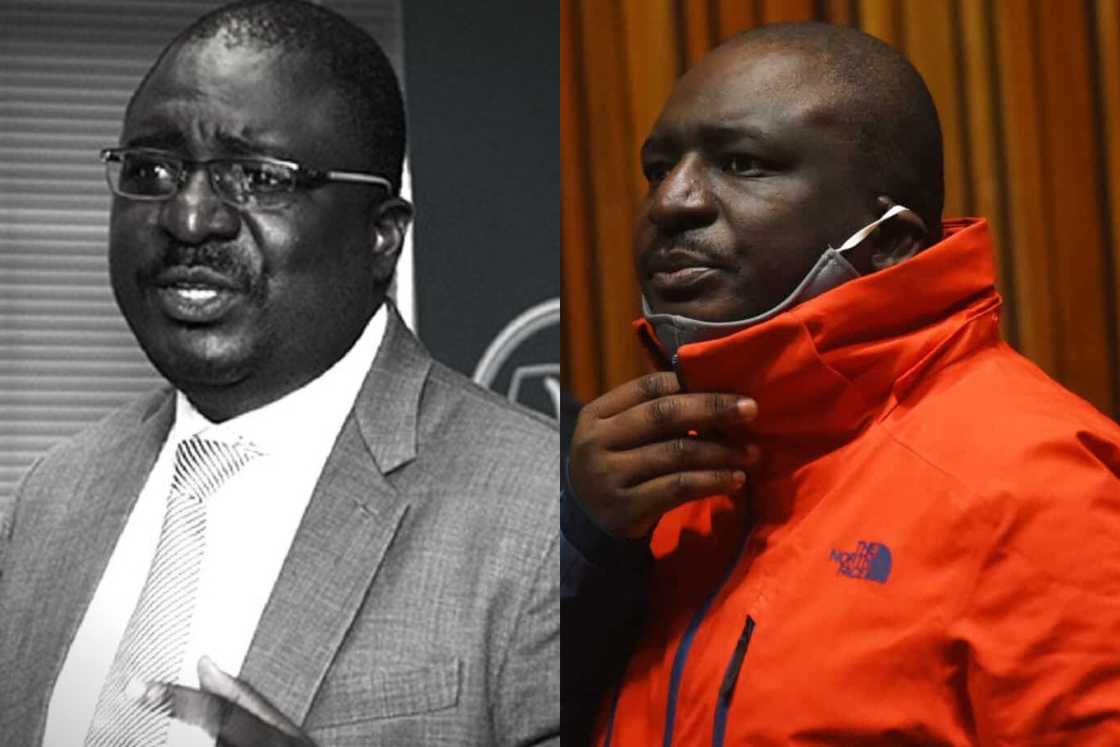

The Daily Maverick mentioned two top-ranking persons involved in the fraud. Their profile is discussed below:

Tshifhiwa Matodzi

Source: Twitter

He was the bank's chairperson at the time. The ex-banker and senior administrative personnel played a prominent role in staging the scheme.

The funds financed their luxurious lifestyles, acquiring businesses and bribing officials to look the other way. He was sentenced to 15 years after pleading guilty to various counts of financial misappropriation.

Read also

Kabza De Small and two other South African celebrities who recently opened their own nightclubs

Minister of Justice Thembi Simelane

Source: Twitter

Simelane was incriminated for receiving over an R500,000 loan from VBS through someone else. She responded by claiming not to have secured better terms elsewhere. The ANC Integrity Committee scheduled her to address the allegations in 2024.

Timeline of major developments

When Advocate Motau was appointed to look into the mismanagement of funds by a bank, little did he know that he was about to unravel devastating realities in the banking industry. Below is a timeline of the event:

VBS busted (11 March 2018)

The bank's financial distress became public knowledge. This happened after the South African Reserve Bank (SARB) placed VBS under curatorship due to liquidity issues.

Questions about VBS's book (18 March 2018)

Concerns were put forward about the accuracy of VBS's statutory reports. This amounted to deeper financial abnormalities.

Dodgy buyers revealed (1 April 2018)

Efforts at rescuing VBS through dubious buyout arrangements were exposed. This discovery dipped the bank's integrity further.

The VBS freebies are exposed (29 April 2018)

Inquiries began to reveal relationships between VBS and diverse political figures. This happened within the African National Congress (ANC) and other political parties.

Forensics reveals the fraud (24 June 2018)

Terry Motau's report, The Great Bank Heist, revealed the nearly R2 billion looting details. This report documented countless beneficiaries of the hoax.

Bribery networks exposed (8 July 2018)

An affidavit by appointed curator Anoosh Rooplal exposed a web of bribes. It involved politicians and municipal officials.

Political ties are confirmed (5 August 2018)

VBS' deep ties with political factions were revealed. The major people in this plot are the Zuma faction in the ANC.

VBS's cross-national connection (5 August 2018 and beyond)

The bank was exposed to be linked with international personalities like the Angolan billionaire Alvaro Sobrinho. This meant that the scandal was on a global crescendo.

Liquidation (13 November 2018)

The North Gauteng High Court issued a final liquidation order against VBS. It aimed at killing any hope of a comeback.

Source: Twitter

Legal actions and consequences

Other figures have been charged besides Matodzi and Simelane. An article by Corruption Watch noted that recovering stolen funds has been little or near impossible. There have been calls for chartered accountants and auditors involved to face professional repercussions.

Impact on customers and municipalities

According to an article by the Parliamentary Monitoring Group, municipalities like Limpopo have deposited substantial public funds into VBS. This led to crises in service delivery when money could not be recovered. For instance, the West Rand District Municipality faced severe financial constraints after the collapse.

According to a report by the University of Witwatersrand, ordinary depositors, most indigents from underprivileged communities, lost all their savings. Customers like Elisa Mudau, who had invested her late husband's inheritance in VBS, got into financial ruin with no possibility of recovery.

Frequently asked questions

Following the revelation of the VBS scam, questions have been raised about its origin, among other things. Below are a few answers to them:

- Does VBS still exist? It is not. It has been declared insolvent since 2018.

- What does VBS Bank stand for? It is an acronym for Venda Building Society.

- What is the bank scandal in South Africa? The VBS scandal was a banking industry scam that left customers with a devastating taste in their mouths.

- What is the origin of VBS Bank? It initially operated as the Venda Building Society but became registered as a South African Bank in the early 90s.

The VBS scandal is a tale of corruption, greed, and institutional failure. The imprisonment of pivotal perpetrators like Tshifhiwa Matodzi was some measure of justice, but what became of the poor customers' looted funds?

READ ALSO: Menendez brothers' net worth: What are Erik and Lyle worth today?

As published on Briefly.co.za, in 1989, Erik and Lyle Menendez shocked the nation with the tragic act that resulted in the loss of their parents. Then, the September 2024 Netflix series of Ryan Murphy's MONSTERS: The Lyle and Erik Menendez Story drew attention to them.

After years of legal battles and incarceration, what is the Menendez brothers' net worth today? Discover this and what they are up to now.

Source: Briefly News