Fed says more US rate hikes coming, pace will slow 'at some point'

Source: AFP

New feature: Check out news exactly for YOU ➡️ find “Recommended for you” block and enjoy!

US central bankers remain committed to raising interest rates further to quell rising prices, but agreed it would be appropriate to slow the pace of the hikes "at some point," the Federal Reserve said Wednesday.

In the minutes of the July policy meeting, which produced a second massive rate increase of 0.75 percentage points, the Fed officials said it will take some time to bring "unacceptably high" inflation back down near the two percent goal.

But many officials at the meeting cautioned that there is a "risk" the Fed could go too far as it tries to cool demand to lower prices that have surged at the fastest pace in more than 40 years.

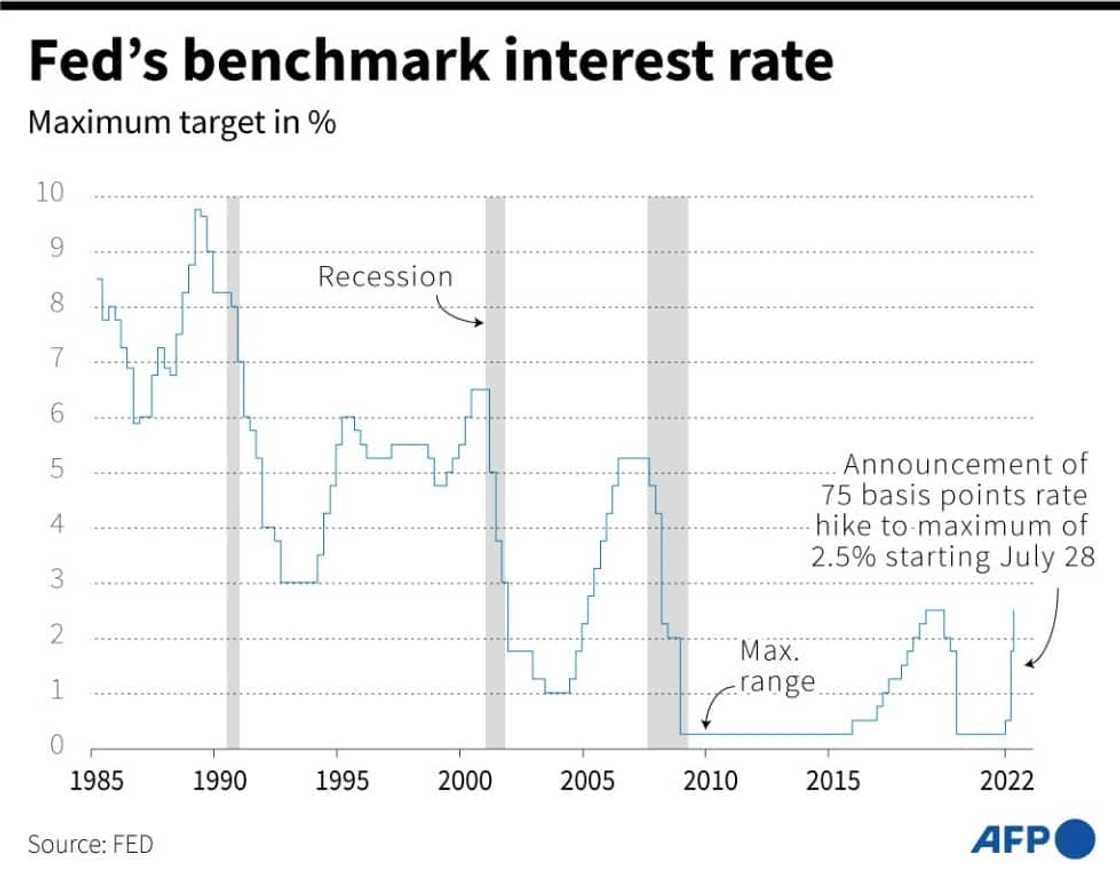

The central bank has raised the benchmark borrowing rate four times this year, including two massive three-quarter-point increases in June and July after US annual inflation spiked to 9.1 percent in June.

In the days since the last Fed meeting, financial markets have been cheered by comments from Federal Reserve Chair Jerome Powell, who signaled that a slowdown in the rapid rate hikes would come eventually.

But officials have tried to dispel some of that excess optimism, stressing in recent speeches that the central bank is committed to pursuing its inflation-fighting battle -- a message echoed in the minutes.

Signs of easing?

There have been some positive signs, as consumer prices slowed in July to 8.5 percent, and soaring gas prices, exacerbated by the war in Ukraine, have fallen in recent weeks.

Source: AFP

Members of the Fed's policy-setting Federal Open Market Committee (FOMC) noted the recent decline in energy prices as well as some signs that supply constraints have eased.

However, they said falling oil prices "cannot be relied on" to lower overall inflation, and instead, slowing demand will be a key factor in curbing price pressures, the minutes said.

Some officials warned against "complacency."

The rapid, aggressive moves by the central bank have started to have an impact, and while officials say the US economy should continue to expand in the second half of the year, "many expected that growth in economic activity would be at a below-trend pace," the minutes said.

While the labor market remains strong, many noted "some tentative signs" the job conditions have started to soften.

Last month, the world's largest economy still had nearly two job openings for every unemployed person in the labor force.

Meanwhile, American consumers have continued to spend despite high prices, drawing on a stockpile of savings, though data indicate a shift towards services and away from cars and other big-ticket items, while rising mortgage rates have started to slow activity in the housing sectors.

New feature: check out news exactly for YOU ➡️ find "Recommended for you" block and enjoy!

Source: AFP