"This Is Extortion": Mzansi Reacts to Tax Consultant's Payslip Reveal Online

- A tax consultant’s payslip sparked national debate after revealing earnings that shocked South Africans

- The video inspired online conversations about pay gaps, qualifications, and fairness in professional salaries

- Viewers reflected on the realities of working professionals and the importance of financial transparency

- Briefly News reached out to Lerato, a qualified tax practitioner and Burbles Ngwenya, a registered tax practitioner and founder of SB Consulting, for expert insight into why South Africans’ payslips often show such large deductions, and how individuals can take back control through better financial literacy

South Africans were stunned by the tax consultant’s payslip that opened up bigger conversations about salary fairness and real earnings in the country.

Source: Facebook

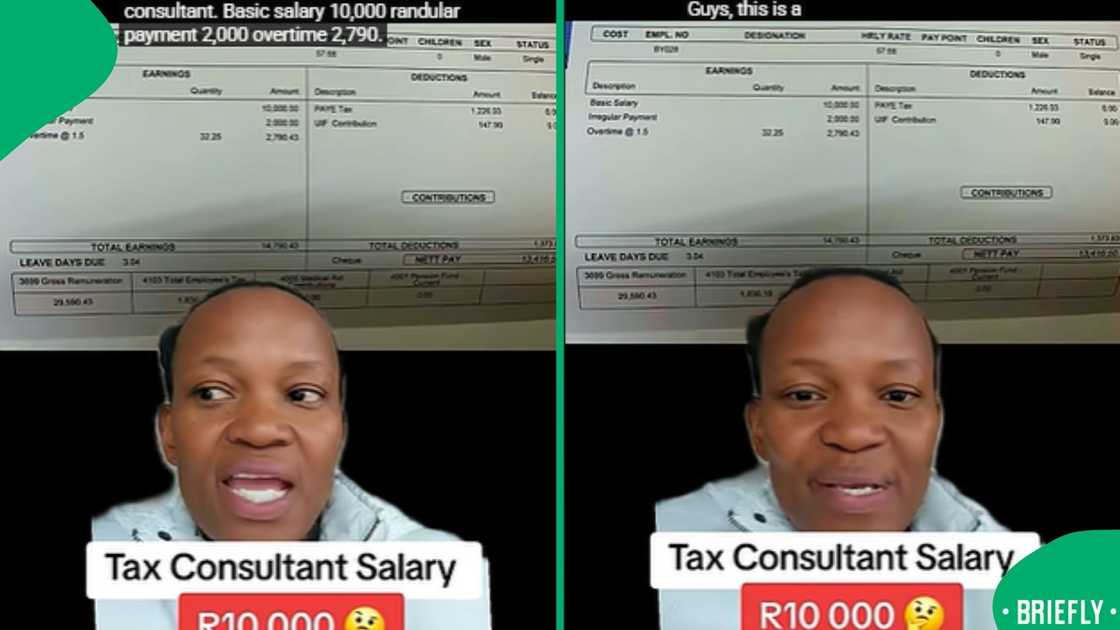

Content creator @liferesetwithboni posted the video three months ago as part of her ongoing trend of sharing people’s payslips anonymously to encourage public discussion. In this particular video, she reviewed a payslip belonging to a tax consultant who holds a BCom Honours in Management and a professional certificate in Taxation. The payslip showed a basic salary of R10,000, an irregular payment of R2,000, and overtime earnings of R2,790, resulting in a total net pay of R13,416 after deductions. The post took many South Africans by surprise, as they assumed that tax consultants, especially those with qualifications, earned far higher salaries.

Read also

Mzansi shared concerns after a viral video warned about a possible rise in inflation for 2026

The clip opened up a broader conversation about real wages and the cost of living in South Africa. Many viewers couldn’t believe that someone in such a skilled role was earning so little, despite years of study and a strong educational background. According to job data from Pnet.co.za, entry-level tax consultants in South Africa typically earn between R18,000 and R30,000 per month, while more senior roles can range from R45,000 to R60,000, and sometimes up to R3 million annually, depending on experience and position. The platform also highlights how experience, role level, and qualifications influence these earnings, meaning someone just starting might face a much smaller paycheck until they progress further. Disclaimer: The information provided and related content are for general informational and educational purposes only. It should not be considered financial advice.

Salary figures spark online debate

The video, posted by YouTuber @liferesetwithboni, quickly spread across multiple social media platforms, drawing in thousands of views and hundreds of comments. Many users expressed shock, while others shared their own workplace frustrations and experiences. Viewers debated whether companies were underpaying skilled professionals or whether the individual’s role was more administrative than consulting-based. The comments section filled up with South Africans comparing qualifications, job titles, and earnings, revealing how uncertain and inconsistent salary expectations can be in the local market.

PAY ATTENTION: stay informed and follow us on Google News!

The post left many reflecting on the financial realities faced by educated South Africans. People felt empathy for the employee and voiced frustration over how challenging it can be to earn a sustainable income, even with advanced degrees. The conversation also opened the door to transparency, with more people encouraging honest discussions about pay gaps and salary awareness to promote fairness in the workplace.

As South Africans debated the viral payslip that left many questioning how much of their income goes to deductions, tax practitioner Lerato explained to Briefly News why the gap between gross and net salary can feel so wide. She highlighted that the country’s progressive PAYE system is the main reason for the difference, alongside several other key deductions.

“South Africans see big deductions mainly because of progressive Pay As You Earn (PAYE), where higher earners pay a higher percentage. The mandatory UIF contributions are not that significant as they are capped. On top of that, retirement fund and medical aid contributions reduce take-home pay. Certain fringe benefits, like company cars and employer medical aid contributions, can also be taxed. Together, these elements create a noticeable gap between gross and net salary."

Lerato added that even small salary increases can have unexpected results due to the structure of tax brackets.

"Because tax brackets haven’t changed, some people who received increments may actually see a lower net salary after being moved into a higher bracket.”

She also offered advice for South Africans looking to make the most of their earnings.

“Start by reading your payslip carefully and understanding each line item. Make use of tax-efficient tools like retirement funds and medical tax credits. Keep records, stay informed using SARS resources or a tax professional, and make sure you claim all allowable deductions for medical, retirement, or work-related expenses. Knowledge is key to maximising your take-home pay. I always advise using a tax professional if you can afford one. Apart from that, knowledge is power."

Read also

A travel influencer's travel guide encouraged South Africans to explore their country’s beauty

Burbles Ngwenya, a registered tax practitioner and founder of SB Consulting, added further guidance on understanding payslips and tax management.

“The biggest portion usually comes from PAYE (Pay As You Earn), which is income tax withheld based on salary brackets. Beyond that, employees often see deductions for UIF (Unemployment Insurance Fund), pension or provident fund contributions, medical aid, and sometimes company-related benefits like group life cover. When you add these up, the take-home pay can look much smaller than expected, but many of these deductions are actually long-term protections or benefits, not just taxes. Start by reviewing your payslip line by line."

"Know what each deduction is for, and whether it’s mandatory or optional. You can also create a SARS eFiling profile to view your tax records directly. If things don’t make sense, consult a registered tax practitioner who can explain how your income is structured and identify ways to legally reduce tax through deductions or rebates. Knowledge is key; once you understand where your money goes, the frustration turns into empowerment.”

Source: Youtube

Here's what South Africans had to say

Janetlily04 said:

“Haibo! This person can start their own tax business; it’s so easy to start. 10k is an insult.”

Nomsamgilane9976 wrote:

“Haibo, she must look for a job; she deserves better.”

Fhatu1m commented:

“Hey, we need to name and shame. This is bad.”

Nkanyisontombela4412 said:

“Too low.”

Jakalasi7540 wrote:

“Kanti inganekwane!”

Check out the YouTube video below:

3 Other Briefly News stories related to payslips

- A woman from Georgia, United States, shared a picture of the payslip she created for her children.

- A TikTok video showing the payslip of a traffic officer from the Western Cape quickly drew attention.

- A TikTok video revealed a South African retail pharmacist's payslip, sparking widespread discussion.

Proofreading by Roxanne Dos Ramos, copy editor at Briefly.co.za.

Source: Briefly News